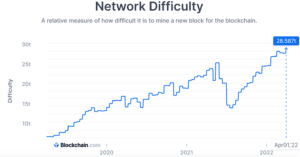

Hold onto your hats, crypto enthusiasts! The Bitcoin network just hit another major milestone, and it’s a big one for network security and mining profitability. On Friday, the Bitcoin mining difficulty reached an unprecedented peak of 28.587 trillion. Think of it as scaling Mount Everest, but for computers solving complex math problems! This surge in difficulty coincides with another monumental event: miners successfully unlocked the 19 millionth Bitcoin into circulation. Let’s dive into what this all means for the world’s leading cryptocurrency and you.

What Exactly is Bitcoin Mining Difficulty and Why Should You Care?

Imagine Bitcoin’s blockchain as a giant, super-secure ledger. Miners are the guardians of this ledger, verifying transactions and adding new blocks to the chain. To do this, they need serious computing power to solve complex cryptographic puzzles. Bitcoin’s network difficulty is essentially a measure of how hard these puzzles are to solve. It automatically adjusts roughly every two weeks (or every 2016 blocks) to maintain a consistent block creation time of approximately 10 minutes.

Why does this matter? Well, a higher mining difficulty has several key implications:

- Enhanced Network Security: Increased difficulty means it requires significantly more computing power to attack the network. This makes Bitcoin even more resistant to malicious activities like double-spending attacks, where someone tries to spend the same Bitcoin twice.

- Healthy Competition Among Miners: A challenging mining environment encourages miners to innovate and invest in more efficient hardware and strategies, leading to a robust and decentralized mining ecosystem.

- Indicator of Network Growth: Rising difficulty often reflects increased interest and investment in the Bitcoin network, signaling confidence in its long-term prospects.

To put it in perspective, the current difficulty level of 28.587 trillion means that the Bitcoin network requires a staggering hash rate of 201.84 exahash per second (EH/s) to process transactions. That’s like having 201,840,000,000,000,000,000 calculations per second dedicated to securing the Bitcoin network!

Bitcoin Hash Rate: The Engine Powering the Difficulty Surge

The hash rate is the total computational power being used to mine Bitcoin. Think of it as the collective strength of all Bitcoin miners worldwide. As the chart below shows, Bitcoin’s hash rate has been on a generally upward trajectory, especially over the past year. This robust hash rate is the driving force behind the increasing network difficulty.

In fact, the Bitcoin hash rate reached an all-time high of 248.11 EH/s on February 13th, 2023, further solidifying the network’s resilience and security.

A higher hash rate is crucial for:

- Security Against Attacks: As mentioned earlier, a greater hash rate makes it exponentially harder for malicious actors to attempt a 51% attack, where they would try to control the blockchain and reverse transactions.

- Faster Transaction Processing (Indirectly): While difficulty adjusts block time, a higher hash rate generally indicates a healthier and more active mining network, ensuring consistent transaction processing.

- Network Stability: A strong hash rate demonstrates the overall health and stability of the Bitcoin network, attracting more users and investors.

Brief Dip Before the Climb: Bitcoin’s Difficulty Adjustment

Interestingly, before reaching this all-time high, Bitcoin’s network difficulty experienced a slight dip. It decreased from 27.96 trillion on March 4th to 27.55 trillion, and then further to 27.45 trillion by March 30th. However, this was a temporary fluctuation in an overall upward trend. Since July 2021, the Bitcoin network has largely seen consistent growth in difficulty, reflecting the continuous expansion of the mining ecosystem.

The 19 Millionth Bitcoin Milestone: Scarcity in Action

Adding to the significance of the difficulty surge, the Bitcoin community also celebrated the mining of the 19 millionth Bitcoin. This is a major milestone because it highlights Bitcoin’s inherent scarcity. With a fixed supply of 21 million coins, we are now nearing the point where the vast majority of Bitcoin has already been mined.

What does this mean for the future?

- Increased Scarcity Value: As fewer Bitcoins remain to be mined, the scarcity principle suggests that demand, and potentially price, could increase over time, assuming consistent or growing adoption.

- Focus on Transaction Fees for Miners: As block rewards (newly minted Bitcoins) diminish over time with each halving event, miners will increasingly rely on transaction fees for their revenue. This could lead to a more sustainable and fee-driven Bitcoin economy in the long run.

Luna Foundation Guard (LFG) and Bitcoin Accumulation: A Whale’s Appetite

Adding another layer of intrigue to the Bitcoin narrative, the Luna Foundation Guard (LFG), associated with the Terra (LUNA) ecosystem, has been aggressively accumulating Bitcoin. On March 30th, LFG’s wallet swelled by a massive $139 million in BTC, bringing their total Bitcoin holdings to a staggering 31,000 BTC, valued at approximately $1.47 billion at the time.

This substantial accumulation by a major player like LFG underscores the growing institutional interest in Bitcoin as a reserve asset and a store of value. Such large-scale acquisitions can have a notable impact on market dynamics and sentiment.

Looking Ahead: A Stronger, More Secure Bitcoin Network

The confluence of Bitcoin’s mining difficulty reaching an all-time high and the 19 millionth BTC being mined paints a picture of a maturing and increasingly robust network. A high difficulty level reinforces Bitcoin’s security, while the approaching scarcity highlights its unique value proposition. As the Bitcoin community continues to grow and innovate, and with major players like LFG showing strong conviction, the future of the crypto king looks brighter than ever.

Related Posts – XRP Price Goes Up After Unexpected Reappearance On Coinbase

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.