Bitcoin Surges Past $27,000 as Nomura Launches Bitcoin Adoption Fund

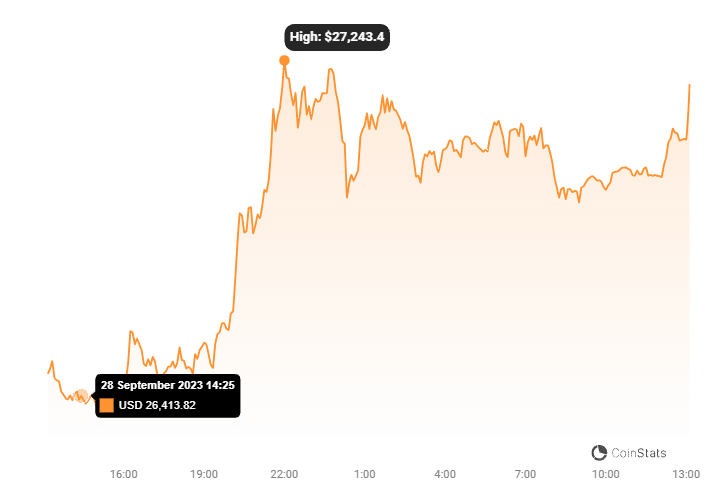

In a surprising turn of events, Bitcoin experienced a significant surge on Wednesday morning, surpassing the $27,000 mark. The cryptocurrency market was excited as Bitcoin reached a high of over $27,400 earlier in the day, ultimately settling at $27,214.15 as of 07:30 a.m. in Hong Kong. This 1.75% increase in the last 24 hours and a 5.11% rise for the week marks a promising uptrend in the crypto world.

Notably, Bitcoin’s rapid ascent was not an isolated event, as most of the top 10 non-stablecoin cryptocurrencies also recorded gains within the past 24 hours. Toncoin, in particular, led the rally with an impressive surge of over 7%. Investors and enthusiasts were left pondering the cause of this sudden crypto market resurgence.

One of the driving forces behind this bullish sentiment was Japan’s leading investment bank, Nomura, which unveiled its Bitcoin Adoption Fund on Tuesday. Nomura’s digital asset subsidiary, Laser Digital, spearheaded the initiative, aiming to provide institutional investors with a seamless gateway into digital assets. With Nomura boasting around $500 billion in assets under management, this move marks a significant step towards the mainstream acceptance of cryptocurrencies.

The Bitcoin Adoption Fund is the first in a series of digital adoption investment solutions that Laser Digital Asset Management plans to introduce to the market. Sebastien Guglietta, the head of Laser Digital Asset Management, emphasized the role of Bitcoin in the ongoing digital transformation of the global economy, noting that it enables investors to capture this macro trend.

While Bitcoin’s surge is remarkable, the crypto market remains closely tied to traditional financial markets. As the equity market eagerly awaits the U.S. Federal Reserve’s interest rate decision, analysts expect a limited impact on the crypto realm. Blockchain research firm K33 Research even suggested that making trading decisions based on macroeconomic data may be less helpful due to Bitcoin’s reduced correlation with traditional assets.

K33 Research also shed light on a concerning trend: a significant decline in Bitcoin trading activities on Binance, the world’s leading crypto exchange. Binance’s seven-day average Bitcoin spot volume had plummeted by 57% since September. This decline coincided with Binance’s increasing regulatory challenges in the United States, raising questions about the exchange’s future.

In conclusion, Bitcoin’s recent surge above $27,000, coupled with the launch of Nomura’s Bitcoin Adoption Fund, has injected new vitality into the cryptocurrency market. However, as the crypto landscape evolves, its relationship with traditional financial markets remains complex and intertwined, with regulatory challenges and changing dynamics playing pivotal roles in shaping its future.