Buckle up, crypto enthusiasts! The market experienced a wild ride recently, and not the fun kind. Bitcoin, the king of crypto, led a significant downturn, tumbling below the crucial $50,000 mark. If you’re holding crypto, you’re probably feeling the chills. Let’s dive into what triggered this market shake-up and what it means for your investments.

Bitcoin’s Big Drop: What Happened?

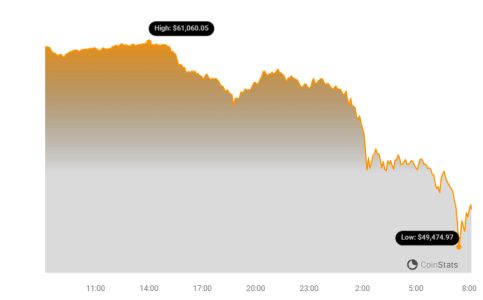

It was a day of red candles across the crypto board. Bitcoin spearheaded the decline, taking a hefty 16% nosedive in just 24 hours. This dramatic fall pushed its price below $50,000, a level many investors were watching closely. Ethereum wasn’t spared either, plummeting by over 23%.

- Bitcoin led the decline with 16% as the price crashed below $50k in the last 24 hours, while Ethereum plummeted over 23%.

The overall crypto market felt the pain too. Investors seemed to be in a risk-off mood, moving away from assets considered more volatile. This broad sell-off resulted in a significant drop in the total crypto market capitalization.

As the dust settled, the numbers paint a clear picture:

- Bitcoin’s Decline: 16% drop in 24 hours, falling below $50,000.

- Ethereum’s Plunge: Over 23% decrease, trading around $2,230 at the time of the initial drop.

- Market Cap Contraction: The total crypto market cap decreased by 11%, reaching $1.84 trillion.

Beyond Crypto: A Global Market Downturn?

Interestingly, this crypto crash wasn’t happening in isolation. It coincided with a general downturn in equity markets, particularly in the Asia-Pacific region. Japan’s Nikkei 225, for instance, experienced a significant 10% fall, continuing losses from the previous week.

What was the trigger in traditional markets? The Bank of Japan’s decision to increase its benchmark interest rate for the first time in 16 years seems to have played a role. This move likely contributed to the risk-averse sentiment across various markets.

Partial Recovery and Market Volatility

The crypto market, known for its volatility, showed some signs of bouncing back. Bitcoin managed a partial recovery and was trading around $51,900 at the time of a later update. However, it’s important to note that this was still a 27% decrease compared to the previous week, and Bitcoin’s market cap had shrunk to approximately $1 trillion.

This partial recovery highlights the dynamic nature of the crypto market. While sharp drops can be concerning, quick rebounds are also a characteristic feature. It’s a reminder that volatility is inherent in crypto investments.

Liquidation Cascade: A Billion Dollars Vanishes

Adding fuel to the fire was a massive liquidation event. Reports indicated that a staggering $1 billion was liquidated from the crypto market within 24 hours. Liquidation happens when traders using leverage (borrowed funds) are forced to close their positions because the price moves against them. This can create a cascading effect, further accelerating price declines.

Stock Market Struggles: Are Broader Economic Factors at Play?

The traditional stock market also faced headwinds in the past week. Disappointing earnings reports, a weaker-than-expected jobs report, rising unemployment, and a slowdown in the manufacturing sector all contributed to market jitters.

Furthermore, the U.S. Federal Reserve’s decision to hold interest rates steady and not signal an imminent rate cut in September disappointed some market participants. Many had anticipated a rate cut, as lower interest rates generally tend to boost the performance of riskier assets like stocks and crypto.

Key Takeaways: Navigating the Crypto Storm

So, what can we learn from this recent crypto market downturn?

- Volatility is the Norm: Crypto markets are inherently volatile. Significant price swings, both up and down, are part of the game.

- Global Economic Factors Matter: Crypto markets are not isolated. Broader economic trends, interest rate decisions, and global market sentiment can significantly impact crypto prices.

- Risk Management is Crucial: Understanding and managing risk is paramount in crypto investing. Avoid over-leveraging and diversify your portfolio.

- Stay Informed, Don’t Panic: Market corrections are normal. Stay informed about market developments, but avoid making impulsive decisions based on short-term price fluctuations.

Looking Ahead: Is This a Buying Opportunity?

Market downturns, while unsettling, can sometimes present buying opportunities for long-term investors. Whether this recent dip is such an opportunity remains to be seen and depends on individual investment strategies and risk tolerance. It’s crucial to conduct thorough research and consider your own financial situation before making any investment decisions.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency investments are highly speculative and carry significant risk. Always do your own research and consult with a qualified financial advisor before investing in cryptocurrencies.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.