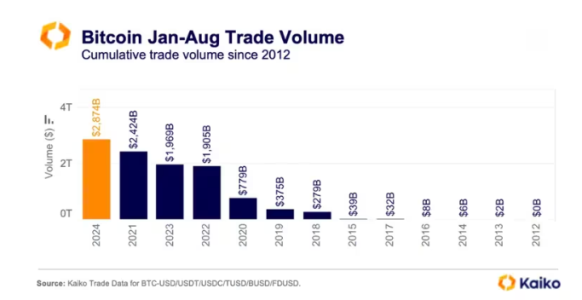

Bitcoin trading volume in 2024 has reached new record highs, surpassing the levels seen during the 2021 bull market by nearly 20%, according to data from Kaiko, reported by CoinDesk. With a cumulative trading volume of $2.874 trillion on centralized exchanges (CEXs) in the first eight months of the year, Bitcoin’s market activity has outpaced the $2.424 trillion recorded in 2021, marking a significant milestone in the cryptocurrency’s market performance.

The surge in trading volume was driven by increased market participation and rising volatility, as Bitcoin’s price volatility spiked to an annualized 100% in April. A combination of strong inflows into spot Bitcoin ETFs and rising expectations of U.S. Federal Reserve rate cuts fueled Bitcoin’s price rally above $70,000. While volatility receded temporarily, it resurfaced in August due to concerns about the U.S. economy and the unwinding of the yen carry trade.

Factors Driving the Trading Volume Surge

The surge in Bitcoin trading volume in 2024 can be attributed to several key factors, including the rising adoption of spot Bitcoin ETFs and heightened market volatility. Bitcoin’s price reached $70,000 in April, driven by strong inflows into spot Bitcoin ETFs, as institutional investors sought to gain exposure to the leading cryptocurrency.

Increased expectations of U.S. Federal Reserve interest rate cuts also contributed to the bullish sentiment in the crypto market, prompting higher levels of trading activity. As the Fed signaled a potential easing of monetary policy, investors flocked to Bitcoin as an alternative store of value, further boosting market participation.

Volatility, which spiked to an annualized 100% in April, played a crucial role in driving trading volumes. Bitcoin’s volatile price movements create opportunities for traders, particularly during periods of heightened market activity. The resurgence of volatility in early August, driven by concerns over the U.S. economy and the unwinding of the yen carry trade, reignited trading interest and sustained high levels of market activity.

Bitcoin’s Record-Breaking Year

The cumulative trading volume of $2.874 trillion recorded on centralized exchanges in 2024 represents an all-time high for Bitcoin. This record-breaking performance exceeds the $2.424 trillion volume seen during the 2021 bull market, highlighting the continued growth of the Bitcoin market and the increasing participation of both retail and institutional investors.

The data from Kaiko underscores the sustained demand for Bitcoin, despite the cryptocurrency’s price volatility. With more investors flocking to the crypto space, Bitcoin has cemented its status as a key asset in the global financial markets. The availability of regulated investment products such as spot Bitcoin ETFs has made it easier for institutional investors to participate in the market, further driving trading volumes.

Bitcoin’s Volatility and Market Sentiment in 2024

Bitcoin’s price volatility, which spiked to an annualized 100% in April, reflects the heightened uncertainty and market activity surrounding the cryptocurrency. As Bitcoin approached its all-time high price of $70,000, traders took advantage of the volatile price swings to maximize profits. The high volatility also drew in new market participants looking to capitalize on short-term trading opportunities.

However, volatility returned in August, driven by concerns about the U.S. economy and the unwinding of the yen carry trade. These factors created renewed uncertainty in the financial markets, leading to further price fluctuations and driving trading activity in Bitcoin. Market participants were particularly sensitive to macroeconomic conditions, which contributed to the ongoing volatility in the Bitcoin market.

Despite the fluctuations, Bitcoin has continued to attract interest as a hedge against inflation and a store of value, especially in light of potential Federal Reserve rate cuts. This growing interest has translated into increased trading volumes, positioning Bitcoin as a leading asset in the volatile world of cryptocurrency.

The Future of Bitcoin Trading in 2024

As Bitcoin continues to set new records in trading volume and market activity, the question remains: Will the momentum continue for the rest of 2024? With Bitcoin already surpassing the levels seen in the 2021 bull market, the cryptocurrency is poised to play an even more significant role in global financial markets.

Spot Bitcoin ETFs have been a driving force behind the surge in trading volume, and their continued adoption by institutional investors is likely to sustain interest in Bitcoin. Additionally, macroeconomic factors such as U.S. Federal Reserve policies, inflation concerns, and global market uncertainties will continue to influence Bitcoin’s price and trading activity.

The return of volatility in August has shown that Bitcoin remains sensitive to macroeconomic developments, creating both risks and opportunities for traders. As Bitcoin maintains its status as a key player in the financial markets, the high levels of trading volume seen in 2024 may be just the beginning of further growth in the cryptocurrency market.

Conclusion: Bitcoin Trading Volume in 2024 Surpasses 2021 by 20%

Bitcoin’s trading volume in 2024 has surged to new heights, with a cumulative total of $2.874 trillion on centralized exchanges, surpassing the $2.424 trillion recorded during the 2021 bull market by 20%. This increase in trading volume has been driven by heightened market volatility, strong inflows into spot Bitcoin ETFs, and growing institutional interest in the cryptocurrency. As Bitcoin continues to break records, its role as a leading asset in the global financial markets is becoming more pronounced.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.