Bitcoin Transaction Fees Surge Amid Price Rally: What Does This Mean for the Crypto Market?

Bitcoin, the king of cryptocurrencies, has been on an extraordinary price rally in recent weeks, surpassing previous all-time highs. However, alongside the surge in Bitcoin’s price, its transaction fees have also spiked, raising concerns and questions among users and miners alike. As Bitcoin’s transaction fees soar to new heights, Ethereum, the second-largest cryptocurrency by market cap, has also faced similar challenges, particularly after the launch of Ethereum’s Beacon Chain.

Bitcoin’s Rising Transaction Fees: A Closer Look

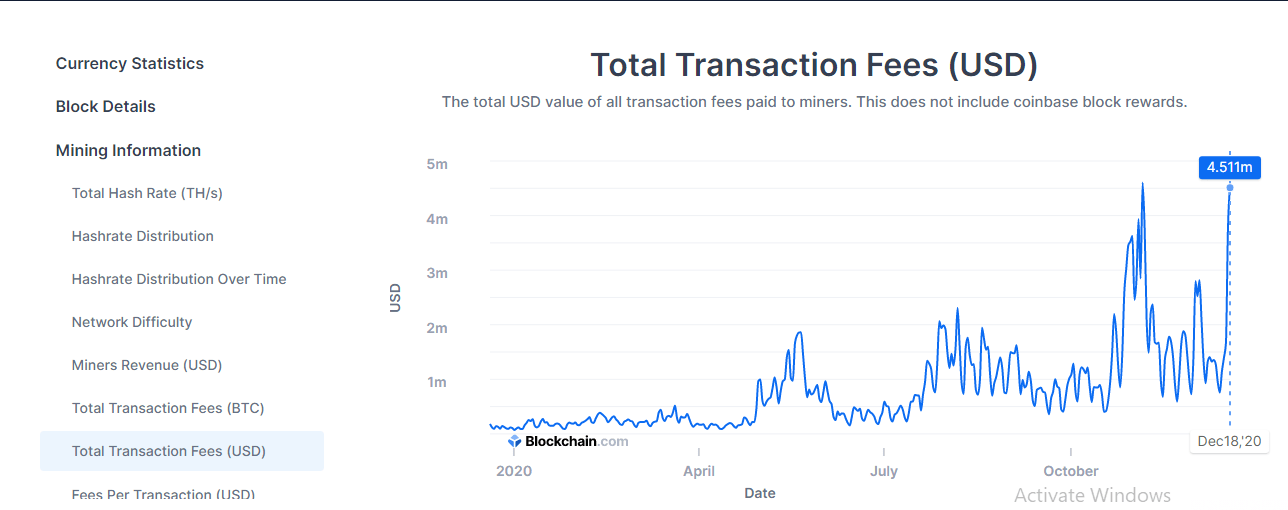

According to data from Blockchain Charts, Bitcoin transaction fees have risen significantly, reaching a staggering $4.511 million. This increase has been particularly notable in the last two months, as Bitcoin experienced massive price gains, mainly driven by institutional players entering the crypto space. In early 2020, Bitcoin’s transaction fees were relatively stable, fluctuating between $1 million and $2 million. However, as Bitcoin’s price began its meteoric rise, so did the transaction fees.

At the time of writing, the average Bitcoin transaction fee stands at $11.828, marking a significant increase. The highest Bitcoin transaction fee recorded during this surge reached $13.154 in October 2020. This is a clear indication of the growing demand for Bitcoin transactions, which comes hand-in-hand with its increasing price.

A Huge Surge in Transaction Fees

Bitcoin’s transaction fees have seen an incredible surge. Over a period of just two weeks, the transaction fees skyrocketed from $2.71 to $11.828, reflecting an increase of approximately 436%. Every few days, the fees have spiked by around 30%, mirroring the fast pace of the overall Bitcoin rally. While these numbers are eye-catching, they still fall short compared to the peak levels of transaction fees seen in 2017.

On December 22, 2017, Bitcoin transaction fees reached a record high of $54.638, the most expensive fees in Bitcoin’s history. The current fees are approximately 461% lower than the fees during the 2017 rally, which further highlights the efficiency of Bitcoin’s network today, despite the recent surge in fees.

Bitcoin’s Price Surge and Its Impact on Transaction Fees

Bitcoin’s soaring transaction fees are directly linked to its price. As Bitcoin’s value increases, so does the demand for Bitcoin transactions. The increased demand for the cryptocurrency naturally leads to higher fees, as miners receive rewards in satoshis (Bitcoin’s smallest unit). The higher the demand, the higher the incentives for miners to process transactions. This dynamic, where transaction fees rise with price surges, highlights Bitcoin’s growing adoption as both a store of value and a medium of exchange.

Despite the increased transaction fees, users are still inclined to pay the higher fees for faster transaction confirmations. This is especially true for those who require quick transactions, such as traders and institutional investors who are heavily involved in Bitcoin’s current bull run.

Bitcoin Network Difficulty and Miner Rewards

Alongside the increase in transaction fees, Bitcoin’s network difficulty has also seen significant growth. The difficulty to mine a block on the Bitcoin network has increased to 18.67 trillion, representing a substantial rise in mining difficulty. As a result, miners’ rewards have surged as well. The total miner rewards currently stand at 27.241 million Bitcoin.

For miners, the increase in difficulty means that they need more computing power and resources to successfully mine a block. However, the higher transaction fees provide an incentive for miners to keep operating, ensuring that the network remains secure and that transactions are processed efficiently.

What Does This Mean for Bitcoin’s Future?

The rise in Bitcoin’s transaction fees signals that the network is becoming more congested, which is a natural outcome of its increasing popularity and adoption. While this is a positive sign in many ways, as it reflects Bitcoin’s growing role in the global financial system, it also raises concerns regarding its scalability.

As the price of Bitcoin continues to rise, the transaction fees will likely keep increasing as well. This could potentially make Bitcoin less suitable for small transactions, especially when compared to other cryptocurrencies with lower fees and faster transaction speeds. However, this issue may be mitigated over time with the ongoing developments in Bitcoin’s Lightning Network, which aims to enable faster and cheaper transactions off-chain.

Moreover, Ethereum, the second-largest cryptocurrency, has been facing similar challenges following the launch of the Ethereum 2.0 Beacon Chain. The launch of Ethereum’s staking system has caused a surge in its transaction fees as well, with Ethereum also seeing increased demand for its network as DeFi projects continue to grow in popularity.

Conclusion: Bitcoin’s Growing Impact on the Crypto Ecosystem

Bitcoin’s rising transaction fees are closely tied to its price rally, and they reflect the growing demand for the cryptocurrency. While the increasing fees may pose challenges for certain users, they also highlight Bitcoin’s increasing importance as a store of value and a mainstream asset. The relationship between transaction fees and Bitcoin’s price will continue to evolve as the network grows and as solutions like the Lightning Network work to address scalability concerns.

As Bitcoin continues to dominate the cryptocurrency space, its price momentum will likely remain a driving factor behind transaction fee fluctuations. For now, Bitcoin’s supporters are celebrating the asset’s achievements and its growing adoption by institutional investors. The question remains: will these rising fees hinder Bitcoin’s progress, or will the network adapt to the increasing demand?

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.