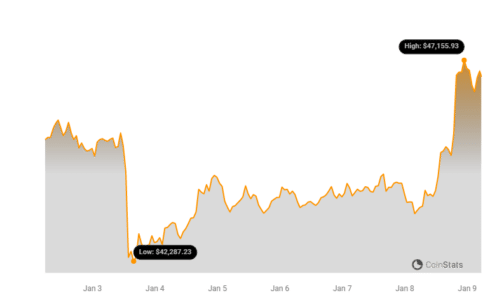

Buckle up, crypto enthusiasts! Bitcoin is back in the spotlight, smashing through the $47,000 mark for the first time in over 20 months. If you blinked, you might have missed it – the king of crypto briefly touched $47,155 before settling around $46,750. This impressive rally, a near 6% jump in just 24 hours, is sending shockwaves through the market. But what’s fueling this explosive growth?

Bitcoin’s Bullish Breakout: A Blast from the Past?

Remember May 2022? The crypto world was reeling from the Terra Luna collapse, and Bitcoin’s price plummeted. Fast forward to today, and it feels like a distant memory. Earlier in the day, Bitcoin had already hit $45,000, a high not seen since those dark days. But the rally didn’t stop there. The momentum kept building, propelling Bitcoin even higher.

Let’s take a closer look at the numbers:

- Price Surge: Bitcoin’s price peaked at $47,155, marking a 20-month high.

- 24-Hour Growth: A significant climb of nearly 6% in just one day.

- Trading Frenzy: Daily trading volume has skyrocketed by over 120%, according to CoinMarketCap.

- Market Cap Boost: Bitcoin’s market capitalization also jumped by 6%, reflecting increased investor confidence.

What’s the Secret Sauce? ETF Approval Buzz is Back!

The crypto community is buzzing with anticipation, and the reason is clear: the long-awaited Spot Bitcoin ETF approval. Rumors and reports are swirling, suggesting that the Securities and Exchange Commission (SEC) might finally give the green light this week, or in the very early days of next week. This anticipation is the primary driver behind the current price surge and the massive influx of trading volume.

This isn’t just speculation either. Former SEC Chair Jay Clayton, in a recent interview with CNBC, stated that Spot Bitcoin ETF approval is “inevitable” and could arrive as early as Wednesday or Thursday this week. Coming from a former регулятор, this statement carries significant weight and is further fueling market optimism.

See Also: The Approval Of Spot Bitcoin ETFs Is Inevitable – Former SEC Chair Jay Clayton

Institutional Money on the Horizon?

The potential impact of a Spot Bitcoin ETF approval cannot be overstated. Banking giant Standard Chartered predicts a staggering $50 to $100 billion could flow into Bitcoin if the SEC gives its approval. This influx of institutional money would be a game-changer for the crypto market, potentially driving prices to new heights.

The current market sentiment is undeniably bullish. Traders are exhibiting strong confidence, and the fear of missing out (FOMO) is kicking in, pushing prices closer to the coveted $50,000 mark. The soaring trading volume across major exchanges confirms this surge in investor interest and activity.

See Also: What Happened To SOL And Solana Meme Tokens Collapse After December Pump

What’s Next for Bitcoin?

With ETF approval potentially on the horizon, the short-term outlook for Bitcoin is undeniably positive. If the approvals materialize as predicted, we could see a continued price surge, potentially breaking through the $50,000 barrier and beyond. However, it’s crucial to remember that the crypto market remains volatile. While the current momentum is strong, unexpected events or regulatory hurdles could still impact prices.

Key Takeaways:

- Bitcoin has surged to over $47,000, a 20-month high, driven by ETF anticipation.

- Trading volume has exploded by 120%, indicating strong market activity.

- Former SEC Chair Jay Clayton believes ETF approval is “inevitable.”

- Analysts predict massive inflows into Bitcoin upon ETF approval.

- Market sentiment is bullish, with potential for further price appreciation.

Keep a close eye on the news this week! The potential Bitcoin ETF approval could mark a significant turning point for the cryptocurrency market. Will Bitcoin reach $50,000 and beyond? The crypto world is watching with bated breath.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.