Fear and Greed Index which reads 16 has given chills down the spine to retail investors. Mass capitulation is on the way and miners have decided to liquidate their holdings for a profit.

Is the Bear market at Its Bottom for Bitcoin?

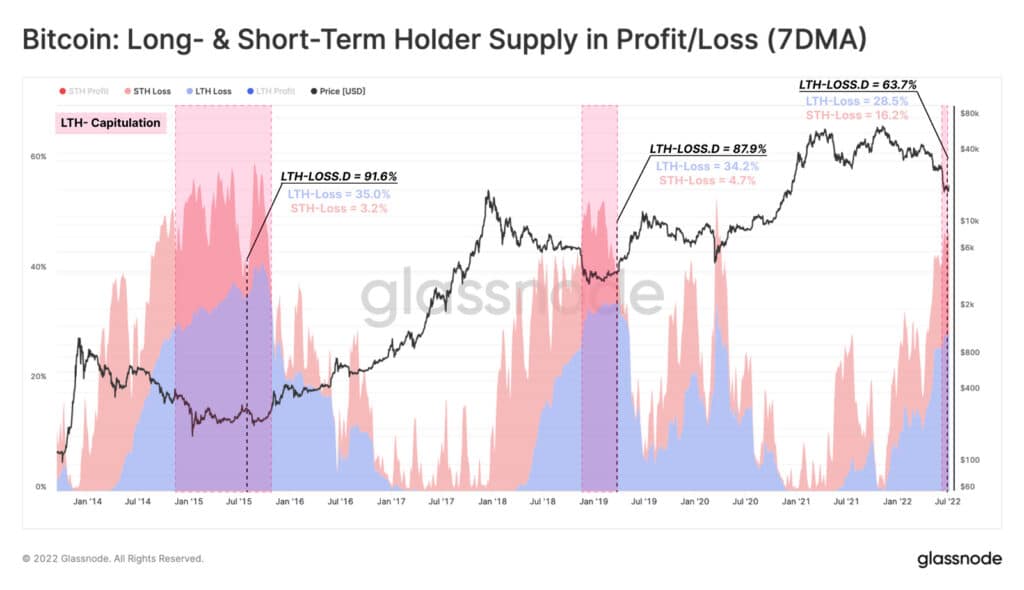

Onchain GlassNode Data shows that bears are looking to target long-term HOLDERS. Only when long-term holders have turned price-sensitive to changes denote that the bare bottom is apparent.

Basically, the reason that a bear market has to reach its bottom. It is necessary that it should target those who are least sensitive to prices. Currently, in this bear market, the LTH or Long Term Holders have a 28% BTC Holding. Whereas, STH or Short Term Holders have 16%.

When compared to the last bear market, it was 34% and 3% to 4% respectively. Considering the adoption rate and price of BTC exploding, the Long Term HOLDERS haven’t submitted to the circumstances. That said, Long Term Holders are still bullish and they are simply waiting for more dips to follow. Once that happens, they will be buying it!

Miners have been the main victims of this bear market. But their sales have dipped nonetheless from May onwards. Instead of selling 7900 BTCs, they are only selling 1350 BTCs per month. In the last bear market, the market capitulation took 4 months. They sold in 2022, in this bear market, we are still not at the bottom. It would possibly take 5 to 6 months before we actually hit the bottom.