In the ever-evolving world of cryptocurrency, trust and transparency are paramount. When you entrust your digital assets to a platform, you want assurance that they’re safe and sound. Binance, a leading name in the crypto exchange arena, understands this implicitly. They’ve just dropped their 10th Proof of Reserves (PoR) report, offering a detailed snapshot of the assets they hold in custody. Let’s dive into what this report reveals and what it means for you and the broader crypto landscape.

What Does Binance’s 10th Proof of Reserves Report Reveal?

Binance’s latest report is like a peek behind the curtain, giving us a glimpse into the vast digital vault they manage. While these reports are intended to boost confidence through transparency, it’s natural to wonder: how reliable are they, really? Let’s break down the key takeaways from this 10th edition.

Key Highlights from the Report:

- Slight Shift in User Deposits: Interestingly, the report indicates a 4.3% decrease in users’ Ethereum (ETH) deposits since the last report. This could be due to various market dynamics or user portfolio adjustments.

- USDT Holdings on the Rise: On the other hand, Tether (USDT) holdings saw a marginal 1% increase, climbing to a significant 15.44 billion USDT. This could reflect a preference for stablecoins amidst market fluctuations.

- Massive Crypto Holdings: The sheer scale of assets held by Binance is impressive. Users are currently holding over 580,000 Bitcoin (BTC) and more than 3.89 million Ethereum (ETH) tokens on the platform. These numbers underscore Binance’s position as a major custodian of digital assets.

| Cryptocurrency | User Holdings (Approximate) |

|---|---|

| Bitcoin (BTC) | 580,000+ |

| Ethereum (ETH) | 3,890,000+ |

| Tether (USDT) | 15.44 Billion |

Strong Capitalization Ratios: A Safety Net?

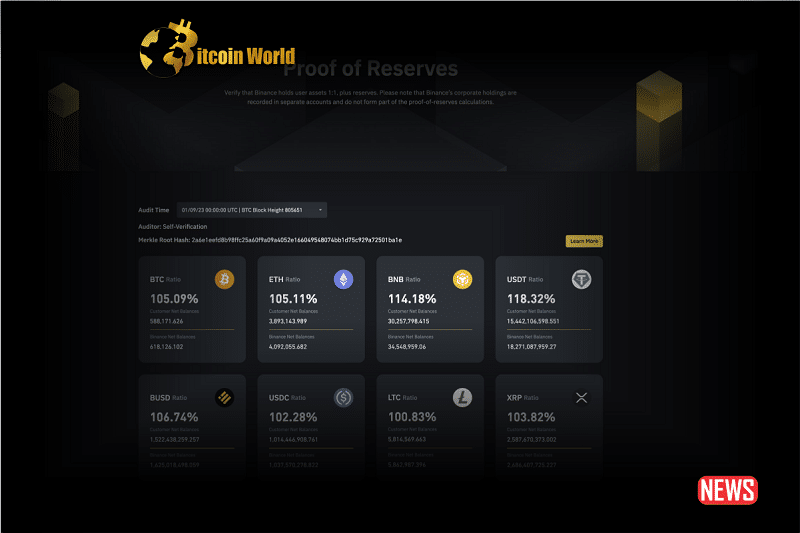

One of the most crucial aspects of a Proof of Reserves report is the capitalization ratio. This ratio essentially tells us if an exchange holds enough reserves to cover user assets. Binance’s report paints a reassuring picture here:

- Bitcoin (BTC): Capitalization ratio of 105.09%

- Ethereum (ETH): Capitalization ratio of 105.11%

- Binance Coin (BNB): Capitalization ratio of 114%

These ratios exceeding 100% suggest that Binance claims to hold reserves that are greater than the user assets it’s responsible for. In simpler terms, for every unit of BTC or ETH you hold on Binance, they state they have slightly more than one unit in reserve. This ‘over-collateralization’ is intended to provide an extra layer of security.

| Cryptocurrency | Capitalization Ratio |

|---|---|

| Bitcoin (BTC) | 105.09% |

| Ethereum (ETH) | 105.11% |

| Binance Coin (BNB) | 114% |

The report further details ratios for a range of other digital assets, generally showing ratios above 100%, reaching up to 119% for Polygon (MATIC). According to Binance, this comprehensive overview indicates their capacity to fully safeguard user deposits across the board.

Merkle Tree Magic: How Does Self-Verification Work?

Binance employs a “Self-Verification” method for its PoR reports, leveraging a clever cryptographic tool known as a Merkle Tree. Sounds technical? Let’s simplify it.

Imagine you have a huge stack of documents. A Merkle Tree acts like a super-efficient way to summarize all that information into a single, unique digital fingerprint called a Merkle Root. Think of it as a cryptographic seal that represents all the data within.

Here’s why it’s important for Proof of Reserves:

- Data Consolidation: The Merkle Tree takes all the individual user account balances and crunches them into a single Merkle Root.

- Cryptographic Seal: This Merkle Root acts as proof that all the data is accounted for and hasn’t been tampered with.

- User Verification: Crucially, this method allows you, the user, to verify that your individual holdings are included within this sealed data and are therefore backed by Binance’s reserves.

In essence, the Merkle Tree method aims to provide a transparent and verifiable way for users to confirm that their assets are indeed part of the exchange’s reported reserves. It’s a step towards greater accountability, allowing for cryptographic verification rather than solely relying on trust.

Proof of Reserves Amidst Executive Exodus and Regulatory Scrutiny?

The timing of this 10th Proof of Reserves report is noteworthy. Binance has been navigating a period of significant internal changes and external pressures. Recently, several high-profile executives have departed, including:

- Mayur Kamat (Global Product Lead)

- Patrick Hillman (Chief Strategy Officer)

- Matthew Price (Senior Director of Investigations)

- And others…

These departures are reportedly linked to the ongoing scrutiny Binance faces, including a U.S. Department of Justice investigation and a lawsuit from the U.S. Securities and Exchange Commission (SEC) earlier in the year. These regulatory challenges add another layer of complexity to the context of the Proof of Reserves report.

Transparency as a Strategy for Trust?

Despite the internal and external headwinds, Binance’s continued commitment to releasing Proof of Reserves reports signals a clear intention to prioritize transparency. In a space where trust is easily eroded, such reports are crucial for maintaining user confidence and demonstrating a commitment to responsible practices.

However, it’s essential to maintain a balanced perspective. While Proof of Reserves reports are a positive step, they are not a foolproof guarantee. The methodology, scope, and frequency of these reports are all factors to consider. Furthermore, the evolving regulatory landscape and internal dynamics within exchanges like Binance mean that ongoing vigilance and critical assessment are necessary from all stakeholders – users, regulators, and the broader crypto community.

The Bottom Line: Proof of Reserves and the Future of Crypto Trust

Binance’s 10th Proof of Reserves report provides valuable insights into their asset holdings and capitalization. The use of Merkle Trees for self-verification is an innovative approach to enhancing transparency. In a volatile and often opaque crypto market, initiatives like Proof of Reserves are vital for building trust and fostering greater accountability.

As the cryptocurrency industry matures, the demand for transparency will only intensify. Proof of Reserves reports, while not a perfect solution, represent a significant step in the right direction. They empower users with more information and encourage exchanges to operate with greater openness. Moving forward, continued scrutiny, refinement of reporting standards, and independent audits will be crucial to solidify the role of Proof of Reserves in establishing long-term trust in the crypto ecosystem. Keep an eye on Binance and other exchanges – their actions and commitment to transparency will shape the future of crypto confidence.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.