Bitcoin (BTC) has surged rapidly in recent weeks, climbing from the $10,000 range to $16,000, signaling the beginning of a potential long-term bull market. Analysts and traders are highlighting technical patterns and fundamental drivers that suggest Bitcoin is primed for a dramatic rally in the months ahead.

Key Indicators Pointing to a Bitcoin Bull Market

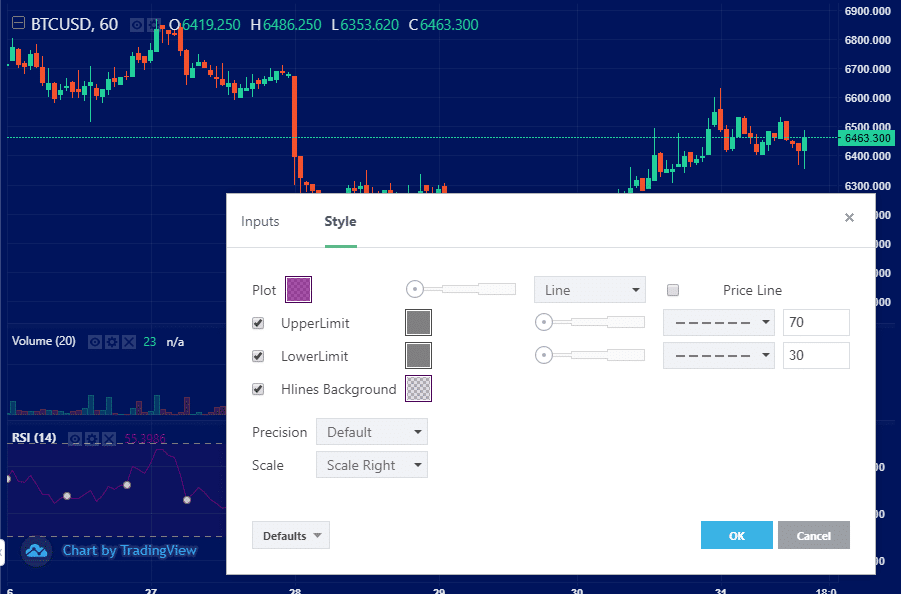

1. Technical Momentum and RSI Levels

- Renowned analyst PlanB notes that Bitcoin’s one-week Relative Strength Index (RSI) is nearing a critical threshold historically associated with bull markets.

- When Bitcoin’s RSI crosses this level, the cryptocurrency has historically seen explosive growth, as evidenced in the 2013 and 2017 bull runs.

- According to PlanB:

“Current #bitcoin price rise to $16K is just a small taste of what will come next. We are just warming up.”

2. Historical Patterns Predicting Massive Gains

- Cryptocurrency trader Josh Rager points to Bitcoin’s history of massive rallies after surpassing its previous monthly all-time high.

- Every time BTC has achieved this milestone, it has rallied 700% to 1,000%, according to his analysis.

- Rager adds:

“November could be the first monthly close that we see breaking the previous high, and historically that’s been a very bullish sign for the crypto market.”

Fundamental Drivers Supporting Bitcoin’s Rise

1. Devaluation of the U.S. Dollar

- The ongoing monetary easing and stimulus measures by the U.S. government have weakened the dollar’s purchasing power, driving investors to seek store-of-value assets like Bitcoin.

2. Bitcoin vs. Gold

- Bitcoin is increasingly seen as a digital alternative to gold, with its finite supply of 21 million coins offering scarcity similar to the precious metal.

- Bitcoin’s ease of transfer, divisibility, and growing adoption make it a more attractive investment for many compared to gold.

What Analysts Are Saying About Bitcoin’s Future

PlanB’s Stock-to-Flow Model

PlanB’s Stock-to-Flow (S2F) model, which measures Bitcoin’s scarcity, predicts a price target of $100,000 or more by the end of 2024.

Institutional Adoption

- Hedge funds, family offices, and major corporations are increasing their exposure to Bitcoin as a hedge against inflation and economic uncertainty.

- Recent entries by firms like MicroStrategy and PayPal indicate growing institutional confidence in Bitcoin.

How High Could Bitcoin Go?

If history repeats, Bitcoin could experience gains between 700% and 1,000%, pushing prices to $100,000 or higher. Key factors supporting this potential include:

- Favorable Technical Patterns: Indicators like RSI and previous all-time highs suggest strong momentum.

- Macroeconomic Tailwinds: Inflation concerns and weakening fiat currencies are driving demand for scarce assets like Bitcoin.

- Institutional Involvement: Increased participation by large investors and corporations provides a stable foundation for sustained growth.

Conclusion

Bitcoin’s recent surge to $16,000 marks the start of what many analysts believe could be its most significant bull market yet. With strong technical signals, institutional interest, and a macroeconomic backdrop favoring scarce assets, Bitcoin is poised to achieve new all-time highs.

For those who missed the 2013 and 2017 rallies, this may be the moment to watch as Bitcoin’s next phase of growth unfolds.

For more updates on Bitcoin’s market trends, explore our article on crypto market predictions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.