The crypto market is buzzing, with Bitcoin and other major cryptocurrencies hitting new highs in 2023. But amidst this excitement, Bitcoin Cash (BCH) seems to be lagging. While the overall market enjoys a bullish phase, on-chain data paints a less optimistic picture for BCH. Let’s dive into the numbers and see what’s causing this slowdown and what it means for BCH’s price.

Is Bitcoin Cash Losing Momentum? On-Chain Data Reveals Network Struggles

Despite the rising tide in the crypto sea, Bitcoin Cash is finding it tough to navigate to new price territories. Recent on-chain data suggests a concerning trend: a noticeable decrease in network activity. What does this mean? Let’s break it down:

- Struggling to Keep Pace: While the crypto market is generally booming, Bitcoin Cash isn’t seeing the same upward momentum.

- Network Activity Decline: On-chain data points towards a reduction in activity within the Bitcoin Cash network.

- Price Ceiling: BCH appears to be hitting a resistance around $245, while other cryptos are soaring.

This week, Bitcoin Cash price action has been capped below the $250 mark. To understand why BCH is underperforming, we need to look at the on-chain data that reveals the key factors dampening its bullish potential.

Why is BCH Network Activity Declining?

While Bitcoin and Solana are grabbing headlines with their price surges, Bitcoin Cash is facing headwinds. On-chain metrics are highlighting a decrease in network activity as a primary reason for BCH’s stalled price movement this week.

Data from IntoTheBlock indicates a significant drop in user engagement within the Bitcoin Cash network.

Look at these numbers:

- Active Addresses Plummet: A dramatic 79% decrease in Bitcoin Cash Active Addresses over the last week.

- New Users Vanishing: An astonishing 85% drop in new addresses joining the BCH network during the same period.

Why are Active Addresses and New Addresses so important? These are vital on-chain indicators that give us a snapshot of the economic health of a blockchain network.

Active Addresses tell us about the current user base actively transacting on the network. New Addresses show how well the network is attracting new participants.

When both of these metrics decline simultaneously, it’s a strong bearish signal. It suggests a potential decrease in demand for BCH in the near future. This could mean Bitcoin Cash holders might see further price dips as the market adjusts.

Transaction Fees Tell the Same Story: BCH Network Slowdown

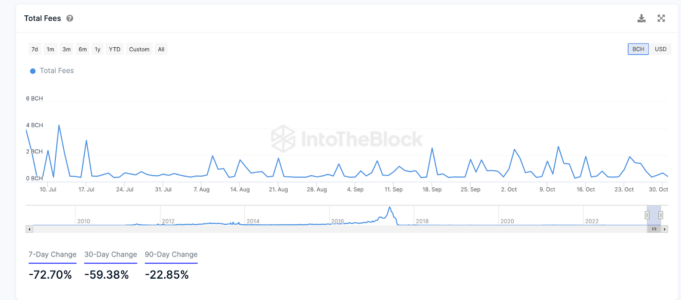

Another key indicator confirming the network activity slowdown is the downward trend in daily BCH Total Fees. Essentially, the fees generated from transactions on the Bitcoin Cash network have significantly decreased. How much?

- Fees in Freefall: A sharp 73% decrease in fees collected on the Bitcoin Cash network in just one week.

This is a worrying trend, indicating that economic activity on the BCH network has fallen below levels seen even in September.

Total Fees represent the total amount users pay to use the blockchain’s services over a period. A drop in transaction fees is typically a bearish sign, signaling reduced network demand.

This suggests that the recent BCH price increase might have been fueled more by general crypto market optimism rather than organic network growth. Without a real surge in network activity, Bitcoin Cash’s price rally might run out of steam soon.

Read More: Axie Infinity (AXS) Rises 15% Amid Sky Mavis and Act Games Partnership

Will BCH Break Through $250 Resistance? Price Prediction Challenges

Despite the positive vibes in the broader crypto market, Bitcoin Cash’s price seems poised for a potential pullback.

On-chain data, specifically the Global In/Out of the Money metric, further supports this. This metric visualizes the historical purchase prices of current Bitcoin Cash holders. It reveals a significant resistance level for BCH around $250.

Here’s why $250 is a hurdle:

- Heavy Resistance at $250: Approximately 1.25 million addresses hold 2.09 million BCH bought around $248.

- Potential Sell-off Pressure: If these holders decide to sell to take profits, it could trigger the predicted price correction.

However, there’s always a ‘bull case’ scenario. If Bitcoin Cash manages to surge past $300, it could invalidate the bearish outlook. In that case, the next major resistance would likely be around $280.

But even reaching $280 won’t be easy. Data shows:

- Resistance at $280-$300: Around 1.51 million addresses currently hold 968,000 BCH bought around $293.

- Need for Network Boost: Overcoming this resistance will require a substantial increase in network demand for Bitcoin Cash.

The Bottom Line: BCH’s Path Forward

Bitcoin Cash is at a critical juncture. While the broader crypto market is experiencing a rally, BCH’s network activity is showing signs of weakness. This divergence suggests that the recent price gains might be unsustainable without a fundamental improvement in network usage and adoption. Keep a close eye on on-chain metrics like active addresses and transaction fees to gauge the true health and future price trajectory of Bitcoin Cash. Will BCH overcome these challenges and regain its momentum, or is it heading for a correction? Only time will tell, but the data suggests caution for BCH bulls in the short term.

Disclaimer. The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.