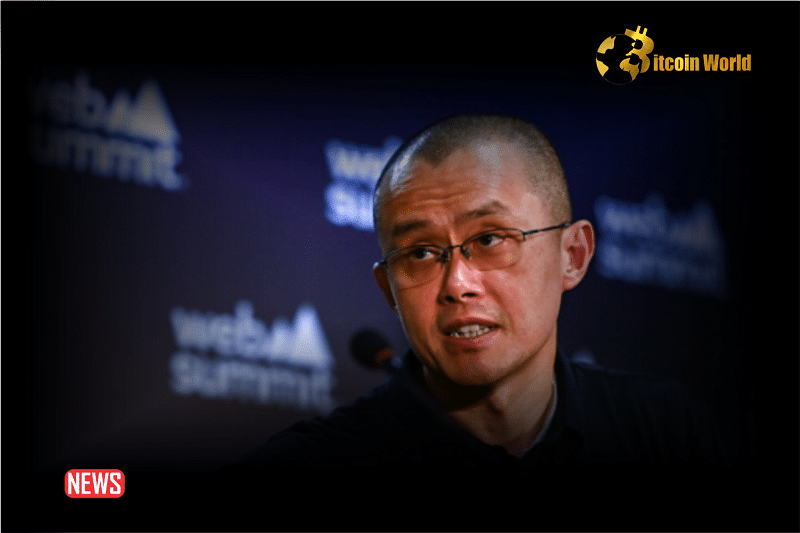

In a seismic shift for the cryptocurrency world, Changpeng Zhao, widely known as ‘CZ,’ has stepped down from his role as CEO of Binance, the world’s largest crypto exchange. This news, breaking yesterday, comes after CZ pleaded guilty to criminal charges in the US, marking a significant turning point for both CZ and the industry giant he built. But what exactly happened, and what does it all mean for the future of Binance and the broader crypto landscape?

CZ’s Day in Court: Guilty Plea and a Staggering Bond

The courtroom drama unfolded as CZ faced charges of violating the Bank Secrecy Act. To secure his release pending sentencing, a hefty personal recognizance bond of $175 million was set. Let’s break down the key components of this bond:

- $175 Million Personal Recognizance Bond: This substantial amount acts as collateral, ensuring CZ’s appearance in court for his sentencing hearing scheduled in Seattle on February 23rd of next year.

- $15 Million in Trust: Adding to the financial assurance, $15 million is being held in a Davis Wright Tremaine trust account.

- Guarantors Required: The bond isn’t solely reliant on CZ’s assets. Two guarantors are also mandated to pledge $250,000 and $100,000 respectively, further reinforcing the commitment to his court appearance.

This multi-layered bond structure underscores the seriousness of the charges and the court’s determination to ensure CZ’s presence for future proceedings. Failure to appear could lead to severe consequences – up to 10 years imprisonment and a $250,000 fine, as outlined in the appearance bond document.

The Charges and the Fallout: What Did CZ Plead Guilty To?

CZ’s guilty plea centers around violating the Bank Secrecy Act. This act is designed to prevent money laundering and other illicit financial activities. Here’s a simplified breakdown of the charges and their implications:

- Violation of the Bank Secrecy Act: This implies Binance, under CZ’s leadership, did not adequately implement measures to prevent the platform from being used for illegal activities.

- $50 Million Personal Fine for CZ: In addition to stepping down, CZ himself faces a significant personal financial penalty.

- $4.3 Billion Fine for Binance: The crypto exchange itself is facing a massive fine for violating money transmission laws and U.S. sanctions. This staggering figure highlights the scale of the regulatory breach and the financial repercussions for Binance.

These penalties are not just slaps on the wrist; they represent a serious reckoning for Binance and a clear message from US regulators about compliance within the crypto industry.

See Also: Richard Teng Likely To Take Over From CZ As Binance CEO

What are the Bond Conditions? Key Dates and Restrictions

Beyond the financial aspects, the bond comes with specific conditions that CZ must adhere to. Let’s delve into the crucial details:

- Court Appearance Deadline: CZ is obligated to appear in court in Seattle on February 23, 2024, for his sentencing hearing.

- Return to the U.S. Timeline: He is required to be back in the United States 14 days prior to this sentencing date. This condition suggests potential travel restrictions and a need for CZ to remain accessible to the US legal system.

- Potential Bail Order Review: The situation is still somewhat fluid. The U.S. authorities are seeking a review of the bail order.

- November 27th – A Key Date: If a district judge denies the review, the bail order becomes effective on November 27th. However, if the judge grants a review by this date, CZ must remain in the U.S. until the judge makes a decision. This introduces a period of uncertainty regarding CZ’s immediate movements.

The Crypto World Reacts: Uncertainty and a Call for Regulation

The news of CZ’s departure and Binance’s massive fine has sent ripples throughout the crypto market. Here are some key takeaways and potential implications:

- Leadership Transition at Binance: With CZ stepping down, Richard Teng is expected to take the helm. This leadership change comes at a critical juncture for Binance as it navigates these regulatory challenges. Will Teng steer Binance towards a more compliant future?

- Increased Regulatory Scrutiny: This case underscores the growing pressure on crypto exchanges to comply with traditional financial regulations. Expect to see even more stringent oversight from regulatory bodies worldwide.

- Market Volatility: News of this magnitude often introduces volatility into the crypto markets. Traders and investors are closely watching how Binance and the broader market will respond in the coming days and weeks.

- A Turning Point for Crypto? Some analysts believe this marks a watershed moment, signaling a move towards greater accountability and regulation within the often-unregulated crypto space. Will this lead to a more mature and stable crypto ecosystem in the long run?

Looking Ahead: Binance and the Future of Crypto Regulation

CZ’s departure from Binance and the hefty fines imposed mark a pivotal moment in the cryptocurrency industry’s evolution. While the immediate impact is being felt in market fluctuations and leadership changes at Binance, the long-term consequences could be far more profound. This case serves as a stark reminder that regulatory compliance is no longer optional for crypto businesses operating globally. As the industry matures, expect to see a greater emphasis on regulation, transparency, and accountability. The path forward for Binance, and indeed the entire crypto sector, will be shaped by how effectively they adapt to this evolving regulatory landscape.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.