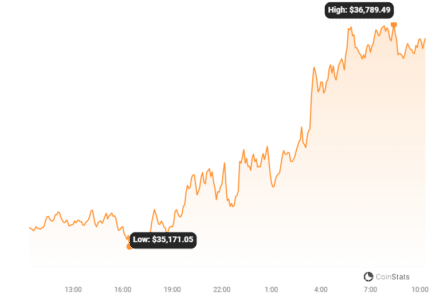

Is Bitcoin back? The cryptocurrency world is buzzing as Bitcoin has smashed through resistance levels, hitting a new 2023 peak of $36,789! What’s fueling this impressive rally, and what does it mean for the future of crypto investments? Let’s dive in.

Bitcoin’s Bull Run: What’s Behind the Surge?

Several factors are contributing to Bitcoin’s recent price surge:

- ETF Hype: The biggest driver is the anticipation surrounding the potential approval of spot-based Bitcoin ETFs. Investors are betting big on increased accessibility and institutional adoption.

- Analyst Predictions: Bloomberg Intelligence analysts estimate a 90% chance of ETF approvals by January 10th, potentially leading to a wave of new investment.

- Grayscale’s Legal Win: Grayscale’s victory against the SEC has paved the way for other companies, like BlackRock and Fidelity, to launch their own Bitcoin ETFs.

The ETF Effect: A Potential Game Changer

The approval of a Bitcoin ETF could be a watershed moment for the cryptocurrency. Bitwise CIO Matt Hougan believes it could be one of the most successful ETF launches ever, predicting inflows exceeding $50 billion within five years. Here’s why:

- Increased Accessibility: ETFs make it easier for traditional investors to gain exposure to Bitcoin without directly holding the cryptocurrency.

- Institutional Adoption: ETFs provide a regulated and familiar investment vehicle for institutions to enter the Bitcoin market.

- Price Discovery: ETFs can improve price discovery and liquidity in the Bitcoin market.

Market Volatility: Liquidations and Risk

While the Bitcoin surge is exciting, it’s essential to remember the inherent volatility of the cryptocurrency market. Recent data from Coinglass reveals significant liquidations:

- $148.42 Million Liquidated: In the last 24 hours, 49,689 traders saw their positions liquidated.

- Shorts Squeezed: A disproportionate amount (81.85%) of liquidations were short positions, indicating a significant short squeeze.

- Binance Dominates: Binance led in liquidation volume, with OKX recording the largest single liquidation order at $7.95 million.

Read Also: Bitcoin Surges to Almost $37K, Triggering Over $140 Million in Liquidations

These liquidations serve as a stark reminder of the risks associated with cryptocurrency trading. Always exercise caution and conduct thorough research before investing.

Looking Ahead: What’s Next for Bitcoin?

The future of Bitcoin remains uncertain, but the current momentum is undeniably positive. The potential approval of Bitcoin ETFs could usher in a new era of mainstream adoption, driving prices even higher. However, it’s crucial to be aware of the risks and volatility inherent in the cryptocurrency market.

Key Takeaways:

- Bitcoin’s price surge is fueled by ETF anticipation and positive market sentiment.

- ETF approval could significantly increase accessibility and institutional adoption.

- Market volatility remains a concern, as evidenced by recent liquidations.

- Always conduct thorough research and exercise caution before investing in cryptocurrencies.

Stay tuned for further updates on Bitcoin and the evolving cryptocurrency landscape!

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.