Buckle up, crypto enthusiasts! The market is experiencing a rollercoaster ride, and not the fun kind. Just when we thought the approval of spot Bitcoin ETFs would send prices soaring, Bitcoin (BTC) has taken a nosedive, plummeting below the $40,000 mark. But Bitcoin isn’t alone in this sea of red; Ethereum (ETH) and Solana (SOL) are also feeling the pressure. Let’s dive into what’s causing this unexpected downturn in the crypto market.

Bitcoin’s Price Plunge: What’s Happening?

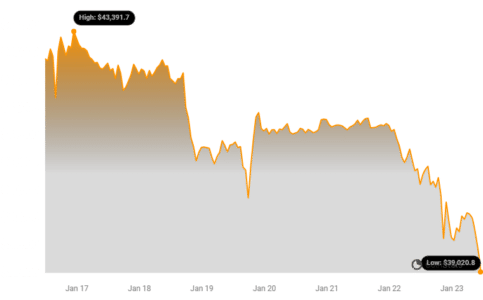

- Bitcoin’s price has continued its downward trend, breaking below the critical $40,000 support level.

As per Coinstats data, Bitcoin (BTC), the king of cryptocurrencies, is currently trading at around $39,020. This represents a significant drop of over 6% in just the last 24 hours. Zooming out, over the past week, BTC has shed more than 7% of its value.

This price dip is particularly noteworthy as it comes shortly after the much-anticipated approval of spot Bitcoin exchange-traded funds (ETFs) in the United States. These ETFs were expected to inject fresh capital into the crypto market, potentially driving prices upwards.

On January 11th, ten spot Bitcoin ETFs commenced trading, allowing mainstream investors to gain exposure to Bitcoin through traditional stock exchanges. While the approval was initially met with optimism, the market reaction has been quite the opposite.

Analysts were divided on the immediate impact of these ETFs, with some predicting a price surge and others anticipating a more muted response. However, the current price action suggests a bearish sentiment prevailing in the short term.

See Also: Two Possible Reasons Why The Price Of BTC Crashed Toward $40K

Why the Sudden Downturn After ETF Approval?

Just a day after the ETF launch, Bitcoin almost touched $49,000, reaching levels not seen since 2021. However, this peak was short-lived, and the price has been on a downward trajectory since then.

The primary culprit behind this recent dip appears to be outflows from Bitcoin ETFs, particularly Grayscale’s Bitcoin Trust (GBTC). Let’s break down why this is happening:

- Grayscale’s GBTC Conversion: Previously, GBTC operated as a closed-end fund. This structure made it difficult for investors to redeem their shares directly.

- ETF Conversion and Redemptions: With its conversion to a spot Bitcoin ETF, GBTC now allows investors to redeem their shares more easily. This has triggered a wave of investors cashing out their holdings.

- Coinbase Custody and Market Pressure: Grayscale is transferring billions of dollars worth of BTC to Coinbase, their custodian, to facilitate these redemptions. This influx of Bitcoin into the market is creating significant selling pressure, driving the price downwards.

GBTC outflows continue, another $570m today. 🤯 pic.twitter.com/y6zzkZTQG0

— Adam Cochran (@adamscochran) January 23, 2024

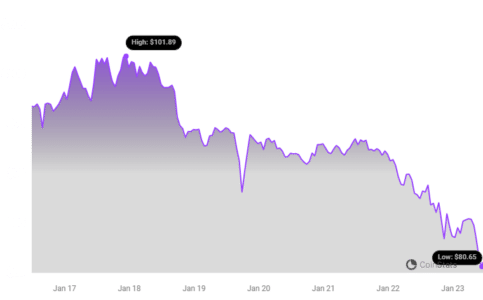

Ethereum and Solana Join the Dip

The negative sentiment isn’t confined to Bitcoin. The broader crypto market is also experiencing a downturn. Ethereum (ETH), the second-largest cryptocurrency, has also declined by over 6% in the last 24 hours and is currently trading around $2,229.

Solana (SOL), another prominent cryptocurrency and the fifth-largest by market capitalization, has witnessed an even steeper decline, shedding over 9% of its price in the past day. SOL is now priced at approximately $81.17.

What Does This Mean for the Crypto Market?

The current market correction highlights the inherent volatility of the cryptocurrency market, even in the face of seemingly positive developments like ETF approvals. While the long-term impact of spot Bitcoin ETFs remains to be seen, the initial reaction suggests that market dynamics are complex and influenced by factors beyond just institutional investment vehicles.

It’s crucial for investors to remember that the crypto market is still relatively young and prone to significant price swings. Conducting thorough research and understanding risk tolerance are paramount before making any investment decisions.

In Summary:

- Bitcoin, Ethereum, and Solana prices are all experiencing significant drops.

- Bitcoin has fallen below $40,000, with ETH and SOL also seeing substantial declines.

- Outflows from Grayscale’s Bitcoin ETF (GBTC) following its conversion are a major contributing factor to the Bitcoin price drop.

- The broader crypto market is reflecting this bearish sentiment.

Will this dip be a temporary setback or the start of a longer bear market? Only time will tell. Stay tuned for further updates and always remember to do your own research before investing in cryptocurrencies.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.