Are Bitcoin whales signaling a massive bull run? Recent data reveals a significant accumulation of BTC by large holders, potentially driving prices higher. Let’s dive into the details and uncover what this means for the future of Bitcoin.

Whale Watching: A Deep Dive into Bitcoin Accumulation

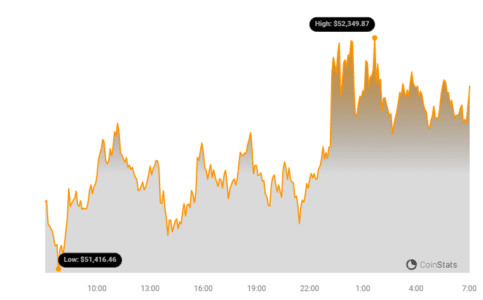

Bitcoin [BTC] has experienced impressive price growth recently, climbing from $38.5k on January 23rd to a peak of $52.8k on February 15th – a 37% surge in just 23 days. While BTC ETFs have contributed to this bullish trend, the actions of Bitcoin whales are also playing a crucial role.

Santiment data highlights a key trend: wallets holding 1,000 to 10,000 BTC have collectively increased their holdings by 248.9k Bitcoin in 2024 alone. That’s roughly $12.95 billion worth of BTC being snapped up by the big players.

What Does Whale Accumulation Mean for Bitcoin?

This accumulation indicates strong confidence among large investors in Bitcoin’s long-term potential. But how does it impact the market?

- Price Appreciation: Increased demand from whales can drive prices higher due to scarcity.

- Market Stability: Large holders can provide stability by holding through market volatility.

- Positive Sentiment: Whale activity can signal positive sentiment to other investors, encouraging further investment.

However, it’s not all sunshine and rainbows. Wallets holding 100 to 1,000 BTC have reduced their positions by 151.2k coins, valued at $7.89 billion. This suggests that some ‘sharks’ are taking profits, potentially anticipating a price correction.

See Also: Beware! Fraudulent Uniswap Airdrop Campaign Targeting DeFi Users, Here’s How To Stay Safe

Whales vs. Sharks: A Tale of Two Traders

The contrasting behavior between whales and sharks paints an interesting picture:

| Investor Type | Wallet Size | 2024 Activity | Potential Motivation |

|---|---|---|---|

| Whales | 1,000 – 10,000 BTC | Accumulated 248.9k BTC | Long-term bullish outlook |

| Sharks | 100 – 1,000 BTC | Dumped 151.2k BTC | Profit-taking, anticipating correction |

Adding to the narrative, the past five days have seen the highest volume of whale transactions (over $100k) since June 2022, reinforcing the idea that significant accumulation is underway.

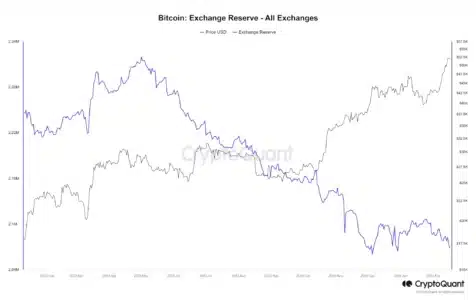

Exchange Reserves: Another Piece of the Puzzle

Analyzing Bitcoin exchange reserves from CryptoQuant reveals a downtrend over the past three weeks. Reserves have decreased from 2.106 million BTC to 2.068 million BTC between January 25th and the present. This decrease, combined with the Santiment data, strongly suggests that demand is outpacing supply, potentially driving prices even higher.

Potential Roadblocks: Stablecoin Supply Ratio

While the overall picture looks bullish, the stablecoin supply ratio has been steadily increasing over the past five months. This indicates a reduction in the buying power of stablecoins, which could introduce some bearish pressure on Bitcoin.

See Also: 90% Of Bitcoin HODLers in Profit As BTC Price Rises To $47K Amid Whale Accumulation

Conclusion: Navigating the Bitcoin Waters

Bitcoin’s recent price surge is supported by strong whale accumulation and decreasing exchange reserves. While some profit-taking and a rising stablecoin supply ratio suggest potential volatility, the overall trend points toward continued bullish momentum. Keep a close eye on the $52k resistance zone, as breaking through this level could signal further upward movement. As always, conduct thorough research and consult with a financial professional before making any investment decisions.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.