Bitcoin continues to trade near cycle highs as macro uncertainty and institutional demand collide. After briefly pushing as high as $97,747 on January 14, BTC has entered a consolidation phase around the $95,000 psychological level, with on-chain data suggesting that the recent breakout marked confirmation rather than exhaustion.

Price action looks calm on the surface. Underneath, the macro backdrop remains tense. Bitcoin consolidates as confidence in U.S. monetary governance faces rare stress, raising a familiar question: is this another range, or the base before something bigger?

Bitcoin consolidates as Trump–fed tensions shake confidence

On January 9, the U.S. Department of Justice served the Federal Reserve with grand jury subpoenas tied to a $2.5 billion renovation probe. The investigation centers on whether Chair Jerome Powell misled lawmakers during his June 2025 testimony. Powell responded with an unusual public address, calling the investigation unprecedented and politically motivated.

President Donald Trump denied direct involvement, yet his past pressure on the Fed remains fresh. Interest rates still sit at 3.50%–3.75% despite easing in 2025. Lawmakers from both parties warned that escalating political pressure could damage institutional credibility, a risk markets tend to price quickly.

Gold rallies, Bitcoin holds its ground

While gold surged to fresh record highs above $4,630 and silver rallied sharply, Bitcoin did not explode higher. Instead, BTC reclaimed the $95,000 level and briefly extended toward $98,000 before settling into consolidation.

That restraint matters. In previous cycles, Bitcoin often behaved like a high-beta risk asset. This time, it looks steadier. Rather than chasing metals higher, BTC held reclaimed levels, reinforcing the idea that Bitcoin is slowly reasserting its hedge narrative.

Institutional demand remains firm

Institutional flows continue to underpin Bitcoin’s price. In late 2024, BlackRock transferred 3,143 BTC to Coinbase Prime, likely to support operational needs for its iShares Bitcoin Trust rather than speculative trading. On-chain transparency confirms these movements reflect infrastructure usage.

ETF data reinforces the trend. U.S. spot Bitcoin ETFs recorded $116.7 million in net inflows, while long-term holder selling slowed, according to Glassnode data. At the same time, corporate accumulation remains aggressive.

Strategy has acquired 13,627 BTC for ~$1.25 billion at ~$91,519 per bitcoin. As of 1/11/2026, we hodl 687,410 $BTC acquired for ~$51.80 billion at ~$75,353 per bitcoin. $MSTR $STRC https://t.co/5UttS1LCy2

— Michael Saylor (@saylor) January 12, 2026

Strategy added 13,627 BTC for approximately $1.25 billion near $91,500, bringing its total holdings to 687,410 BTC. Michael Saylor’s strategy is well known: accumulation during consolidation phases rather than chasing breakouts. That approach continues to shape broader market sentiment.

Why $95,000 Was the On-Chain Inflection Point

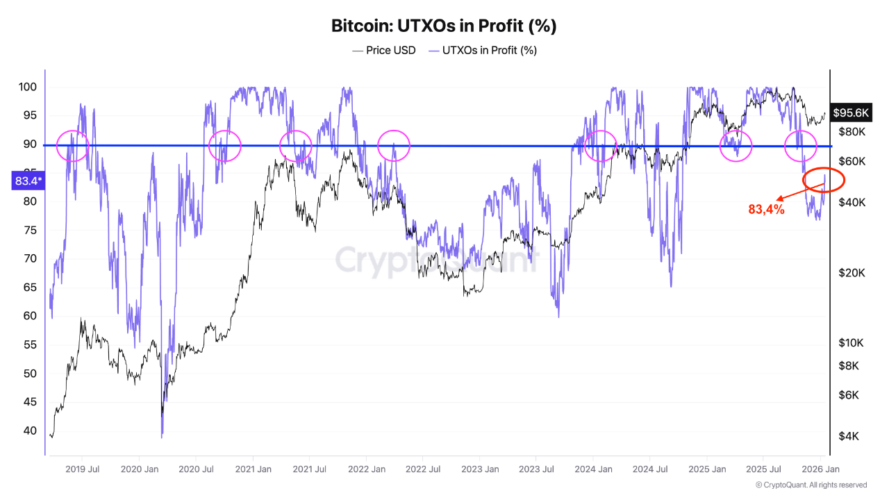

Bitcoin UTXOs in profit and price action. Source: CryptoQuant

UTXOs in Profit (%) measures the share of Bitcoin supply currently held at a profit and serves as a key indicator of market psychology. In early January, this metric hovered around 83–84%, suggesting most holders remained profitable but momentum was fragile.

Within that structure, $95,000 emerged as the critical on-chain pivot. The level aligned with the cost basis of short-term UTXOs and acted as the threshold for restoring broader profitability.

Bitcoin has since broken above $95,000, validating the level as an inflection point rather than unresolved resistance. Sustained acceptance above it allowed the UTXOs in Profit ratio to expand back toward the 90% zone, reinforcing market confidence. Rather than signaling exhaustion, the breakout suggests Bitcoin successfully transitioned from redistribution into continuation.

Analyst view: Bitcoin’s long-term bias remains upward

Luke Fraser of CoinPaper argues that Bitcoin’s current behavior reflects conviction rather than exhaustion. According to Fraser, consolidation near highs following strong institutional inflows is often a precursor to continuation, not reversal.

Fraser’s Bitcoin forecast places it well above current levels, with projections for 2026 ranging from $85,000 to $125,000, depending on how macro pressures and institutional adoption evolve. Beyond that, Fraser points to constrained supply, ETF demand, and recurring trust shocks as drivers that could support significantly higher prices over the coming decade.

CoinCodex Bitcoin price prediction for 2026

CoinCodex Bitcoin price prediction for 2026. Source: CoinCodex

CoinCodex’s Bitcoin price prediction presents a more measured outlook. According to CoinCodex models, BTC is expected to trade near the $95,000–$100,000 range in early 2026, with price briefly pushing above $100,000 before entering a longer consolidation phase later in the year.

The model projects a gradual softening toward the second half of 2026, reflecting historical post-cycle behavior rather than a breakdown in structure. While less aggressive than some analyst forecasts, the CoinCodex outlook still frames $100,000 as a meaningful milestone rather than a speculative outlier.

Together, the analyst and algorithmic views suggest that Bitcoin’s long-term bias remains upward, even if short-term volatility persists.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.