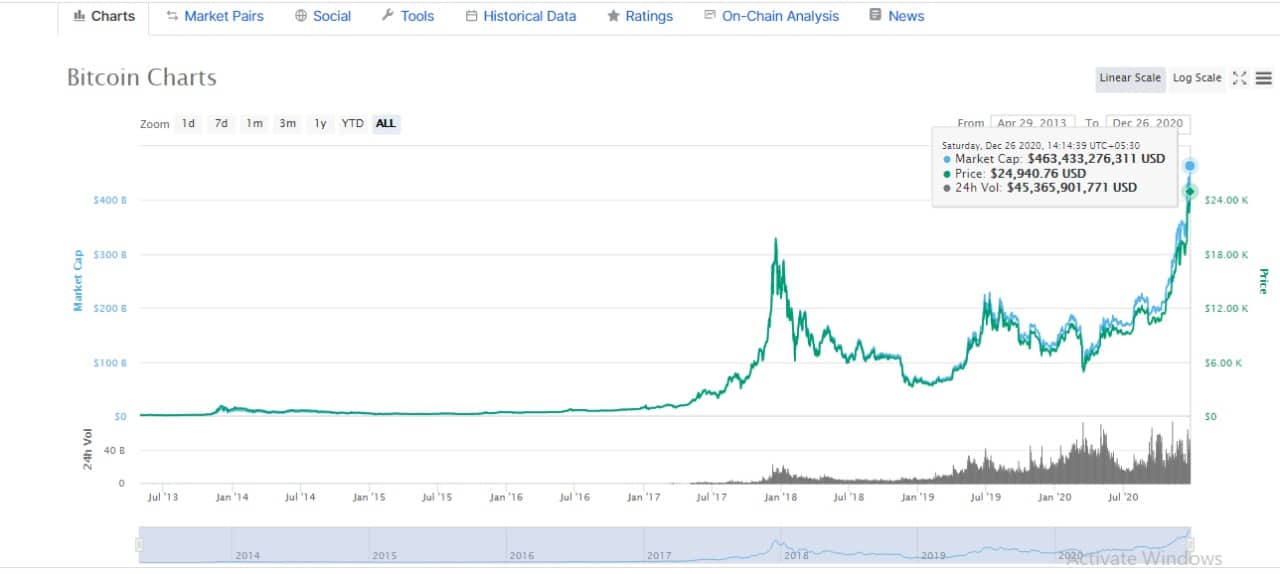

Bitcoin price has reached yet another all-time high, surpassing its intraday record set five days ago. The price of Bitcoin (BTC) surmounted to $25,000 for the first time ever. It is just a week after breaking $24,000 for the first time. The leading cryptocurrency extended its current rally, establishing a new all-time high of $25,005.53 before falling back to $24,971.23, up 6.28% on the day.

Insert image

However, before this week, the Bitcoin price fell by approximately $3,000 as news of SEC’s implementation against XRP and large-volume profit-taking pulled on prices. The new all-time record caps a year of profits for the world’s prominent cryptocurrency. Today’s rally has made its year-to-date gain approximately 300%, expanding roughly five times since March lows.

Factors contributing towards increase in Bitcoin Price

Various factors have contributed to the Bitcoin price rally. The increasing interest of significant companies and wealthy investors indicates a sharp turn-around. Several Wall Street institutions have recently begun to recognize Bitcoin as a safe haven and anti-inflationary asset at the time of unpredictability due to the Covid-19 pandemic, stimulating an increase in the demand.

Other factors that have helped its current record gains incorporate PayPal formally introducing cryptocurrency services. Moreover, several large institutional investors displayed an interest in funding products associated with cryptocurrency. Cryptocurrency funds and products have gathered inflows of $5.24 billion so far this year. This promotes the sector’s AUM to $14.5 billion, notwithstanding the coronavirus pandemic’s economic collapse. This is in accordance with the latest figures from CoinShares.

In 2020, New York-based Grayscale Investments witnessed $4.6 billion in YTD inflows, making it the best year. Moreover, Square Inc., a payments company established and operated by Twitter CEO Jack Dorsey, also stated revenue generation from trading bitcoin to its Cash App. The consumers almost doubled, resulting in at a total of $1.63 billion related to $875 million in the previous quarter. This number also indicates an 1100% increase from the amount reported during the same period in 2019.

Follow BitcoinWorld for the latest updates.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.