Bitcoin’s recent volatility has investors on edge. After a promising start to the year fueled by ETF approvals, the leading cryptocurrency faces potential further declines, according to Standard Chartered. Let’s dive into the factors influencing this prediction and what it means for the future of Bitcoin.

Standard Chartered’s Revised Bitcoin Outlook: How Low Can It Go?

Despite previous optimistic forecasts, Standard Chartered now suggests Bitcoin could fall to the $50,000 – $52,000 range. This revised outlook stems from a combination of crypto-specific challenges and a deteriorating macroeconomic environment.

- Macroeconomic Headwinds: Higher interest rates, signaled by the Federal Reserve, are deterring investors from risk-on assets like Bitcoin.

- Crypto-Specific Concerns: Bitcoin’s break below the $60,000 mark has opened the door for further downward movement.

- ETF Outflows: The initial hype surrounding Bitcoin ETFs has cooled, leading to significant outflows from these funds.

Will Bitcoin Still Hit $100K in 2024? Standard Chartered’s Conflicting Predictions

It’s worth noting that Standard Chartered has previously made bullish predictions about Bitcoin’s price. Let’s examine the timeline:

- April Prediction: Bitcoin will reach $100,000 by the end of 2024.

- July Prediction: Bitcoin could surge to $120,000 in the same timeframe.

- Last Month Prediction: Bitcoin could potentially hit $150,000 per coin by year-end.

These conflicting predictions highlight the inherent volatility and unpredictability of the cryptocurrency market. While long-term forecasts remain positive, short-term fluctuations are influenced by a multitude of factors.

See Also: Doge With Hat (DOGEHAT) Will Rally 5,500%, As Shiba Inu And Bonk Lag

The ETF Effect: A Boom and Bust Cycle?

The approval of 11 Bitcoin ETFs in January triggered a surge in Bitcoin’s price, attracting new investors and driving the cryptocurrency to a new all-time high of $73,737 in March. However, this initial enthusiasm has waned, leading to significant outflows from the ETFs.

Here’s a breakdown of the ETF impact:

- Initial Surge: The introduction of ETFs provided easier access to Bitcoin for traditional investors, leading to a flood of capital into the market.

- Record High: Bitcoin reached a new all-time high of $73,737 in March.

- Cooling Hype: The Federal Reserve’s decision to maintain high interest rates has dampened investor sentiment, resulting in ETF outflows and a price correction.

Where Does Bitcoin Stand Now?

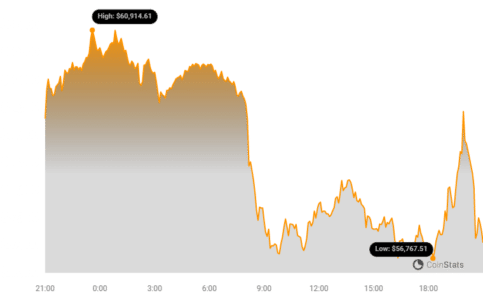

Despite reaching a record high in March, Bitcoin’s current price stands at $56,900, reflecting a 13% drop in the past seven days. It continues to trade below its 2021 peak of $69,044.

Key Takeaways:

- Bitcoin’s price is subject to significant volatility and is influenced by both macroeconomic factors and crypto-specific events.

- Predictions should be taken with a grain of salt, as market conditions can change rapidly.

- While ETFs have provided increased access to Bitcoin, their impact can be short-lived.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.