Could the long-awaited turning point for Bitcoin be on the horizon? For those closely watching the cryptocurrency markets, the question of when Bitcoin (BTC) will hit its cyclical bottom is paramount. A well-respected voice in the crypto space, analyst Benjamin Cowen, believes a significant on-chain indicator is suggesting we might be closer than we think.

What’s This ‘Magic’ Indicator Pointing To?

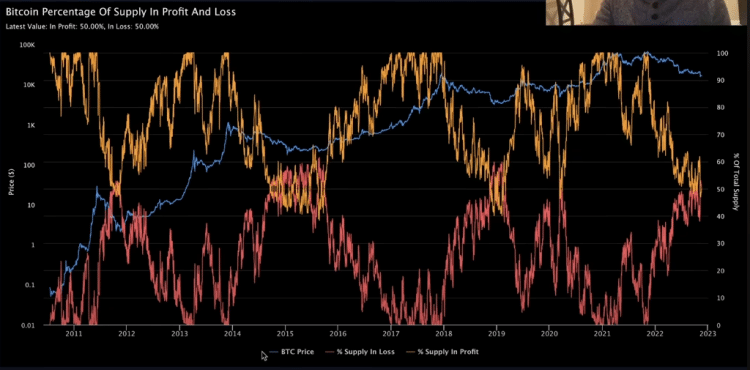

In his recent video update, which has caught the attention of his 774,000 YouTube subscribers, Cowen delves into the Bitcoin “percentage of supply in profit and loss.” But what exactly does this mean for the average crypto enthusiast?

Simply put, this on-chain indicator tracks the proportion of Bitcoin currently held at a profit versus those held at a loss. It’s like taking a temperature reading of the overall Bitcoin market sentiment.

Think of it this way: if a large percentage of Bitcoin holders are in profit, it might suggest a market top, as there’s more incentive to sell. Conversely, when a significant portion are at a loss, it could indicate capitulation and a potential bottom as fewer are willing to sell at a loss.

Cowen’s Historical Perspective: Why This Indicator Matters

Cowen emphasizes the cyclical nature of this indicator, highlighting its historical accuracy in identifying bear market bottoms. As he explains:

- The Ebb and Flow: The indicator naturally oscillates between periods of high profit and high loss, mirroring the bull and bear market cycles.

- The Crossover Point: Crucially, Cowen points out that in every previous bear market, the lines representing the percentage of supply in profit and loss have crossed. This crossover has historically occurred before the market bottom is truly in.

He visually demonstrates this pattern, referencing key bear market periods in Bitcoin’s history:

- 2011

- 2014-2015

- 2018-2019

And now, according to Cowen, this crossover is happening again in late 2022.

The 30-Day Moving Average: Adding Another Layer of Confirmation

To further strengthen his analysis, Cowen applies a 30-day moving average to the Bitcoin percentage of supply in profit and loss. Why is this significant?

The 30-day moving average helps to smooth out short-term fluctuations and provides a clearer picture of the underlying trend. Cowen notes that historically, the crossover of these moving averages has consistently preceded the actual price bottom.

“If you apply the [30-day] moving average to [the Bitcoin percentage of supply in profit and loss]… what you’ll notice is that historically, they have always crossed before the bottom was in.”

What Does This Mean for Bitcoin’s Price?

While Cowen’s analysis offers a compelling perspective, it’s important to remember that no indicator is foolproof. The cryptocurrency market is inherently volatile and influenced by a multitude of factors.

As of the latest update, the price of Bitcoin stands at $16,114, reflecting a decrease of over 3.50% from the previous day. This underscores the current market uncertainty. However, Cowen’s on-chain analysis suggests that despite the current price action, underlying market dynamics might be hinting at a shift.

Key Takeaways: Navigating the Potential Bottom

- Historical Precedent: The Bitcoin percentage of supply in profit and loss indicator has historically signaled bear market bottoms.

- Analyst Confirmation: Benjamin Cowen, a respected crypto analyst, highlights the current crossover of this indicator.

- Moving Average Significance: The 30-day moving average crossover further reinforces the potential for a bottom.

- Market Volatility Remains: While the indicator is promising, be aware of ongoing market fluctuations.

- Do Your Own Research (DYOR): Always conduct thorough research before making any investment decisions.

Looking Ahead: Is This the Turning Point?

While the future of Bitcoin’s price remains uncertain, the on-chain analysis presented by Benjamin Cowen offers a potentially valuable insight. The historical accuracy of the Bitcoin percentage of supply in profit and loss indicator, combined with the current crossover, suggests that the market might be approaching a significant turning point. Whether this translates to an immediate price surge remains to be seen, but for those closely following the crypto markets, this on-chain signal is definitely worth keeping an eye on.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.