Ever experienced a sudden internet outage right when you needed it most? Well, even blockchain networks aren’t immune to hiccups! Recently, Arbitrum (ARB), a leading solution for scaling Ethereum, faced a temporary network stall that got everyone talking. Let’s dive into what happened, why it matters, and how the ARB token is holding up amidst the buzz.

What Exactly Happened with the Arbitrum Network?

On December 15th, Arbitrum One, the main network, experienced downtime. According to Arbitrum’s status page, the issue began around 10:29 AM ET. The network’s sequencer and feed, crucial components for processing transactions, stalled. For over an hour, users couldn’t access the Arbitrum One network, leading to a halt in transaction processing and block production.

The Timeline of the Arbitrum Network Downtime:

- December 15th, 10:29 AM ET: Arbitrum One Sequencer and Feed stalled due to a surge in network traffic.

- Duration: Over 60 minutes of inaccessibility.

- Impact: Halt in block production and transaction processing.

- Investigation: Immediate investigation initiated by the Arbitrum team to identify the root cause and deploy a fix.

Was it Ordinals to Blame for the Arbitrum Outage?

The crypto community is always quick to speculate, and this time was no different. Martin Köppelmann, co-founder of Gnosis, pointed fingers at ordinals as a potential culprit. For those unfamiliar, ordinals are a way to inscribe data onto individual satoshis (the smallest unit of Bitcoin), essentially creating Bitcoin-based NFTs. Köppelmann suggested that stress testing blockchains with ordinals might have triggered the Arbitrum disruption.

Ordinals stress testing various blockchains is certainly entertaining to watch. Now they brought the Arbitrum sequencer down 😂 https://t.co/oyjT6REZFw

— Martin Köppelmann (@koeppelmann) December 15, 2023

He tweeted, “Ordinals stress testing various blockchains is certainly entertaining to watch. Now they brought the Arbitrum sequencer down.” While this is an interesting theory, official confirmation from the Arbitrum team is still awaited. Whether ordinals were the direct cause or simply a contributing factor to a traffic surge remains to be seen.

What’s the Impact of Network Downtime?

Any network downtime, especially in the fast-paced world of crypto, raises concerns. For users and projects relying on Arbitrum, a halt in block production means:

- Transaction Delays: Transactions get stuck, impacting time-sensitive operations.

- Potential Losses: In DeFi, delays can lead to missed opportunities or even losses in volatile markets.

- Erosion of Trust: Frequent or prolonged downtimes can shake user confidence in a network’s reliability.

However, it’s important to note that Arbitrum addressed the issue swiftly and initiated an investigation. Transparency and quick response are crucial in such situations, and the community is now looking forward to a detailed post-mortem analysis from the Arbitrum team to understand the root cause and preventative measures.

See Also: Good News For Arbitrum Holders, Arbitrum Can Soon Touch $2

How is ARB Token Performing Amidst This?

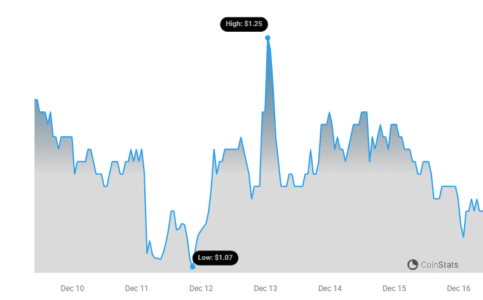

Interestingly, despite the network hiccup and broader market volatility, the ARB token has shown resilience. Let’s break down its recent performance:

ARB Token Performance Snapshot:

| Timeframe | Performance | Observation |

|---|---|---|

| Past 24 Hours | Decline of 4.94% | Short-term market fluctuation, potentially influenced by the outage and general market sentiment. |

| Last 180 Days | Growth of 17.76% | Strong long-term growth trend despite short-term volatility. |

While there was a slight dip in the last 24 hours, likely reflecting the immediate market reaction to the news and general crypto market movements, ARB’s performance over the past six months remains positive. This suggests that investors maintain confidence in Arbitrum’s long-term potential.

What Do Arbitrum’s Fundamentals Say?

Looking beyond short-term price fluctuations, Arbitrum’s underlying metrics paint a promising picture:

Key Arbitrum Network Metrics:

| Metric | Value | Significance |

|---|---|---|

| Circulating Market Cap | $1.49 Billion | Substantial market presence and investor interest. |

| Fully Diluted Market Cap | $11.69 Billion | Reflects the potential future value as more tokens enter circulation. |

| 30-Day Revenue Growth | 68.00% Increase | Indicates strong and growing network usage and demand. |

| Annualized Revenue Projection | $85.97 Million | Highlights the project’s ability to generate significant and sustainable revenue. |

| Daily Active Users (30-day avg.) | 166.37 Thousand | Demonstrates increasing user adoption and network activity. |

Data from Token Terminal reveals robust growth in revenue and user activity. These metrics suggest that despite the recent outage, Arbitrum’s fundamentals remain strong. The increasing number of active users and substantial revenue growth point towards a healthy and expanding ecosystem.

Final Thoughts: Is Arbitrum Still a Strong Contender?

Network outages are undoubtedly concerning, but they also provide valuable learning opportunities for blockchain projects. Arbitrum’s quick response and the resilience of the ARB token suggest a robust underlying ecosystem and community confidence. While the post-mortem analysis is crucial to prevent future incidents, the strong fundamentals – including growing revenue, user base, and long-term price performance – indicate that Arbitrum remains a leading Layer 2 scaling solution for Ethereum. For investors and users alike, keeping an eye on Arbitrum’s response to this event and its continued development will be key to assessing its long-term viability and potential.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.