The Bitcoin network is buzzing with activity, and here’s a fascinating development: the number of reachable Bitcoin nodes powering the network has soared past 17,000 for the first time in ten years! That’s a significant milestone, indicating a potentially stronger and more resilient Bitcoin ecosystem. Let’s dive into what this node surge means and why it should matter to anyone interested in crypto.

Bitcoin Node Network Growth: A Decade in the Making

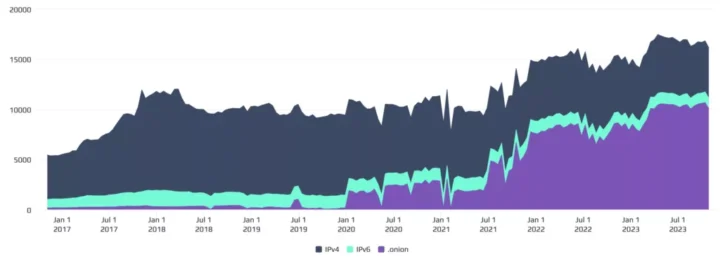

According to data from Bitnodes, the current count of publicly accessible Bitcoin nodes stands at a robust 16,814. This isn’t just a random fluctuation; it represents a remarkable 70% increase over the past two years. To put this growth into perspective, consider these points:

- 2020 Baseline: Back in 2020, the network hovered around 10,000 nodes.

- 2021 Bull Run: Even during the peak of the 2021 bull market, the node count remained around 10,000 for most of the year.

- Historical Data: Looking back further, Bitnodes’ data from 2016 shows approximately 5,000 nodes.

Decoding the Node Growth Chart: What Does It Tell Us?

The chart above, originally highlighted by Trustnodes, reveals an interesting pattern. It seems that each Bitcoin bull cycle peak contributes an increment of roughly 5,000 nodes to the network. Let’s break down this trend:

- 2017 Surge: Node counts first reached the 10,000 mark in November 2017. Interestingly, at that time, very few nodes were utilizing the Tor network.

- IPv4 vs. Tor: Fast forward to the present, and we see a shift. IPv4 node numbers have decreased to around 5,000, while Tor nodes have surged to approximately 10,000 as of November.

The Tor Node Phenomenon: Why the Rise?

The increase in Tor nodes is particularly noteworthy. Let’s examine the timeline:

- January 2020: As the bull market was on the verge of ignition, Tor nodes saw an increase of 2,000, while overall node numbers remained stable at 10,000.

- July 2021: Tor nodes experienced another jump, increasing by 5,000.

- December 2021: The upward trend continued with an additional 8,000 Tor nodes.

- March 2023: During the banking sector turbulence, Tor nodes peaked at 10,000.

This data suggests a correlation between Bitcoin’s price appreciation and the growth of nodes, implying increased adoption. However, the dominance of Tor nodes raises some intriguing questions.

Are Tor Nodes a Cause for Concern?

The significant number of Tor nodes, while beneficial for privacy, introduces a layer of complexity. Here’s why:

- Centralization Risk?: It becomes challenging to ascertain if these Tor nodes are operated by diverse, independent entities or potentially a single, controlling entity.

- 51% Attack Vector?: While not definitively a 51% attack vector at the network layer, the concentration of Tor nodes could present other attack possibilities.

Understanding Potential Attack Vectors

Let’s consider a scenario: When you set up a new Bitcoin node, it needs to synchronize with the network’s history. This synchronization process relies on connecting to existing nodes. If a significant portion of nodes are controlled by a single actor, they could, in theory, manipulate the history provided to new nodes.

The Solution? Sync from multiple, diverse nodes. However, if a single entity controls a large number of nodes, even syncing from ‘multiple’ nodes might inadvertently lead you back to the same entity’s nodes.

Mitigation Strategy: You can configure your node to prioritize syncing from IPv4 and IPv6 nodes, limiting Tor node synchronization to a smaller percentage (e.g., 10% or your preferred ratio). This approach enhances security by diversifying your data sources.

