Hold onto your hats, crypto enthusiasts! Bitcoin just pulled off a move that has the market buzzing, soaring past the $27,000 mark. It’s like the digital gold decided to sprint, and the whole crypto space is feeling the energy. What sparked this sudden surge? Well, let’s dive into the exciting details, including a major announcement from a financial giant that could signal a significant shift in Bitcoin’s journey towards mainstream adoption.

Bitcoin’s Bullish Bounce: What’s Driving the Price Surge?

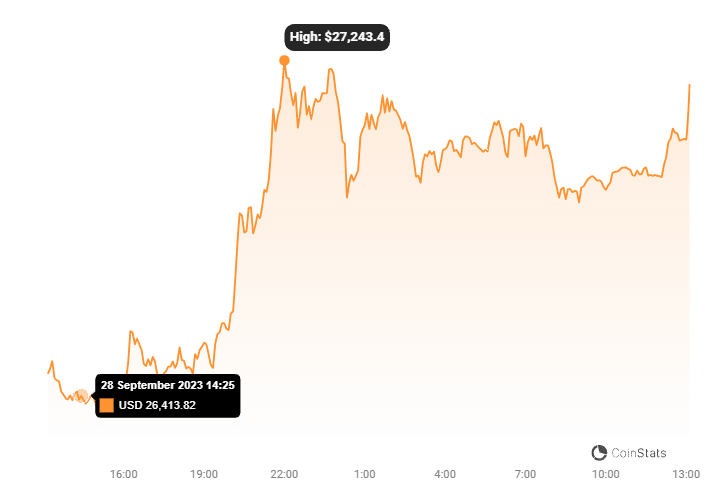

Wednesday morning saw Bitcoin paint the charts green, hitting a peak of over $27,400 before settling slightly at $27,214.15 (as of 7:30 a.m. in Hong Kong). That’s a solid 1.75% jump in just 24 hours, and a whopping 5.11% climb over the week! If you’ve been watching the crypto market, you know this kind of upward movement is like a shot of espresso for the entire industry.

But Bitcoin wasn’t alone in this rally. It seems like the positive vibes were contagious, with most of the top 10 cryptocurrencies (excluding stablecoins) also flashing green in the last day. Toncoin stood out as the star performer, rocketing up by over 7%! So, what’s the secret ingredient behind this crypto market resurgence? Let’s uncover the key factor that’s got everyone talking.

Nomura Enters the Bitcoin Arena: A Game Changer for Institutional Adoption?

Enter Nomura, Japan’s leading investment bank, and their bold move: the launch of a dedicated Bitcoin Adoption Fund! Announced just on Tuesday, this isn’t just another crypto fund; it’s a statement. Nomura, managing around $500 billion in assets, is signaling to the traditional finance world that Bitcoin is not to be ignored.

Their digital asset arm, Laser Digital, is spearheading this initiative, aiming to create a smooth, professional gateway for institutional investors to dive into the world of digital assets. Think about it – institutions managing massive capital are now getting a clearer path to invest in Bitcoin. This is a big deal for several reasons:

- Validation of Bitcoin as an Asset Class: When a major player like Nomura creates a Bitcoin Adoption Fund, it sends a powerful message. It says Bitcoin is not just a speculative fad, but a legitimate asset class worthy of institutional consideration.

- Influx of Institutional Capital: Institutional investors bring in significant capital. Even a small allocation to Bitcoin from these giants can have a substantial impact on demand and, consequently, price.

- Increased Market Maturity: Institutional participation often brings more sophisticated trading strategies, better risk management, and overall market maturity, potentially reducing volatility in the long run.

Laser Digital’s Vision: Bitcoin as a Cornerstone of Digital Transformation

Sebastien Guglietta, the head honcho at Laser Digital Asset Management, didn’t mince words about Bitcoin’s importance. He emphasized Bitcoin’s central role in the ongoing digital transformation of the global economy. The Bitcoin Adoption Fund isn’t a one-off; it’s the first in a planned series of digital adoption investment solutions from Laser Digital Asset Management. Their vision is clear: Bitcoin isn’t just a cryptocurrency; it’s a key piece of the puzzle in the evolving digital landscape, offering investors a chance to tap into this macro trend.

Crypto vs. Traditional Markets: Are They Decoupling?

While the crypto market is buzzing with Bitcoin’s surge and Nomura’s fund, the bigger financial picture is still in play. The equity market is on tenterhooks, waiting for the U.S. Federal Reserve’s interest rate decision. Historically, crypto and traditional markets have shown correlations, but are we seeing a shift?

Blockchain research firm K33 Research suggests that the impact of macroeconomic data on crypto might be lessening. They argue that making trading decisions solely based on macro factors might be less effective now due to Bitcoin’s potentially weakening correlation with traditional assets. This could mean that positive developments within the crypto space itself, like institutional adoption, are starting to hold more sway over Bitcoin’s price action.

Binance’s Volume Dip: A Cause for Concern?

However, it’s not all sunshine and rainbows in the crypto world. K33 Research also highlighted a concerning trend: a significant drop in Bitcoin trading activity on Binance, the world’s largest crypto exchange. Binance’s seven-day average Bitcoin spot volume has reportedly plummeted by a staggering 57% since September.

This volume decline coincides with Binance facing increasing regulatory scrutiny in the United States. The regulatory pressure raises questions about the exchange’s future operations and its overall market position. A decrease in trading volume on a major exchange like Binance can sometimes indicate reduced market liquidity and potentially increased volatility.

Key Takeaways: What Does This Mean for the Future of Bitcoin?

Let’s recap the key takeaways from this exciting week in crypto:

- Bitcoin’s Price Surge: Bitcoin’s jump above $27,000 signifies renewed bullish momentum in the crypto market.

- Nomura’s Bitcoin Fund: The launch of Nomura’s Bitcoin Adoption Fund is a landmark event, signaling growing institutional interest and mainstream acceptance of Bitcoin.

- Institutional Adoption as a Catalyst: Nomura’s move could pave the way for more institutional investment, potentially driving further price appreciation and market maturation.

- Decoupling from Traditional Markets? There are signs that Bitcoin’s price may be becoming less correlated with traditional macroeconomic factors, making crypto-specific news and developments more influential.

- Binance’s Challenges: The decline in trading volume on Binance and ongoing regulatory challenges are factors to watch closely, as they could impact market liquidity and sentiment.

Looking Ahead: Navigating the Evolving Crypto Landscape

In conclusion, Bitcoin’s recent price surge, fueled in part by Nomura’s groundbreaking Bitcoin Adoption Fund, injects a fresh dose of optimism into the cryptocurrency market. The increasing involvement of institutional players like Nomura is a significant step towards mainstream adoption, potentially ushering in a new era for Bitcoin and the broader crypto ecosystem.

However, the crypto landscape remains dynamic and complex. While institutional adoption is a positive catalyst, regulatory challenges and market shifts, like the changes observed on Binance, remind us that the journey is not always a straight line upwards. Staying informed, understanding market dynamics, and keeping a balanced perspective are crucial for navigating the exciting, yet sometimes turbulent, world of cryptocurrencies. The story of Bitcoin and crypto is still being written, and it’s certainly a captivating one to follow!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.