Buckle up, crypto enthusiasts! If you blinked, you might have missed the rollercoaster ride the market took in the last 24 hours. Bitcoin, the king of crypto, took a significant tumble, dropping by 4%, and as usual, altcoins felt the impact even harder. Let’s dive into what happened and which altcoins are feeling the heat.

What Sparked the Crypto Plunge?

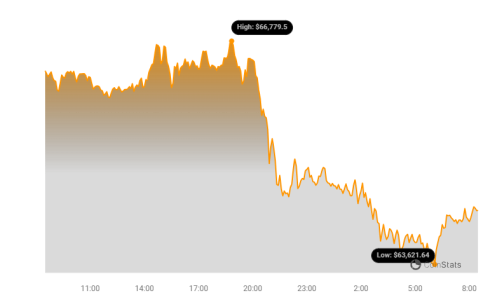

After a relatively calm period, the crypto market experienced a sudden jolt. Bitcoin (BTC) price action took a dramatic turn, plummeting over $3,500 to touch $63,300. This sharp decline wasn’t isolated to Bitcoin alone; the altcoin market mirrored this downward trend, leading to a massive liquidation event.

To put it in perspective:

- Bitcoin’s Drop: Fell by more than 4% in 24 hours.

- Liquidation Surge: Nearly $225 million in crypto positions were wiped out across the market.

This sudden downturn came after a promising start to the week. Bitcoin had briefly soared to its highest level since early June, hitting the $70,000 mark. However, this peak proved to be short-lived, facing a swift rejection that pushed Bitcoin below $65,500.

While Bitcoin managed to find some footing around $66,800, the stability was fragile. A press conference by Federal Reserve Chair Jerome Powell acted as a catalyst for another wave of selling pressure. Following Powell’s remarks, Bitcoin tumbled once again, landing at $64,300 – a further 3% decrease within just 24 hours.

Geopolitical Tensions and Economic Signals: A Double Whammy?

The market jitters appear to be fueled by a combination of factors. A report from the New York Times highlighting Iran’s call for retaliation against Israel after the assassination of a Hamas leader in Tehran added to the uncertainty. This news injected geopolitical risk into the market, making investors wary of riskier assets like cryptocurrencies.

Simultaneously, on the economic front, the Federal Reserve’s decision to hold steady on benchmark interest rates offered little clarity on the much-anticipated rate cut in September. While Chair Powell hinted at a growing consensus within the Fed regarding a potential rate reduction in September, no firm commitment was made. This lack of definitive direction from the Fed likely contributed to the risk-off sentiment in the crypto market.

Altcoins Bleed as Bitcoin Recedes: WIF, BONK, RUNE, and JUP Lead the Decline

As Bitcoin stumbled, altcoins experienced even steeper declines. Memecoins and newer projects were particularly hard hit:

- Dogwifhat (WIF): Plunged by a significant 12.4%.

- BONK: Experienced a sharp 10% drop.

- THORChain (RUNE): Also fell by 10%.

- Jupiter (JUP): Decreased by 8%.

- Ethereum Name Service (ENS): Slipped by 9%.

Even larger-cap cryptocurrencies weren’t spared from the downturn. Here’s how some of the major players fared:

| Cryptocurrency | Percentage Drop |

| Solana (SOL) | 8% |

| XRP | 6% |

| Cardano (ADA) | 4% |

| Ethereum (ETH) | 4.4% |

| Dogecoin (DOGE) | 4.4% |

Massive Liquidations Highlight Market Volatility

The data from CoinGlass paints a clear picture of the market turmoil. A staggering 67,000 traders felt the sting of this increased volatility, with their positions being liquidated.

Here’s a snapshot of the liquidation data:

- BTC Liquidations: $61.85 million

- ETH Liquidations: $61 million

- Total Liquidations: $225.4 million (at the time of writing)

Key Takeaways: Navigating the Crypto Storm

This recent crypto market dip serves as a stark reminder of the inherent volatility in the cryptocurrency space. Factors ranging from geopolitical events to macroeconomic signals can trigger significant price swings. For traders and investors, staying informed, managing risk effectively, and understanding market dynamics are crucial to navigate these turbulent waters.

While market corrections can be unsettling, they also present potential opportunities. Keep an eye on market developments and be prepared for further volatility as the market reacts to global events and economic indicators. Will Bitcoin and altcoins recover quickly, or is this the start of a deeper correction? Only time will tell, but one thing is certain: the crypto market is never short of excitement!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.