- The Bitcoin halving event is set to slash miner rewards by 52.5%.

- Bob Burnett, CEO of Barefoot Mining, gave insights on potential impacts and the evolving landscape for Bitcoin miners.

The Bitcoin miners are on the verge of a defining moment. With less than 25,000 blocks remaining before the much-anticipated halving event, the industry is buzzing.

Once the critical milestone is reached, the rewards generated by Bitcoin miners each block, excluding transaction fees, are expected to plummet precipitously. The incentive will be reduced from 6.25 BTC per block to 3.125 coins following the halving, increasing the strain on miners who rely significantly on these payouts for profitability.

Timing and Speculations of the Impending Halving

The blockchain’s block height currently stands at 815,315. The quickly coming fourth subsidy epoch, often known as the ‘reward halving,’ is around 24,685 blocks away. There has been a lot of speculation about the actual date of the halving.

While some researchers and fans point to April 20, 2024, others predict a slight delay to April 24, 2024. A few outliers, encouraged by the current faster block intervals, predict that the event may occur sooner, potentially on March 23, 2024. It’s worth noting that the most recent block interval was only eight minutes and 8.4 seconds long, emphasizing the increased pace.

Bob Burnett, the acclaimed chairman and CEO of Barefoot Mining, recently took the stage to address and explain a widely held misperception concerning Bitcoin’s production rate. Burnett revealed in a fascinating post on social networking site X that the actual mean block time is not the widely assumed 10 minutes.

I've seen several posts on the halving and people saying that we'll go from 900 bitcoin produced per day to 450 at the halving. This seems logical because most people think there are 144 blocks per day and each block has 6.25 bitcoin so 144 x 6.25 = 900. But, it doesn't…

— Bob Burnett (@boomer_btc) November 3, 2023

In actuality, the speed has been faster, resulting in the development of around 146.7 blocks each day rather than the predicted 144. When all block rewards and transaction fees are considered, daily Bitcoin production has risen to a startling 966, exceeding the projected 900.

A Closer Look at the Figures: Effects on Output and Revenue

Burnett’s analysis is straightforward. Following the halving event, the block reward will be reduced by 50%.

The silver lining for Bitcoin miners, however, comes in the form of transaction fees, which will keep the total daily Bitcoin output from falling to the previously feared 450. Burnett’s estimations show that the post-halving output will be roughly 507.6 Bitcoin per day.

It denotes a cut of 52.5% of the current output rate, slightly less than the rounded-off forecast of a 50% cut. Such data intricacies are critical for traders and miners alike, as they have major consequences for market liquidity and income estimates.

Burnett expressed his excitement, saying, “I feel there is a decent chance that fees will increase materially in the next epoch.” He also commented on the possibility of daily Bitcoin production figures increasing as a result of growing transaction fees.

Burnett anticipates a scenario in which transaction fees rival the subsidy by the end of the next era in 2027, boosting daily output close to the present 900+ Bitcoin record. If the optimistic forecast comes true, it might usher in an exciting period for the mining industry, as Burnett predicted, “If so, the mining business will roar.”

Read Also: Institutional Interests and Custody Can Kill Bitcoin – Arthur Hayes

The Bitcoin Miner Landscape: Upcoming Challenges and Strategies

While the cryptocurrency ecosystem as a whole is buzzing with speculation, Bitcoin (BTC) miners are at a crossroads, facing major changes to their operational landscape. Despite being a foregone conclusion, the reward halving has the potential to drastically alter mining entities’ revenue streams.

Savvy miners and businesses are likely to be digging into specific estimates like those offered by Burnett. The strategic path forward is projected to be controlled by a combination of sophisticated calculations and investments in cutting-edge mining technology, guaranteeing that miners can weather the impending storm and emerge profitable.

Getting a Glimpse of Bitcoin Mining’s Future

The impending halving event highlights Bitcoin’s fundamental dynamic, bringing both difficulties and possibilities to miners’ attention.

As industry leaders like Burnett shed light on possible paths, it’s clear that adaptation and strategic vision will be critical. Miners are recalibrating their techniques as the crypto industry awaits the momentous milestone, ensuring they remain robust and lucrative in the ever-changing Bitcoin ecosystem.

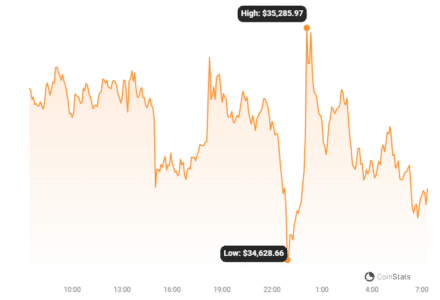

At press time, Bitcoin’s value currently stands at about $34,824, according to Coinstats.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.