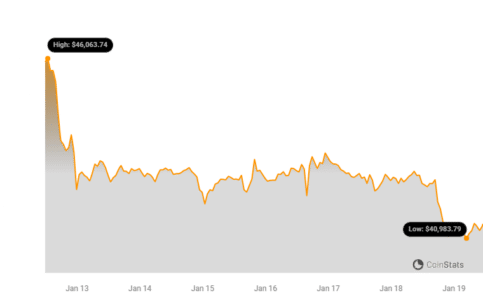

Just when the crypto world was celebrating the landmark approval of spot Bitcoin ETFs, a surprising twist unfolded. Bitcoin (BTC), the king of cryptocurrencies, took an unexpected nosedive, dropping 4.5% on January 18th and hitting a one-month low of $40,900. This sudden downturn has left investors and analysts scratching their heads, wondering why the anticipated ETF euphoria didn’t translate into sustained price gains. Let’s dive into the factors behind this intriguing market reaction.

Spot Bitcoin ETF Approval: A Milestone or a Mirage?

The approval of spot Bitcoin ETFs by the US Securities and Exchange Commission (SEC) was widely hailed as a game-changer. Finally, mainstream investors could access Bitcoin exposure through traditional investment vehicles, without the complexities of direct crypto ownership. This was expected to unlock significant institutional capital and propel Bitcoin to new heights.

See Also: CFX Price Surges 8% As Conflux Launches EVM-Compatible Bitcoin L2 Solution

However, the market’s response has been far from celebratory. Instead of soaring, Bitcoin’s price stumbled, erasing gains and prompting questions about the immediate impact of these ETFs. Coinstats, a leading crypto market tracker, mirrored this bearish sentiment, reporting a 3.9% drop in Bitcoin’s price over the last 24 hours.

This unexpected downturn begs the question: What’s causing Bitcoin’s price to retreat despite the positive ETF news? Let’s explore some key factors at play.

The ETF Hype Fades: A Shift in Trader Focus?

Bartosz Lipiński, CEO of Cube.Exchange, suggests that the initial ETF excitement might be wearing off. According to Lipiński, “the ETF hype has faded a bit, it would make sense for traders’ attention to be focused elsewhere. Current options positioning suggests support around $40,000, which is a major psychological price point.”

This perspective implies that the market’s focus is shifting beyond the ETF narrative, with traders potentially seeking new opportunities or consolidating positions after the initial volatility.

Grayscale’s GBTC: A Major Piece of the Puzzle

One significant factor influencing Bitcoin’s price is the dynamics surrounding Grayscale’s Bitcoin Trust (GBTC). GBTC, a behemoth in the crypto investment space, held over $28 billion in assets before converting to a spot ETF. However, since its ETF conversion and subsequent trading, GBTC has witnessed substantial outflows, totaling approximately $1.6 billion.

GBTC Outflows vs. New ETF Inflows: A Balancing Act

While GBTC experiences outflows, new spot ETF issuers have been actively accumulating Bitcoin. In their first week of operation, these new ETFs amassed over 68,000 BTC. However, when we factor in GBTC’s shedding of roughly 40,000 BTC, the net addition to Bitcoin ETFs becomes approximately 28,000 BTC.

This outflow from GBTC is crucial because:

- Profit Taking: Michael Safai, founding partner at Dexterity Capital, points to the “GBTC situation,” explaining that “many investors wanted to wait for the Grayscale discount to collapse prior to exiting their positions. Now that the discount is virtually gone, some newly liberated traders may have sold and are waiting to get back into ETFs soon.” In essence, investors who were previously locked into GBTC at a discount are now taking profits as it trades closer to NAV as an ETF.

- Fee Structure: GBTC’s relatively higher fees compared to new ETFs might be prompting investors to rotate into lower-cost options.

Global ETP Outflows: A Wider Trend?

Adding another layer to the complexity, K33 Research Analyst Vetle Lunde highlights that the outflows aren’t limited to GBTC alone. Even before the US ETF approvals, spot Bitcoin products were trading globally. Lunde notes that global Exchange-Traded Products (ETPs) hold over 864,000 Bitcoin, putting the initial US ETF additions into perspective.

Cleaned up the ETF flows for yesterday. Inflows slowed down from day 1 and 2, but still net positive with 5.5k BTC. GBTC bleeding 7.7k BTC.

Net net negative day of -2.2k BTC.

And yes, ex-GBTC the ETFs are still hoovering up BTC at a decent pace. pic.twitter.com/DKjHw5hHys

— Vetle Lunde (@VetleLunde) January 17, 2024

Lunde further points out that Canadian and European ETPs have also experienced significant outflows recently. This suggests a broader trend of profit-taking or portfolio reallocation, potentially driven by investors shifting funds to the more competitive US ETFs or simply cashing out profits after the ETF approval rally.

See Also: $APP Staking In The $INJ Ecosystem IDOs Via Moon App Begins Today

Ripple Effect: Public Crypto Companies Feel the Pressure

The Bitcoin price dip has had a cascading effect on publicly listed companies with exposure to the crypto market. Coinbase Global Inc (NASDAQ: COIN), the largest US crypto exchange, witnessed a 6.7% decline and is down 17% since the ETF approvals. Bitcoin miners like Marathon Digital (6.9% down) and Bitcoin proxy MicroStrategy Inc (NASDAQ: MSTR) (3% down) have also felt the downward pressure.

Looking Ahead: Dip or Deeper Correction?

The recent Bitcoin price correction serves as a reminder that market reactions, especially in the volatile crypto space, are rarely linear. While spot Bitcoin ETF approval is undoubtedly a positive long-term catalyst, short-term price movements are influenced by a complex interplay of factors, including investor sentiment, fund flows, and broader market dynamics.

Is this a temporary dip, a healthy correction before the next leg up, or the start of a deeper downturn? Only time will tell. However, understanding the nuances of GBTC outflows, global ETP trends, and shifting trader focus provides valuable context for navigating the current market landscape. Investors should closely monitor these factors and remain vigilant as the market absorbs the implications of spot Bitcoin ETFs and charts its next course.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.