Bitcoin’s recent rollercoaster has left many investors reeling. After the initial excitement surrounding the Bitcoin ETF launch, a sharp price correction triggered panic among short-term holders. Is this a healthy pullback, or a sign of deeper troubles ahead? Let’s dive into the factors influencing Bitcoin’s price and what experts are predicting.

Bitcoin’s Wild Ride Post-ETF Launch

The debut of spot Bitcoin ETFs in the US was expected to usher in a new era of stability and growth for Bitcoin. However, the reality has been far more volatile. Here’s a breakdown of what happened:

- Initial Surge: Bitcoin briefly touched $49,000 on the ETF launch day.

- Sharp Correction: The price quickly reversed, falling back to the $41,500 level.

- Liquidation Cascade: The drop triggered significant liquidations, particularly among leveraged long positions.

- Uncertainty Prevails: The market is now grappling with conflicting narratives, with some predicting a rebound and others bracing for further declines.

What’s Driving the Volatility?

Several factors are contributing to Bitcoin’s current price swings:

- ETF Profit-Taking: Some investors who bought Bitcoin in anticipation of the ETF launch may be taking profits, contributing to selling pressure.

- Macroeconomic Uncertainty: Concerns about inflation and the Federal Reserve’s interest rate policy are weighing on risk assets, including Bitcoin.

- Speculative Overreach: The rapid price appreciation leading up to the ETF launch may have been unsustainable, leading to a natural correction.

- Short-Term Holder Sentiment: As the content suggests, short-term holders are more prone to panic selling during price drops, exacerbating the volatility.

Expert Opinions: Bullish or Bearish?

The outlook for Bitcoin remains highly debated among analysts. Here’s a glimpse of the contrasting viewpoints:

The Bullish Case:

- Support Retest: Some analysts believe the recent dip represents a healthy support retest, paving the way for future growth.

- Technical Indicators: Traders like Skew point to reclaiming $42,500 and RSI staying above 50/100 as positive signals.

- Long-Term Holder Confidence: Long-term holders appear unfazed by the volatility, suggesting strong conviction in Bitcoin’s long-term potential.

The Bearish Case:

- Resistance at $48,000: Analyst Matthew Hyland cautions that Bitcoin may struggle to overcome resistance around $48,000.

- Potential Flush to $30,000: Some analysts are predicting a further drop to the $30,000 range before a sustained recovery.

- Macroeconomic Headwinds: Persistent inflation and potential interest rate hikes could continue to weigh on Bitcoin’s price.

The Fed’s Next Move: What to Expect

The Federal Reserve’s upcoming interest rate decision is a key event to watch. While markets don’t expect a rate cut this month, the outlook for future cuts remains uncertain.

- CPI Data: Recent CPI numbers showed prices climbing more than expected in December 2023, indicating that inflation remains a concern.

- Market Expectations: Despite the CPI data, markets still anticipate rate cuts starting in March.

- FedWatch Tool: The CME Group’s FedWatch Tool currently puts the odds of a January rate freeze at over 95%.

Short-Term Holders Panic: A Sign of Weakness?

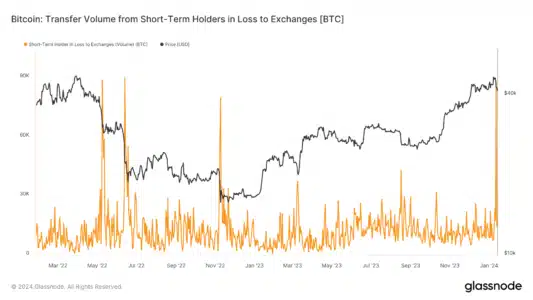

The recent price drop triggered a wave of panic selling among short-term Bitcoin holders. According to Glassnode, on January 12th, 88,000 BTC ($3.75 billion) were sold for less than their purchase price. This behavior highlights the vulnerability of short-term holders to market volatility.

- STH Behavior: Short-term holders, defined as those holding Bitcoin for up to 155 days, were quick to sell during the price decline.

- LTH Resilience: In contrast, long-term holders showed little reaction, suggesting a stronger belief in Bitcoin’s long-term value.

Key Takeaways and Actionable Insights

- Volatility is Inherent: Bitcoin remains a highly volatile asset, and investors should be prepared for significant price swings.

- Long-Term Perspective: A long-term investment horizon can help weather short-term market fluctuations.

- Risk Management: Implement proper risk management strategies, such as setting stop-loss orders and diversifying your portfolio.

- Stay Informed: Keep abreast of market news, expert analysis, and macroeconomic developments to make informed investment decisions.

Conclusion: Navigating the Bitcoin Landscape

Bitcoin’s recent price action underscores the importance of understanding market dynamics and managing risk effectively. While short-term volatility may create opportunities for some, a long-term perspective and a disciplined approach are crucial for navigating the Bitcoin landscape successfully. Whether the market rebounds or dips further, staying informed and prepared will be key to making sound investment decisions.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.