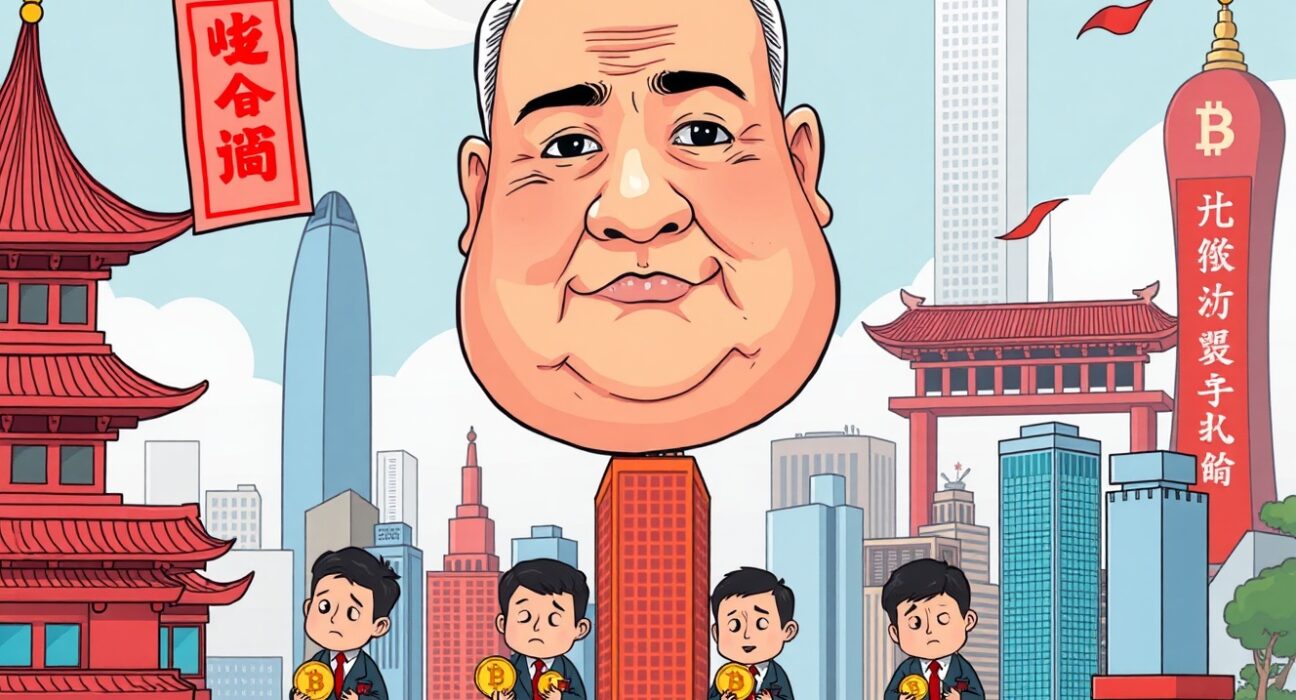

A seismic shift is underway in Hong Kong’s digital landscape. The Chinese government has issued a stunning directive, implementing a significant Hong Kong crypto ban. This move directly targets major internet companies, their affiliates, state-owned enterprises, and state-owned financial institutions operating in Hong Kong, prohibiting their involvement in stablecoin and cryptocurrency-related businesses. This decision, as reported by local economic outlet Caixin, underscores Beijing’s clear intention to redirect focus towards the real economy, moving away from virtual asset ventures.

What Does This Hong Kong Crypto Ban Mean for Key Players?

This comprehensive prohibition extends its reach far and wide, impacting a crucial segment of Hong Kong’s economic fabric. Specifically, the ban affects entities with strong ties to the mainland, including:

- State-Owned Enterprises (SOEs): These powerful entities are now barred from engaging with virtual assets.

- Big Tech Firms and Their Affiliates: Major internet companies, often with extensive operations and investments, must cease their crypto-related activities.

- State-Owned Financial Institutions: Banks and other financial bodies under state control are also included in this sweeping directive.

The core of the directive is a complete disengagement from stablecoin and broader cryptocurrency activities. This isn’t just a suggestion; it’s a firm instruction from Beijing, highlighting a strategic pivot in its economic priorities.

Why Is Beijing Prioritizing the Real Economy Over Virtual Assets?

Beijing’s rationale behind the Hong Kong crypto ban is rooted in a long-standing economic philosophy. The Chinese government has consistently emphasized the development and stability of the “real economy” – traditional industries like manufacturing, agriculture, and services that produce tangible goods and services. Virtual assets, from this perspective, are often viewed as speculative, volatile, and potentially disruptive to financial stability.

