Bitcoin, the king of cryptocurrencies, has taken a significant tumble, breaching the critical $60,000 mark. If you’re a crypto enthusiast, investor, or just someone keeping an eye on the market, this sudden drop likely has you wondering: what’s going on? Let’s dive into the details behind this latest Bitcoin dip and what it could mean for the crypto landscape.

Bitcoin Breaks Below $60K: A Fresh Sell-Off

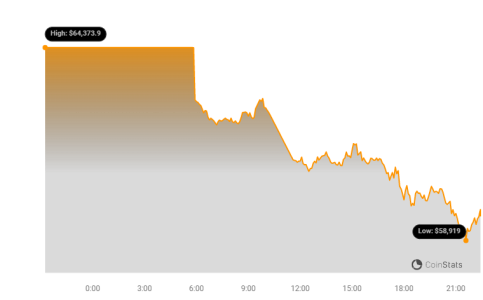

On [Date – Today’s Date], Bitcoin (BTC) experienced a sharp decline, falling over 5% and dipping below the crucial $60,000 threshold. This level has been a key psychological and support point for Bitcoin, and breaking below it signals potential further downward pressure. Here’s a quick snapshot of what happened:

- Bitcoin Price Plunge: BTC price dropped more than 5%, falling below $60,000.

- Mt. Gox News: The sell-off intensified following the announcement that Mt. Gox, the infamous defunct crypto exchange, will begin repaying creditors in July.

- Potential $9 Billion Sell Pressure: Analysts are anticipating a potential $9 billion worth of Bitcoin entering the market as Mt. Gox creditors receive their repayments.

This isn’t just a minor fluctuation; it’s a significant move that has caught the attention of the entire crypto market. Bitcoin had previously reached highs of $71,974 on June 7th, showing strong momentum. However, since then, a downtrend has been forming, culminating in today’s dramatic drop below $60,000 for the first time since early May.

Why is Bitcoin Dropping? The Mt. Gox Factor

The primary catalyst behind this recent Bitcoin sell-off appears to be the news surrounding Mt. Gox. For those unfamiliar, Mt. Gox was once the largest Bitcoin exchange, which suffered a devastating hack in 2014. Now, a decade later, the exchange is finally set to distribute approximately 141,000 BTC, worth around $9 billion at current prices, to its creditors starting in July.

But why is this causing a price drop? Let’s break it down:

- Profit Taking Potential: Back when Mt. Gox was hacked, Bitcoin was trading around $40. Creditors who receive Bitcoin now are sitting on astronomical gains. Many are expected to sell a portion, if not all, of their newly acquired BTC to realize these profits.

- Market Anticipation and Fear: The anticipation of this massive Bitcoin distribution is creating fear in the market. Traders and investors are preemptively selling, expecting a surge in supply to depress prices. This ‘sell-the-news’ type reaction is common in volatile markets like crypto.

- Existing Market Weakness: Even before the Mt. Gox news, Bitcoin was showing signs of weakening after failing to sustain momentum above $70,000. This pre-existing vulnerability made it more susceptible to negative news triggers.

The combination of these factors has created a perfect storm, leading to the significant sell-off we are witnessing.

Expert Analysis: What’s Behind the Bitcoin Downtrend?

To gain further insight, let’s consider the perspective of market analysts. Before Bitcoin breached the $60k level, Julio Moreno, Head of Research at CryptoQuant, offered a valuable observation:

“What’s happening right now with Bitcoin prices is mostly related to a lack of demand growth or momentum from traders, whales, ETFs, etc.”

Moreno’s analysis points to a broader issue beyond just the Mt. Gox news. It suggests that underlying demand for Bitcoin has been waning. Factors contributing to this lack of demand growth could include:

- ETF Inflows Slowdown: The initial excitement and massive inflows into Bitcoin ETFs have cooled off. Reduced ETF buying pressure impacts overall demand.

- Profit Taking After Rallies: After significant price appreciation earlier in the year, some investors are likely taking profits, reducing buying pressure.

- Macroeconomic Uncertainty: Global economic uncertainties and inflation concerns can make investors more risk-averse, impacting demand for volatile assets like Bitcoin.

What’s Next for Bitcoin? Key Support Levels to Watch

For those watching the charts, the immediate question is: how low could Bitcoin go? According to Moreno, the last time Bitcoin dropped below $60,000, it found support around $56,500. This level could act as a crucial support zone once again.

Key Support Level: $56,500

If Bitcoin breaks below $56,500, we could see further downside. However, if this level holds, it could signal a potential bottom and a possible rebound. It’s important to remember that crypto markets are highly volatile, and predicting short-term price movements is incredibly challenging.

Navigating the Bitcoin Volatility: Key Takeaways

This recent Bitcoin price drop serves as a reminder of the inherent volatility in the cryptocurrency market. Here are some key takeaways to consider:

- Stay Informed: Keep abreast of market news and developments, such as the Mt. Gox repayment situation, which can significantly impact prices.

- Manage Risk: Understand your risk tolerance and invest accordingly. Volatility is part of the crypto game, so be prepared for price swings.

- Long-Term Perspective: Focus on the long-term potential of Bitcoin and blockchain technology rather than getting overly caught up in short-term price fluctuations.

- Diversification: Consider diversifying your portfolio across different asset classes to mitigate risk.

In Conclusion: Bitcoin’s Dip and the Road Ahead

Bitcoin’s recent plunge below $60,000 is a significant event driven by a combination of factors, primarily the Mt. Gox repayment news and a general lack of demand momentum. While the sell-off may be concerning in the short term, it’s crucial to maintain a balanced perspective. The crypto market is known for its cyclical nature, and periods of correction are often followed by periods of growth. Keeping a close eye on support levels, market sentiment, and broader economic factors will be key to navigating the coming weeks and months in the Bitcoin and cryptocurrency space. Will $56,500 hold as the ultimate support? Only time will tell, but one thing is certain: the crypto journey is rarely a smooth ride.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.