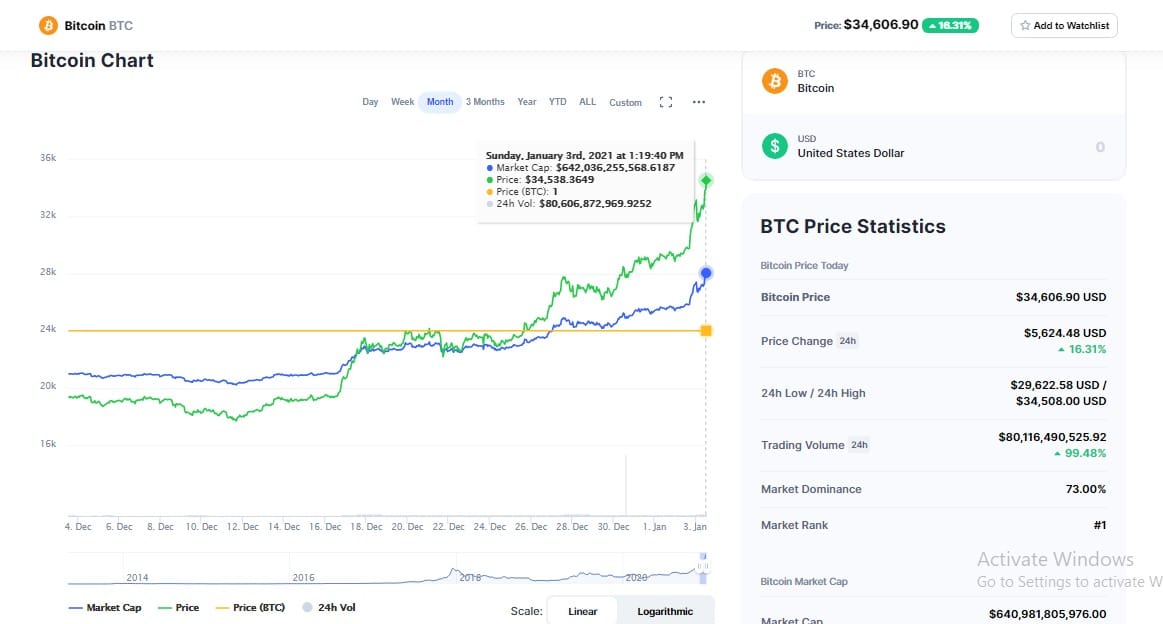

Buckle up, crypto enthusiasts! 2021 kicked off with a bang, and leading the charge was none other than Bitcoin. Just when you thought the crypto rollercoaster might take a breather, Bitcoin shattered expectations, surging to a breathtaking $34,538. Yes, you read that right! After a phenomenal climb in December, Bitcoin’s momentum didn’t just continue – it accelerated, grabbing headlines and reigniting the global conversation around digital gold.

In a world still navigating the choppy waters of the COVID-19 pandemic and economic uncertainties, Bitcoin has emerged as a beacon of sorts. Forget traditional markets for a moment – stocks wobbled, the dollar danced nervously – but Bitcoin? Bitcoin stood tall, proving its mettle as a store of value in these unpredictable times.

Bitcoin’s Rocket Ride to $34,000: How Did We Get Here?

Let’s rewind a bit. Bitcoin’s journey in 2020 was nothing short of spectacular. Imagine this: its value quadrupled! It wasn’t just a gradual climb; it was a full-fledged ascent to crypto stardom. And with its market capitalization soaring past $631 billion, Bitcoin cemented its position as the undisputed king of cryptocurrencies. But what fueled this incredible surge?

Key Engines Powering Bitcoin’s Ascent:

- The Big Players are Here: Institutional AdoptionRemember when Bitcoin was just a fringe asset? Those days are fading fast. Now, major financial institutions and savvy hedge funds are jumping into the Bitcoin arena. Why? They’re eyeing it as a smart move to shield against inflation and economic instability. Think of it as the new-age gold rush, but digital!

