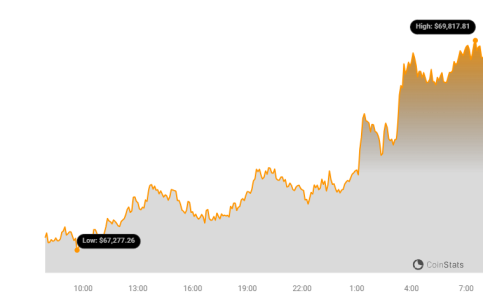

Buckle up, crypto enthusiasts! Bitcoin is back in the game, staging a powerful rebound and leaving bears in the dust. After a bit of a dip, BTC has surged past the $67,000 mark, and guess who’s fueling this rally? You guessed it – the Bitcoin whales are back on the accumulation trail, signaling strong confidence in the king of crypto. Let’s dive into what’s driving this bullish momentum and what it means for Bitcoin’s next move.

- Bitcoin whales are accumulating BTC as the price has impressively surged nearly 4.5% from yesterday’s low, swiftly breaking through the $67K barrier.

Adding fuel to the fire, Open Interest contracts have exploded by a staggering $1.4 billion intraday as Bitcoin bounced back from the $64,000 level. This surge in derivatives activity points towards increased market participation and renewed bullish sentiment.

As of now, Bitcoin is trading at $67,450, reflecting a robust 2.5% intraday gain. This recovery comes after recent selling pressure had pushed Bitcoin down by 3% in the previous trading session. But the bulls have clearly returned with force!

The rebound was sharp and decisive, seemingly propelled by significant buying activity from Bitcoin whales. This price appreciation is mirrored in the derivatives market, where Open Interest contracts witnessed that massive $1.4 billion jump in just one day.

Decoding the Derivatives Data: What’s Behind the $1.4 Billion Surge?

The derivatives data paints a clear picture of renewed optimism. The $1.4 billion inflow into BTC contracts as Bitcoin recovered from its $63.5K daily low signifies a major shift in market sentiment. An increase in Open Interest typically suggests that traders are opening new positions, indicating expectations of future price volatility and, in this case, a leaning towards bullish positions.

Adding another layer to the narrative is the buzz surrounding the Bitcoin 2024 conference in Nashville, Tennessee, particularly due to Donald Trump’s presence. The anticipation around potential positive comments from Trump regarding Bitcoin is likely influencing trader behavior.

It appears that short-term futures traders are increasingly placing bets on long positions, hoping for a positive catalyst from Donald Trump’s speech at the Bitcoin 2024 conference. This anticipation is driving up demand in the derivatives market.

However, this bullish skew in the futures market also presents a potential risk. According to on-chain analytics from app.santiment.net, even a slight retracement back to $65,000 could trigger liquidations of these $1.4 billion worth of long positions. This highlights the inherent volatility and leverage in the crypto derivatives market.

Bitcoin Whales: Accumulating Like Never Before?

Adding even more weight to the bullish narrative, on-chain analytics platform CryptoQuant has detected significant Bitcoin accumulation by large investors – the Bitcoin whales. This isn’t just any accumulation; it’s being described as something truly remarkable.

CryptoQuant CEO Ki-Young Ju himself labeled this trend as “unprecedented,” in a recent post on X (formerly Twitter). When industry leaders use words like “unprecedented,” it’s time to pay attention!

Unprecedented whale accumulation happening.

358K $BTC moved to permanent holders in the past month.

Global spot ETF inflows in July: 53K $BTC.

Not all BTC are in custody wallets, but the accumulation phase is clear. pic.twitter.com/4d7q3D4s0v

— Ki Young Ju (@ki_young_ju) July 29, 2024

According to Ki Young Ju, a massive 358,000 BTC has been moved to permanent holder addresses just in the past month. To put that into perspective, global spot ETF inflows for the entire month of July were only 53,000 BTC. This highlights the sheer scale of whale accumulation currently underway.

While not all of this Bitcoin is necessarily in custody wallets, the message is clear: long-term holders are aggressively accumulating Bitcoin. This significant transfer of wealth into the hands of strong holders suggests a bullish long-term outlook for Bitcoin.

Further underscoring the health of the Bitcoin ecosystem, the Total Value Locked (TVL) in Bitcoin currently stands at a robust $701.92 million. This high TVL indicates continued engagement and investment within the Bitcoin network and the broader cryptocurrency market.

Can Bitcoin Break Through $70K This Time?

Looking at the BTC/USD daily chart, the recent rebound is undeniable. Yesterday’s strong recovery has extended into today, with Bitcoin showcasing an impressive 2.5% intraday rise and successfully reclaiming the $67,000 level. Crucially, Bitcoin has bounced back from the 50-day EMA (Exponential Moving Average), reinforcing the bullish momentum.

The long-term trend for Bitcoin remains firmly bullish, with the price currently trading nearly 14% above the 200-day EMA. The immediate hurdle to overcome is around $68,000. If Bitcoin can successfully breach this level, the path towards $70,000 and beyond could become clearer.

However, it’s crucial to remain vigilant. A break below the recent support level of $63,000 would invalidate the current bullish scenario and could lead to further price retracement. Risk management remains key in these volatile markets.

Currently, the MACD (Moving Average Convergence Divergence) line and signal line are showing a divergence, which often suggests a continuation of the prevailing trend – in this case, the upward momentum.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.