BlackRock’s Bitcoin ETF Options Launch with $1.9B in Trading Volume

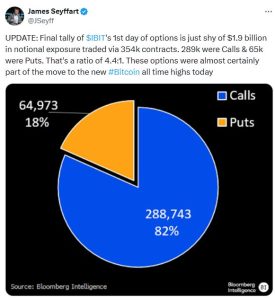

BlackRock’s iShares Bitcoin ETF (IBIT) made a stellar debut in the options market, recording $1.9 billion in notional trading volume on its launch day. According to Bloomberg ETF analyst James Seyffart, 354,000 contracts were traded, with a dominant share of call options, signaling strong bullish sentiment among investors. The launch is believed to have contributed to Bitcoin’s recent surge to new all-time highs.

Key Highlights of BlackRock’s Bitcoin ETF Options Launch

1. Trading Volume and Activity

- Total Trading Volume: $1.9 billion in notional exposure.

- Number of Contracts Traded: 354,000 contracts.

- Calls: 289,000 contracts (dominant with a 4.4:1 ratio over puts).

- Puts: 65,000 contracts.

2. Investor Sentiment

- The overwhelming preference for call options reflects bullish market sentiment, with investors expecting Bitcoin’s price to continue climbing.

- Options trading provided a new layer of market activity, attracting both institutional and retail investors.

Impact on Bitcoin’s Price Movement

The strong debut of BlackRock’s Bitcoin ETF options coincided with Bitcoin reaching new all-time highs.

Market Factors Driving Bitcoin’s Surge:

- Institutional Involvement:

- BlackRock’s participation has reinforced institutional confidence in Bitcoin as a mainstream asset.

- The high trading volume underscores growing adoption of Bitcoin financial products.

- Increased Liquidity:

- The launch of ETF options has added liquidity to the market, enabling more sophisticated trading strategies.

- Bullish Sentiment:

- With a dominant share of call options, investors anticipate further price gains for Bitcoin.

What Are Bitcoin ETF Options?

Bitcoin ETF options are derivative contracts that allow investors to speculate on the future price of Bitcoin through an ETF.

Key Features:

- Call Options: Provide the right to buy Bitcoin ETF shares at a predetermined price, reflecting bullish sentiment.

- Put Options: Provide the right to sell Bitcoin ETF shares at a specific price, used for bearish strategies or hedging.

The introduction of options expands the range of strategies available to investors, including hedging, speculative trading, and managing risk.

Significance of BlackRock’s ETF Options Launch

1. Boost to Bitcoin’s Legitimacy

BlackRock’s involvement continues to elevate Bitcoin’s reputation as an institutional-grade asset. The success of IBIT options trading reinforces Bitcoin’s integration into traditional financial markets.

2. Increased Market Accessibility

Options trading provides investors with flexible tools to manage exposure, hedge risks, or leverage positions, attracting a broader audience to Bitcoin investing.

3. Enhanced Market Liquidity

The high trading volume on launch day demonstrates the liquidity and demand for Bitcoin-based financial products, which can contribute to more stable price movements.

FAQs About BlackRock’s Bitcoin ETF Options

1. What is BlackRock’s iShares Bitcoin ETF (IBIT)?

IBIT is a spot Bitcoin ETF launched by BlackRock, allowing investors to gain exposure to Bitcoin without directly holding the cryptocurrency.

2. What are Bitcoin ETF options?

These are derivative contracts linked to Bitcoin ETFs, enabling investors to speculate on Bitcoin’s price movements or hedge their positions.

3. How much trading volume did IBIT options record on launch day?

BlackRock’s IBIT options saw $1.9 billion in notional exposure and 354,000 contracts traded on their first day.

4. What does the call-to-put ratio indicate?

A 4.4:1 call-to-put ratio reflects strong bullish sentiment, with most investors expecting Bitcoin’s price to rise.

5. How did the launch affect Bitcoin’s price?

The successful debut of IBIT options contributed to Bitcoin’s recent surge to new all-time highs by boosting market confidence.

Conclusion

The launch of BlackRock’s Bitcoin ETF options marks a milestone for Bitcoin’s integration into mainstream finance, with $1.9 billion in trading volume on the first day signaling robust investor interest. The dominance of call options highlights continued optimism for Bitcoin’s price trajectory, further fueled by institutional adoption. As the market for Bitcoin-based financial products grows, the stage is set for broader participation and innovation in cryptocurrency investing.

For more updates, explore our analysis on Bitcoin ETF Trends and Market Impact.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.