SPV Wallets: Why Node Diversity Matters Even More

Simplified Payment Verification (SPV) wallets are particularly vulnerable in this context. SPV wallets rely on node clients for transaction verification without performing full node verification themselves. If they primarily connect to a cluster of controlled Tor nodes, they could be misled about transaction validation.

Read Also: A Uniswap User Lost $700,000 to an MEV Bot — But it Only Made $260

In a hypothetical scenario where a single entity operates a vast Tor node network, they could potentially target SPV wallets, falsely indicating transaction validation for unconfirmed transactions.

Running Your Own Node: A Best Practice for Security

For businesses handling substantial cryptocurrency volumes, such as exchanges, running your own full Bitcoin node is not just recommended—it’s crucial. For retail users, a simpler approach to verify transaction status is to cross-reference with reputable Bitcoin explorers like Blockchain.info to confirm transaction validation.

Assessing the Real-World Risks

While potential attack paths exist, it’s important to note that network-level attacks remain challenging and not decisively impactful on the Bitcoin network’s overall integrity. Tor nodes, however, do offer resilience against Distributed Denial of Service (DDoS) attacks, which is a significant advantage.

The Privacy Advantage of Tor Nodes

Beyond DDoS protection, Tor nodes contribute to user privacy. A report from the China Cyber Security Annual Conference in December 2022 highlighted the risk of deanonymizing node IPs using cyberspace search engines that specialize in network-level cataloging. Such capabilities could potentially be used by governments to monitor or even disrupt Bitcoin activity at the network level.

Tor nodes, with their inherent obfuscation, present a greater challenge to such surveillance efforts, especially as Bitcoin developers continue to enhance network layer encryption.

Is There Evidence of Malicious Intent?

It’s crucial to emphasize that, currently, there’s no concrete evidence suggesting that these Tor nodes are operated by a single malicious entity. The possibility remains theoretical. However, the concentration warrants attention and proactive security considerations.

The Cost Factor: Is It Economically Feasible to Control Thousands of Nodes?

Running a Bitcoin node does require resources—storage and bandwidth to maintain network connections. Estimates suggest that operating 10,000 nodes might cost in the range of $1 million to $10 million annually. While substantial, this is within reach for well-resourced organizations or even individuals with strategic goals.

However, if the primary objective were financial gain through network-level manipulation, the cost-benefit analysis would likely be unfavorable. The risks and complexities might outweigh potential monetary rewards.

Beyond Reachable Nodes: The Hidden Network

It’s also worth noting that estimates suggest there are around 100,000 inaccessible Bitcoin nodes, far exceeding the reachable node count. For users seeking maximum security and control, running their own node and selectively syncing from IPv4/IPv6 nodes remains a robust option.

A Sign of Organic Growth?

Ultimately, the surge in Bitcoin nodes, particularly correlating with price increases, can be interpreted as a positive sign of organic demand growth, even during market downturns. This trend is mirrored in other cryptocurrencies like Ethereum, which has also seen its node count increase from approximately 5,000 to 7,500.

Key Takeaways:

- Node Count Surge: Reachable Bitcoin nodes have hit a decade high, surpassing 17,000, indicating network growth.

- Tor Node Dominance: A significant portion of this growth is attributed to Tor nodes, raising questions about potential centralization risks.

- Security Considerations: While no immediate network-level threats are apparent, understanding potential attack vectors, especially for SPV wallets, is crucial.

- Run Your Own Node: For enhanced security, especially for businesses, running your own full Bitcoin node is a best practice.

- Organic Growth Indicator: The node growth, aligned with price trends, suggests continued and potentially organic adoption of Bitcoin.

In Conclusion: A Stronger, More Complex Network

The surge in Bitcoin nodes is undoubtedly a positive sign for the network’s overall health and resilience. It points towards growing interest and adoption. However, the increasing prevalence of Tor nodes introduces new dimensions to network security and decentralization considerations. By understanding these nuances and adopting proactive security measures, participants can continue to benefit from a robust and evolving Bitcoin ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.