Is Avalanche (AVAX) the crypto world’s rising star? While other major cryptocurrencies are making steady gains, AVAX is absolutely soaring! Over the last 12 hours, this layer-1 blockchain’s token has jumped an impressive 10%, outperforming many of its high-cap peers. What’s the secret behind this momentum? Let’s dive into the factors propelling Avalanche to new heights.

- AVAX Outperforms the Market: Gained 10% in just 12 hours, leading the charge among high-cap cryptos.

- RWA Tokenization Buzz: Partnerships with giants like JP Morgan and Citi are fueling excitement around real-world asset tokenization on Avalanche.

- ASC-20 Ordinals Mania: A staggering 96% of Avalanche network transactions are now driven by ASC-20 ordinals minting.

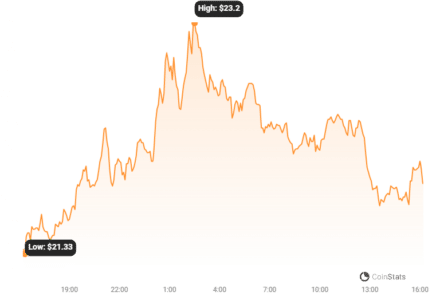

Currently trading around the $23 mark, AVAX is demonstrating remarkable strength. This surge isn’t just a flash in the pan; it’s part of a larger trend. But is this rally sustainable, and what exactly is driving this intense interest in Avalanche?

Why is Avalanche Hype Reaching Fever Pitch? The RWA Tokenization Factor

The buzz around Avalanche isn’t just noise; it’s a roar! This high-throughput blockchain is becoming the talk of the crypto town, and for good reason. Over the past two weeks alone, AVAX has witnessed an astonishing 80% price increase. Zoom out to the last month, and you’re looking at gains exceeding 140%! This explosive growth is fueled by a potent mix of factors, including strategic partnerships, a thriving GameFi and NFT ecosystem, and a powerful narrative shift towards real-world asset (RWA) tokenization.

Read Also: Avalanche Shines With A 31% Rally – Can AVAX Bulls Maintain Push To $22?

But what exactly is RWA tokenization, and why is it so significant for Avalanche? Simply put, it’s about bringing traditional assets – think gold, real estate, commodities, even government bonds – onto the blockchain. Avalanche is positioning itself to be the go-to platform for this groundbreaking shift.

Recent announcements have solidified this vision, most notably partnerships with financial powerhouses JP Morgan and Citi. These institutions aren’t just dipping their toes in; they are actively experimenting with RWA tokenization using Avalanche’s cutting-edge technology. This is a massive vote of confidence for Avalanche and its potential to bridge the gap between traditional finance and the decentralized world.

According to DeFi researcher ‘Emperor Osmo’, this surge in institutional interest and real-world applications is creating a ripple effect:

$AVAX is a sleeping giant awakening

– Subnets are being adopted

– L1 is cheap and fast

– $50M RWA fund

– Institutions experimenting with tokenization

– ASC-20 ordinals driving txnsResurgence of excitement will trickle across the ecosystem from both retail and institutions looking to get exposure 🚀 pic.twitter.com/0j51o799nB

— Emperor Osmo 🧂 (@Flowslikeosmo) November 19, 2023

The potential of RWA tokenization is immense. Industry experts at Bernstein estimate that a staggering $3 trillion – roughly 2% of the global money supply – could be tokenized within the next five years. This represents a massive opportunity, and established financial institutions are keen to capitalize on it. Avalanche, with its robust and scalable infrastructure, provides a ready-made solution, eliminating the need for banks to build complex blockchain systems from scratch.

Avalanche’s commitment to RWA tokenization is further underscored by the Avalanche Foundation’s launch of “Avalanche Vista” in July. This $50 million initiative is specifically designed to invest in and accelerate the adoption of RWA tokenization within the Avalanche ecosystem.

Read Also: AVAX and Near Attract New Investors As They Outshine Bitcoin, Ethereum

ASC-20 Ordinals: Riding the Bitcoin Ordinals Wave on Avalanche?

Adding another layer of excitement to the Avalanche narrative is the emergence of ASC-20 ordinals. Similar to Bitcoin ordinals, ASC-20 allows for the inscription of data onto the Avalanche blockchain, enabling the creation of unique digital assets and collectibles. Blockworks researcher Dan Smith highlighted on November 20th that Avalanche now has its own ordinals standard, and it’s taking the network by storm.

The data speaks for itself: ASC-20 minting has exploded, accounting for a remarkable 96% of all transactions on the Avalanche network in the past day. Over 170,000 wallets are actively participating in minting these ordinals, indicating a massive surge in user engagement and network activity. This ordinals frenzy is contributing significantly to Avalanche’s on-chain activity and further boosting its appeal within the crypto community.

What’s Next for AVAX Price?

The combined forces of RWA tokenization excitement and the ASC-20 ordinals craze have propelled AVAX to impressive heights. During the Monday morning Asian trading session, AVAX reached an intraday peak of $23.18, demonstrating strong bullish momentum.

Will AVAX maintain this upward trajectory? The fundamentals certainly look strong. The increasing adoption of Avalanche for RWA tokenization by major financial institutions, coupled with the vibrant activity around ASC-20 ordinals, paints a bullish picture. However, the crypto market is known for its volatility, and it’s crucial to remember that price movements can be unpredictable. Keep an eye on further developments in RWA tokenization and the evolution of the ASC-20 ecosystem to gauge the long-term sustainability of AVAX’s current rally.

In Conclusion: Avalanche is not just riding a wave; it’s creating one. Fueled by real-world asset tokenization, partnerships with financial giants, and a thriving ordinals market, AVAX is proving to be a force to be reckoned with in the crypto space. As the crypto landscape evolves, Avalanche’s innovative approach and strategic positioning suggest that its journey is just beginning. Keep watching AVAX – it might just be the avalanche that reshapes the future of finance.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.