Buckle up, crypto enthusiasts! It was another day of high drama in the Bitcoin world, all thanks to a mischievous ghost in the machine – or rather, a hacker with access to the SEC’s official X (formerly Twitter) account. Just when everyone was on tenterhooks waiting for the official nod on the Spot Bitcoin ETF, a rogue tweet claiming approval sent Bitcoin’s price on a wild ride. Let’s dive into this rollercoaster and see where Bitcoin stands now.

The Tweet That Wasn’t: Bitcoin’s Brief Rocket Ride

Imagine the scene: anticipation is building, the market is poised, and then BAM! A tweet from the official SEC account declares the much-awaited Spot Bitcoin ETF approval. Bitcoin’s price, naturally, reacted like a shot of adrenaline straight to the crypto heart. It surged upwards, breaking through resistance levels faster than you can say ‘bull run’.

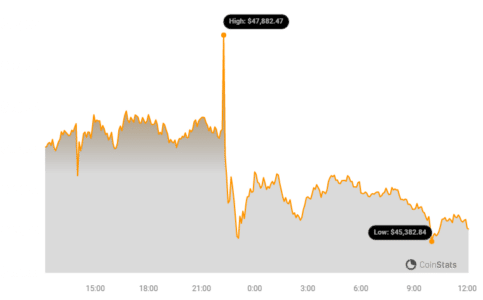

The price of Bitcoin made a beeline towards the coveted $48,000 mark. We saw a rapid ascent, pushing past $47,800 and even flirting with the $48,000 resistance. The bulls were out in force, fueled by what appeared to be the green light for a Spot BTC ETF. For a brief, glorious moment, it looked like the crypto dream was coming true.

However, as quickly as the party started, the music stopped. The celebratory mood turned to confusion and then…disappointment. It was revealed that the SEC’s X account had been compromised. The ETF approval tweet? Fake news. A digital mirage. The market reacted swiftly. Bitcoin, having tasted the highs, retraced its steps just as quickly.

But here’s the silver lining: even with the fake-out, Bitcoin’s underlying uptrend seems resilient. Despite the dramatic spike and fall, key support levels held. As of now, Bitcoin is trading above $45,500, comfortably above the 100 hourly Simple Moving Average. This suggests that the market’s fundamental bullish sentiment remains intact.

Bitcoin Price Faces Reality Check: What Happened After the Fake Tweet?

Let’s break down the price action following this extraordinary event. Bitcoin had been building momentum, steadily climbing above the $45,500 resistance zone. The fake tweet acted as a catalyst, pushing it further into bullish territory, past $46,000 and $46,500 with ease. The market was clearly primed for positive ETF news, and the fraudulent tweet simply triggered a premature celebration.

The peak of this excitement saw Bitcoin hitting a high near $47,988, tantalizingly close to $48,000. But the euphoria was short-lived. Once the SEC clarified the situation – confirming the account hack and debunking the tweet – reality set in. A sharp rejection followed, pulling the price back down from these highs.

The correction was swift and decisive. Bitcoin retreated below $47,000 and $46,500, eventually dipping towards the $45,000 support level. The low point of this correction landed near $44,828. However, demonstrating resilience, Bitcoin quickly found its footing and began to recover.

Currently, Bitcoin is showing signs of recovery, trading above $45,500 and reclaiming ground lost during the correction. It’s also sitting above the 23.6% Fibonacci retracement level, measured from the recent high of $47,988 to the low of $44,828. This retracement level is often watched by traders as an indicator of potential trend continuation.

Analyzing Bitcoin’s Current Stance: Triangle Formation and Key Levels to Watch

Looking at the hourly chart for the BTC/USD pair, a fascinating technical pattern is emerging – a major contracting triangle. This triangle pattern suggests a period of consolidation, with the price action narrowing between converging trendlines. The resistance for this triangle is currently around $46,800.

On the upside, the immediate hurdle for Bitcoin is near the $46,400 level, closely followed by $46,800. Interestingly, the $46,400 level aligns with the 50% Fibonacci retracement of the recent price drop (from $47,988 to $44,828). This confluence of resistance levels makes the $46,400 – $46,800 zone a critical area to watch.

A decisive break above the $46,800 resistance could pave the way for further gains, potentially targeting the $47,200 resistance next. Beyond that, the psychological barrier of $48,000 looms large. Clearing $48,000 could signal a strong bullish continuation, with the next major resistance level then positioned around $49,250.

However, if Bitcoin fails to overcome the $46,800 resistance, we might see a fresh wave of selling pressure. In this scenario, immediate support lies near $45,550, followed by stronger support at $45,200. A break below $45,200 could trigger further downside, potentially pushing the price back towards the $44,800 support in the short term.

Technical Indicators at a Glance:

- Hourly MACD – The MACD is showing signs of losing bearish momentum, suggesting a potential shift in momentum.

- Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is currently below the 50 level, indicating slightly bearish momentum, but it’s crucial to watch for any upward shifts.

- Major Support Levels – Key support levels to monitor are $45,500 and then $45,200.

- Major Resistance Levels – On the upside, watch out for resistance at $46,400, $46,800, and $47,200.

Key Takeaways and What to Watch For

- Fake Tweet Impact: The incident highlights the crypto market’s sensitivity to news, especially regarding ETF approvals. Even false information can trigger significant price swings.

- Uptrend Resilience: Despite the fake-out and subsequent correction, Bitcoin’s uptrend support near $45,200 remains intact, indicating underlying bullish strength.

- Triangle Pattern: The contracting triangle formation suggests a potential breakout is on the horizon. Traders should watch for a decisive move above $46,800 or below $45,200 to anticipate the next price direction.

- Key Price Levels: Keep a close eye on the support levels at $45,500 and $45,200, and resistance levels at $46,400, $46,800, and $47,200 for potential trading opportunities.

- Market Sentiment: The quick recovery after the fake tweet incident suggests strong underlying bullish sentiment for Bitcoin, particularly in anticipation of potential Spot BTC ETF approvals.

In Conclusion: Navigating the Bitcoin Waters

The Bitcoin market proved its volatility once again, showcasing a dramatic reaction to misinformation. While the fake SEC tweet caused a temporary frenzy, the underlying market dynamics remain focused on the potential approval of Spot Bitcoin ETFs. As we move forward, keeping a close watch on price action around the key levels mentioned, and monitoring official news channels for genuine updates on the ETF front will be crucial for navigating the Bitcoin waters. Stay informed, trade wisely, and remember – in the crypto world, things can change in a tweet!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.