Hey crypto enthusiasts! Ever feel like the market is throwing you curveballs? Avalanche (AVAX) is a prime example right now. Despite some seriously positive news hitting the wires, AVAX’s price has been on a bit of a rollercoaster – and not the fun kind. Let’s dive into what’s going on with AVAX, why it’s facing some headwinds, and what the charts are telling us.

AVAX Price Under Pressure: What’s Causing the Downturn?

It’s a bit of a head-scratcher, isn’t it? Avalanche, a blockchain known for its speed and scalability, has been making some impressive moves behind the scenes. We’re talking about real-world adoption here, folks! But when you look at the AVAX price chart, it’s telling a different story. Here’s the lowdown:

- Bearish Momentum: AVAX price is currently in a consolidation phase, but the overall signs are leaning bearish. Think of it like a tug-of-war where the bears seem to have a stronger grip right now.

- Decreasing Volume: The volume of AVAX being traded has decreased, which can be a sign of increased selling pressure. Basically, more people are selling than buying, and with less overall trading activity.

Over the past couple of weeks, AVAX has been feeling the downward pressure, even as the broader crypto market showed signs of life, particularly after the Bitcoin Conference 2024. It’s like AVAX missed the memo on the market’s mini-revival.

And get this – just recently, California, yes, the state with a massive economy, digitized a whopping 42 million car titles using Avalanche’s C-Chain! That’s huge! It’s a major win for Avalanche, solidifying its position as a go-to blockchain for Real World Asset (RWA) tokenization. Despite this fantastic news, AVAX price actually dropped 3.4% in the last 24 hours, trading around $25.34. Talk about market disconnect!

California DMV Goes Digital with Avalanche: A Game Changer?

Let’s zoom in on this California DMV news because it’s a pretty big deal. On July 31st, John Wu, President of Ava Labs (the team behind Avalanche), announced that the California DMV had successfully digitized 42 million car log books onto the Avalanche C-Chain.

California DMV just digitized 42M car titles on @avalancheavax C-Chain. @CA_DMV is responsible for issuing and recording vehicle titles, vehicle registration, driver licenses, identification cards, and occupational licenses. #RWA

— John Wu (@John1wu) July 31, 2024

This isn’t just about keeping up with the times; it’s about fundamentally changing how car ownership transfers work in California. Think about the implications:

- Modernization: Moving away from paper log books to a digital system streamlines processes and reduces bureaucracy.

- Real-World Adoption: This is tangible proof of blockchain technology being used for real-world applications, specifically in the burgeoning RWA tokenization space.

- Avalanche’s Position: It firmly establishes Avalanche as a leading blockchain for enterprises and government entities looking to digitize assets.

California’s economy is massive – ranking as the 5th largest globally! You’d expect a partnership of this scale to send AVAX prices soaring. After all, AVAX is the gas token for the C-Chain, meaning more activity on the network could translate to increased demand for AVAX. However, the market sometimes has its own logic, and AVAX price continued its downward trajectory, possibly influenced by a broader market dip triggered by Bitcoin’s movements.

Is a Further Avalanche Price Drop Inevitable? Analyzing the Charts

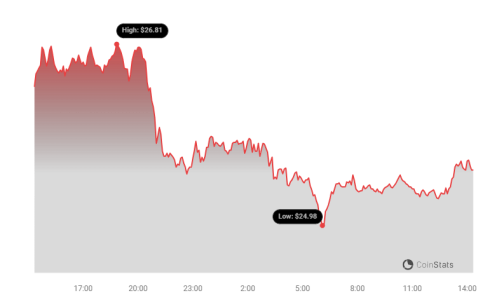

Let’s get technical and look at what the AVAX price chart is telling us. Since hitting a peak around $65.39, AVAX has been in a clear downtrend, marked by lower highs and lower lows. This is classic textbook bearish price action.

Adding to the bearish sentiment, AVAX price has consistently traded below both the 200-day Exponential Moving Average (EMA) – the black line in the chart – and the 50-day EMA – the green line. These EMAs are often used to gauge the long-term and medium-term trends, and trading below them is generally considered bearish.

If you’re familiar with chart patterns, you might spot a head-and-shoulders pattern forming. The neckline of this pattern is around the $32.29 level. For those unfamiliar, a head-and-shoulders is a bearish reversal pattern that often signals further price declines. Unfortunately, the neckline has been breached and even retested recently, strengthening the bearish signal.

Currently, the crucial support level to watch for AVAX is around $24. This level has acted as support in the past. If AVAX breaks below this, we could see a further drop towards $20 – that’s a potential 21% decrease from the current price. On the flip side, resistance is looming around $28.65 (the 50-day EMA) and then $32.29 (the 200-day EMA).

Interestingly, the daily trading volume for AVAX has decreased during this price slump. This could suggest that the selling pressure might be weakening. However, we need to be cautious because the overall bearish trend is still very much in play.

Looking at other indicators:

- Chaikin Money Flow (CMF): The CMF is negative at -0.07, indicating capital outflows from AVAX. This supports the bearish narrative.

- Relative Strength Index (RSI): The RSI is at 40.77. While not yet in oversold territory (below 30), it’s getting closer, suggesting potential for a bounce, but not necessarily a trend reversal yet.

The Bullish Counter-Argument?

It’s not all doom and gloom for AVAX bulls! If AVAX price can manage to break above $32 (the 200-day EMA) and hold above it, that would be a significant sign of strength. It would invalidate the bearish head-and-shoulders pattern and could potentially flip the script, turning the price action bullish. In such a scenario, we might see AVAX catapult towards the $40 mark, which is the next major resistance zone.

Key Takeaways: Navigating AVAX’s Price Action

So, what’s the bottom line for AVAX? Here’s a quick recap:

- Fundamentals vs. Price: Avalanche has strong fundamentals, highlighted by the California DMV adoption, but the price is currently under bearish pressure.

- Bearish Technicals: The price chart shows a downtrend, trading below key EMAs and forming a head-and-shoulders pattern, suggesting further downside risk.

- Support and Resistance: Watch the $24 support level closely. A break below could lead to $20. On the upside, $28.65 and $32 are key resistance levels to overcome.

- Potential Bullish Reversal: Breaking above $32 could invalidate the bearish pattern and open the door for a move towards $40.

AVAX is at a critical juncture. While the underlying technology and adoption are promising, the price action is currently painting a cautious picture. Keep an eye on those key levels and stay informed as the situation unfolds. Crypto markets are known for their volatility, and things can change quickly!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.