Bitcoin’s story is one of volatility and resilience. But beneath the surface of price swings, a powerful trend is emerging: HODLing. A significant portion of the Bitcoin supply is locked away, untouched for a year or more, signaling strong conviction among long-term investors. Let’s dive into what this means for the future of BTC.

Bitcoin HODLing: A Deep Dive

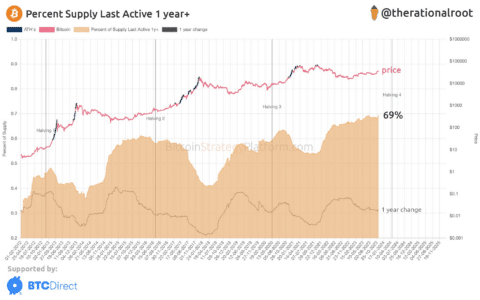

On-chain data reveals a compelling narrative: a record percentage of the Bitcoin supply hasn’t moved in over a year, reaching a staggering 69%. This milestone underscores the growing belief in Bitcoin’s long-term value. Analyst Root highlighted this trend on X, emphasizing the significance of these ‘long-term holders’ (LTHs).

LTHs vs. STHs: Understanding the Divide

The Bitcoin investor base is broadly divided into two groups:

- Long-Term Holders (LTHs): These investors hold their coins for an extended period, typically more than five to six months. They represent the more committed segment of the market.

- Short-Term Holders (STHs): These investors hold their coins for a shorter duration, usually less than five to six months. They are often more reactive to market fluctuations.

Why Does HODLing Matter?

The longer a holder keeps their coins dormant, the less likely they are to sell. This reduces the available supply, potentially driving up the price when demand increases. LTHs are less prone to panic selling during market downturns, providing stability.

1-Year+ HODLers: The Stalwart Diamonds

Investors who have held Bitcoin for over a year demonstrate even stronger conviction. They’ve weathered market volatility and remain committed to their investment. The increasing percentage of supply in this category suggests a growing belief in Bitcoin’s long-term potential.

As the chart below displays, the percentage of the total Bitcoin supply in circulation that’s been dormant since more than a year ago has recently seen some fresh rise and has now reached the 69% mark, a new ATH.

One year ago, BTC was still trading around the lows it had attained after the collapse of the FTX exchange. Thus, the supply that had just recently matured into the range would have been bought in the first week after this crash.

Since these lows, Bitcoin has more than doubled in value, so it’s remarkable that these investors are still not giving into the allure of profit-taking and are rather choosing to HODL the asset further. Perhaps these investors have even higher hopes for the asset, so they are holding out until further price uplift.

The FTX Crash and the Rise of HODLing

Interestingly, much of the Bitcoin that recently crossed the 1-year threshold was acquired shortly after the FTX exchange collapse. Despite Bitcoin more than doubling in value since then, these investors have resisted the urge to sell, further solidifying the HODLing trend.

Read Also: German Lawmaker Pushes For Bitcoin To Become Legal Tender

Looking Ahead: The Impact of Dormant Supply

With a record amount of Bitcoin locked away, the ongoing rally could be significantly impacted. Reduced selling pressure, coupled with increasing demand, could lead to further price appreciation.

BTC Price

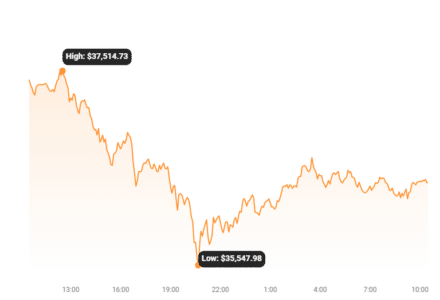

At the time of writing, Bitcoin is trading at around $36,378, down 2% in the past week.

Conclusion: The Power of HODLing

The increasing prevalence of Bitcoin HODLing is a testament to the growing confidence in its long-term value. As more coins become dormant, the potential for price appreciation increases. Whether you’re a seasoned crypto investor or just starting, understanding the HODLing trend is crucial for navigating the Bitcoin landscape.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.