The crypto world moves fast, and sometimes, announcements can lead to more questions than answers. Recently, Hedera’s token (HBAR) experienced a wild ride, surging over 100% before plummeting after BlackRock clarified its position on a supposed partnership for tokenizing its funds. Let’s dive into what happened and what it means for the future of tokenization.

What Sparked the HBAR Frenzy?

It all started with an announcement by the HBAR Foundation, claiming that blockchain firms Archax and Ownera had tokenized BlackRock’s ICS U.S. Treasury Fund on the Hedera network. This news quickly spread like wildfire, generating massive excitement within the crypto community.

The announcement by the HBAR Foundation gained significant traction, accumulating over 2.9 million views and 3,200 reposts within a little over 36 hours. You can see the original announcement here.

BlackRock Sets the Record Straight

However, the excitement was short-lived. BlackRock issued a statement clarifying that they have no commercial relationship with Hedera and did not choose Hedera Hashgraph to tokenize any of its funds.

In their words, “BlackRock has no commercial relationship with Hedera nor has BlackRock selected Hedera to tokenize any BlackRock funds.” This clarification caused a significant correction in the market.

The HBAR Price Rollercoaster

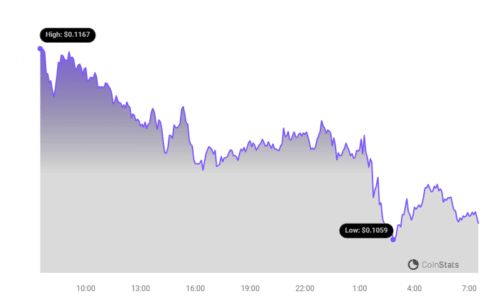

Following the initial announcement, the HBAR token skyrocketed, gaining 103% and soaring from $0.0880 to $0.1759. However, after BlackRock’s denial, HBAR experienced a sharp decline, dropping over 35% from $0.1746 to $0.1143.

So, What Actually Happened?

To understand the situation, it’s essential to consider the perspective of Archax, one of the firms involved in the tokenization effort. Archax CEO Graham Rodford explained that their clients were interested in investing in the BlackRock fund. To facilitate this, Archax established an account at BlackRock and tokenized shares of BlackRock’s money market fund on Hedera.

In essence, Archax independently chose to tokenize BlackRock’s fund shares on the Hedera network for their clients, without direct involvement or endorsement from BlackRock itself.

Key Takeaways for Crypto Investors

- Verify Information: Always double-check the source and validity of announcements before making investment decisions.

- Understand Partnerships: Distinguish between independent actions and official partnerships.

- Market Volatility: Be prepared for rapid price swings in the crypto market, especially in response to news events.

The Future of Tokenization

While this particular situation caused confusion, the broader trend of asset tokenization remains promising. Tokenization offers several potential benefits, including increased liquidity, fractional ownership, and greater accessibility to a wider range of investors.

Disclaimer

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.