The familiar narrative that every bear market in crypto follows the same script might just be getting a reality check this time around, especially when we look at Bitcoin (BTC) and other digital assets. Sure, the plummeting prices feel like déjà vu, echoing previous market downturns. But dig a little deeper, and you’ll find that this bear market is serving up a unique cocktail of challenges that sets it apart. It’s not just about the price charts anymore; there’s a deeper, more intricate story unfolding beneath the surface. Let’s dive into what makes this Bitcoin bear market feel… different.

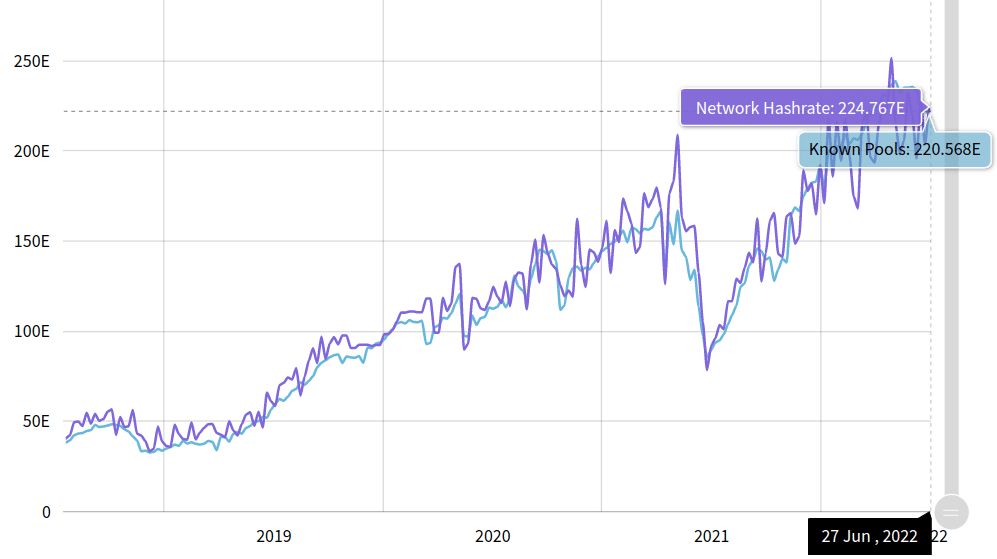

Why is Bitcoin’s Hashrate Plummeting?

Remember the great mining migration out of China? That seismic shift had a ripple effect that’s still being felt across the Bitcoin network, particularly in its hashrate. China, with its historically affordable electricity, was a miner’s paradise. But when the crackdown hammer fell, miners had to relocate, primarily to regions like the US. While this sounds like diversification and decentralization – generally good things – it came with a hefty price tag: increased operational costs.

Here’s the crux of the issue: electricity costs in places like the US are significantly higher than in China. This squeeze on profitability directly impacts Bitcoin mining. As mining becomes less lucrative, some miners are forced to power down their rigs, leading to a noticeable drop in the network’s overall hashrate. We’ve seen dips of up to 30%, a stark reminder of how geographical and regulatory shifts can impact Bitcoin’s fundamental infrastructure.

Think of hashrate as the muscle of the Bitcoin network – it’s the total computational power being used to validate transactions and secure the blockchain. A lower hashrate can, in theory, make the network slightly more vulnerable (though still incredibly robust). More immediately, it signals potential stress within the mining industry, a crucial component of the Bitcoin ecosystem.

Are Bitcoin Active Addresses Really Declining?

Another intriguing signal from this bear market is the decrease in active Bitcoin addresses. But before we jump to conclusions about mass exodus, let’s unpack the different interpretations of this data. A drop in active addresses could mean a couple of things, and both narratives are playing out simultaneously:

- Hodlers Hunkering Down (and Moving Offline): The phrase “buy the dip” became a rallying cry as Bitcoin revisited the $20,000 price range – levels not seen in over two years. It’s highly likely that many investors did exactly that: bought Bitcoin at these lower prices. However, instead of keeping their newly acquired BTC on exchanges, they might be transferring it to cold wallets for long-term storage. This “hodling” behavior, moving assets off exchanges and into personal custody, naturally reduces the number of ‘active’ addresses on exchanges.

- Reduced Trading Activity: Bear markets are often characterized by lower trading volumes. When prices are uncertain and sentiment is bearish, many traders step back from active trading. This reduced activity also contributes to fewer active addresses being recorded on exchanges.

So, is the drop in active addresses necessarily a bad sign? Not entirely. It could actually indicate a maturing market where long-term investors are accumulating and securing their Bitcoin holdings, rather than just speculating on short-term price movements.

Bitcoin Exchange Reserves: A Rapid Depletion?

Perhaps one of the most striking and potentially concerning differences in this bear market compared to previous ones is the rapid decline in Bitcoin reserves held on exchanges. Unlike past cycles, exchanges are witnessing a significant outflow of BTC, and at an alarming rate.

Reports indicate that over 21 major exchanges have collectively lost around $20,000 worth of Bitcoin every hour. This isn’t a slow trickle; it’s a substantial and continuous drain. Such a rapid loss of liquidity presents significant challenges for exchanges. Reduced reserves can make it harder for them to facilitate trading, process withdrawals efficiently, and potentially even impact their operational stability if the trend continues.

Why is this happening?

- Increased Self-Custody: The narrative of “not your keys, not your coins” has gained significant traction in the crypto community. Events like exchange failures and concerns about centralized platforms are pushing users towards self-custody solutions like hardware wallets. This trend directly contributes to Bitcoin leaving exchanges.

- DeFi Opportunities: While the bear market cools down speculative trading, it doesn’t necessarily diminish interest in the broader crypto space. Decentralized Finance (DeFi) platforms continue to offer yield-generating opportunities, and users might be moving Bitcoin off exchanges to participate in DeFi protocols, seeking returns beyond simple holding.

- Loss of Trust?: While less definitive, it’s possible that some users are losing confidence in centralized exchanges, particularly in the face of market volatility and potential contagion risks within the crypto industry. This lack of trust could be accelerating the movement of Bitcoin to safer, self-controlled storage.

The rapid depletion of exchange reserves is a critical development to watch. It signals a potential shift in how Bitcoin holders are interacting with the market and could have long-term implications for exchange business models and market liquidity.

Key Takeaways: This Bear Market is Unfolding Differently

While bear markets are never pleasant, this Bitcoin downturn is presenting a unique set of circumstances that differentiate it from previous cycles. Here’s a recap of the key aspects:

- Hashrate Under Pressure: The mining landscape has been reshaped by geopolitical events, leading to increased costs and a noticeable hashrate decline. This highlights the sensitivity of Bitcoin’s infrastructure to external factors.

- Active Addresses – A Nuanced Picture: Decreasing active addresses aren’t necessarily bearish. They could indicate a shift towards long-term holding and self-custody, potentially a sign of market maturation.

- Exchange Reserve Exodus: The rapid depletion of Bitcoin reserves on exchanges is a significant and potentially concerning trend. It points to a possible shift in user behavior towards self-custody and potentially DeFi, while also raising questions about exchange liquidity and trust.

For Bitcoin traders and investors, understanding these nuances is crucial. This isn’t just another price dip; it’s a bear market shaped by specific events and trends that are reshaping the Bitcoin landscape. Staying informed about these underlying dynamics is key to navigating the current market and making informed decisions in the evolving world of cryptocurrency.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.