- The People’s Choice: Retail InterestIt’s not just the big guys; everyday investors are also playing a crucial role. Retail interest is buzzing! Many are eagerly watching, waiting for those slight dips to dive in and grab a piece of the Bitcoin pie. The fear of missing out (FOMO) is real, and it’s driving demand.

- The Core Appeal: Decentralization and AnonymityLet’s not forget what makes Bitcoin fundamentally attractive. Its decentralized nature and the degree of anonymity it offers resonate deeply with technologists, financial institutions seeking alternatives, and investors looking for a reliable store of value outside the traditional financial system. It’s about control, security, and a break from the norm.

To Buy or Not to Buy? Navigating the Bitcoin Investment Question at $34,000

Okay, the million-dollar question (or should we say, $34,000 question?): Is now the right time to jump in? While Bitcoin’s trajectory is pointing skyward, the crypto market is known for its twists and turns. The possibility of a price correction is always on the table, and investors are actively debating this.

Institutional Muscle vs. Retail Strategy: A Market Tug-of-War

- The Institutional Edge: The entry of institutional players isn’t just about big money; it’s about validation. Their involvement adds a layer of legitimacy to Bitcoin, suggesting a more sustained and mature growth phase. They’re not in it for a quick flip; they’re thinking long-term.

- The Retail Game Plan: Many retail investors are playing it cool, patiently waiting for a potential dip. They’re looking for a more favorable entry point. However, timing the market is notoriously tricky, and predicting the depth and duration of any dip is anyone’s guess.

Twitter Buzz and Bitcoin: The Social Media Echo Chamber

In today’s world, no rally is complete without social media going into overdrive. Bitcoin’s surge has sparked a frenzy on Twitter, with crypto influencers and enthusiasts sharing their takes and predictions. The digital town square is buzzing with Bitcoin fever!

Voices from the Crypto-Sphere: Ivan on Tech Weighs In

Ivan on Tech, a prominent voice in the crypto community, captured the sentiment perfectly in a tweet:

“What a time to be alive. Bitcoin keeps soaring and proving skeptics wrong.”

Can Bitcoin Keep the Momentum Going? Analyzing the Rally’s Sustainability

The crypto landscape is currently charged with energy and optimism. Bitcoin is not just hitting records; it’s smashing them. But is this a sprint or a marathon? Let’s delve into the factors that suggest this rally might have staying power, and the potential speed bumps along the way.

Bullish Signals: Green Lights for Continued Growth

- Institutional Confidence: Major firms are not just dipping their toes; they’re making significant allocations to Bitcoin. This suggests a strong belief in Bitcoin’s long-term value proposition and its role in the evolving financial system.

- Technological Foundation: Bitcoin’s inherent features – decentralization and its capped supply (scarcity) – continue to be powerful magnets, especially in an environment where inflation worries are simmering. It’s seen as a hedge against traditional economic uncertainties.

- Market Vibe: The overall sentiment is overwhelmingly positive. Enthusiasm is palpable among both retail and institutional investors, creating a powerful wave of support for the rally.

Bearish Whispers: Potential Caution Flags

- The Inevitable Dip: What goes up, must eventually take a breather. Price corrections are a natural part of any market cycle, especially in the volatile crypto world. While dips are expected, the million-dollar question is: how deep and how long? This uncertainty keeps some investors on the sidelines, cautiously observing.

Final Thoughts: Bitcoin’s Bold New Chapter

Bitcoin’s breathtaking ascent past $34,000 is more than just a number; it’s a statement. It underscores Bitcoin’s increasing acceptance and its resilience as a financial asset in a world grappling with economic shifts. While retail investors keenly watch for potential dips to seize opportunities, the consistent influx of institutional interest is a powerful engine driving demand, firmly establishing Bitcoin as a central player in the modern financial narrative.

As Bitcoin inches closer to the next psychological barrier of $35,000 resistance, the big question remains: Will this rally maintain its vigor, or are we due for a temporary cooling-off period? Regardless of the short-term fluctuations, one thing is increasingly clear: Bitcoin’s role as a transformative financial asset is becoming undeniable.

Want to dive deeper into the crypto world and explore the innovative startups shaping its future? Explore our article on latest news, where we spotlight the most promising ventures and their potential to revolutionize traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.