Buckle up, crypto enthusiasts! The Bitcoin ride is getting bumpy. Despite some ‘boomer’ confidence floating around, the crypto market is feeling the jitters, and Bitcoin is just barely hanging onto the $41,000 mark. What’s causing this unease in the usually thrilling world of crypto? Let’s dive in.

This week’s crypto market mood swing is largely thanks to a couple of major economic events: the latest US Consumer Price Index (CPI) data and the Federal Open Market Committee (FOMC) meeting. These events are acting like pressure cookers, turning up the heat on BTC price volatility.

First, some good news (or at least, expected news): the CPI figures showed US inflation easing down to 3.1%. This was pretty much in line with what the market anticipated and offered a slight sigh of relief. Now, all eyes are on Federal Reserve Chair Jerome Powell, who is set to give us the lowdown on economic projections at the December 13 FOMC meeting.

See Also: Is Argentina’s New President, Javier Milei, Brave Enough To Promote Bitcoin?

Why is Bitcoin Feeling the Pre-FOMC Pressure? Investor Apprehension Explained

Think of it like this: Bitcoin is holding its breath before Powell speaks. As the FOMC meeting gets closer, Bitcoin’s price is showing weakness, signaling that the market is super sensitive to any hints Powell might drop about the economic future. Investors are definitely feeling apprehensive.

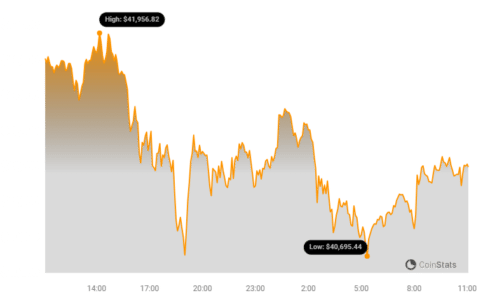

We’ve seen Bitcoin take a noticeable dip in the last 24 hours, a clear sign of this pre-FOMC jitters. But honestly, this wasn’t entirely out of the blue. If you’ve been watching the market, you’d notice a growing sense of skepticism among investors in the days leading up to this week.

Want some numbers? Over the past week, a whopping 40,000 BTC – worth around $1.6 billion – were sold off. This increased exchange holdings from 1.05 million to 1.09 million Bitcoins. Who was doing the selling? Mostly retail investors. And when the big whale addresses started selling on Monday, it was like the domino effect, triggering a price correction for Bitcoin.

See Also: Shiba Inu Or LUNC Burn: Which One Has Had A Better Impact?

Bitcoin’s 8% Plunge: Did Asia Trigger the Sell-Off?

The price drop wasn’t just a minor wobble; Bitcoin actually plunged by about 8%, briefly touching $40,400. And guess who started the week with a bang (or rather, a sell-off)? Asian traders. They offloaded massive quantities, leading to over $197 million in long positions and $8.23 million in short positions getting liquidated.

This sell-off also wiped out $1.2 billion from open interest, bringing it down to $17.50 billion. That’s a significant chunk of market activity!

Interestingly, while Bitcoin was in the red, traditional markets in early Wall Street trading were showing gains. The S&P 500 rose by 0.1%, the Dow Jones Industrial Average by 0.2%, and the Nasdaq Composite by 0.1%. This divergence highlights the unique pressures currently facing the crypto market.

So, what’s the general feeling about the FOMC meeting? Most people seem to think the central bank will likely hold interest rates steady in the 5.25% to 5.50% range. Why?

Well, if we look back at the FOMC’s recent history, they’ve kept interest rates unchanged in both their November and September meetings. This sets a precedent. Plus, statements from those meetings suggested a likely continuation of stable rates for a while. However, and this is crucial, the FOMC has also emphasized its flexibility, meaning they’re ready to change course if economic conditions shift.

Key Takeaway:

- CPI Relief, but Uncertainty Persists: Lower inflation is good news, but the market is still on edge.

- FOMC Meeting Looms Large: Powell’s words will be critical in shaping market direction.

- Investor Skepticism: Pre-FOMC selling indicates caution among investors.

- Volatility is the Name of the Game: Expect continued price swings as the market reacts to economic data and FOMC announcements.

As Bitcoin navigates this shaky ground, hovering just above $41,000 before the FOMC meeting, the crypto market is indeed at a pivotal moment. The current unease is a mix of increased volatility, investor caution, and the big question mark of the FOMC’s upcoming decisions. Keep a close watch – things are likely to stay interesting!

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.