This stance is not new; mainland China has implemented strict prohibitions on crypto trading and mining for years. Moreover, the extension of this policy to state-affiliated entities in Hong Kong signals a broader strategy to contain perceived risks and ensure that capital and resources are channeled into sectors deemed more productive and stable for national development. It reflects a cautious approach to financial innovation, especially when it involves decentralized and unregulated assets.

The Impact of the Hong Kong Crypto Ban on the Region’s Digital Future

Hong Kong has, in recent years, attempted to position itself as a burgeoning hub for virtual assets, seeking to attract crypto businesses and talent. This new directive, however, introduces significant challenges to that ambition. While the ban specifically targets state-owned and big tech firms, its ripple effects could be substantial.

- Reduced Institutional Participation: The absence of major state-backed and tech giants will inevitably limit institutional involvement in the crypto space.

- Regulatory Uncertainty: The move could create further uncertainty for other crypto firms operating in Hong Kong, even those not directly targeted.

- Innovation Slowdown: With key players sidelined, the pace of innovation in stablecoins and other virtual assets might decelerate within the region.

Consequently, this situation presents a complex landscape for Hong Kong, balancing its desire for digital innovation with Beijing’s overarching economic directives.

Navigating the Future: What’s Next for Crypto Businesses in Hong Kong?

Despite the comprehensive nature of the Hong Kong crypto ban for state-affiliated entities, the broader crypto market in Hong Kong is not entirely shut down. Private, non-state-affiliated firms may still find avenues for operation, provided they adhere to local regulations. However, the environment has undeniably become more challenging.

For businesses still keen on the region, understanding the evolving regulatory landscape will be paramount. This could involve:

- Strict Compliance: Adhering to all existing and future local regulations concerning virtual assets.

- Focusing on Specific Niches: Identifying areas where private sector innovation might still be encouraged or tolerated.

- Monitoring Policy Shifts: Staying informed about any further directives from Beijing or local Hong Kong authorities.

The long-term impact will depend on how Hong Kong’s government navigates these conflicting pressures and defines its future role in the global digital asset space.

In essence, Beijing’s directive marks a critical juncture for Hong Kong’s aspirations in the digital asset world. The Hong Kong crypto ban on state-owned and big tech firms underscores a firm commitment to the real economy, potentially reshaping the region’s trajectory as a crypto hub. While the immediate implications are clear for the targeted entities, the broader market will need to adapt to this new, more restrictive environment, carefully charting a course through evolving regulations and strategic priorities.

Frequently Asked Questions (FAQs)

Q1: Who exactly is affected by this Hong Kong crypto ban?

A1: The ban specifically targets major internet companies, their affiliates, state-owned enterprises, and state-owned financial institutions in Hong Kong. It prohibits their involvement in stablecoin and other cryptocurrency-related businesses.

Q2: Why did Beijing implement this directive?

A2: Beijing’s primary motivation is to prioritize the development of the “real economy” – traditional industries and services – over what it views as speculative virtual asset ventures. This aligns with China’s long-standing cautious stance on cryptocurrencies.

Q3: Does this ban affect all crypto businesses in Hong Kong?

A3: No, the ban specifically targets state-owned and big tech firms and their affiliates. Private, non-state-affiliated crypto businesses may still operate, but they must adhere to local regulations, and the overall market sentiment and regulatory environment could become more challenging.

Q4: How might this impact Hong Kong’s role as a financial hub?

A4: While Hong Kong has aimed to be a virtual asset hub, this ban could limit institutional participation and potentially slow down innovation in the crypto space. It reinforces Beijing’s influence over the region’s financial policies, particularly concerning digital assets.

Q5: Are stablecoins also included in the prohibition?

A5: Yes, the directive explicitly prohibits the targeted entities from participating in stablecoin-related businesses, alongside other cryptocurrency ventures.

Q6: What should crypto firms in Hong Kong do now?

A6: Firms not directly targeted by the ban should focus on strict compliance with existing and evolving local regulations, identify niche opportunities, and closely monitor policy shifts from both Hong Kong and Beijing authorities.

If you found this article insightful, consider sharing it with your network! Stay informed on the latest developments shaping the cryptocurrency world by sharing this piece on your social media platforms.

To learn more about the latest crypto market trends, explore our article on key developments shaping the digital asset space and institutional adoption.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.