- Asset management giant BlackRock has clarified that it has no commercial partnership with Hedera and did not choose Hedera Hashgraph to tokenize any of its funds.

Asset management giant BlackRock has clarified that it has no commercial relationship with Hedera and did not choose Hedera Hashgraph to tokenize any of its funds.

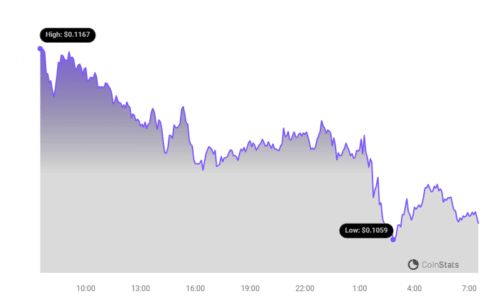

The statement comes after Hedera’s token (HBAR) experienced a significant rally of over 100% following an announcement by the HBAR Foundation claiming that blockchain firms Archax and Ownera had tokenized BlackRock’s ICS U.S. Treasury Fund on Hedera.

While some misinterpreted the announcement to suggest BlackRock’s active involvement in the tokenization effort, the asset management firm stated that “BlackRock has no commercial relationship with Hedera nor has BlackRock selected Hedera to tokenize any BlackRock funds.”

See Also: Polkadot’s New Storagehub Parachain Targets Improved Data Storage Efficiency

The HBAR Foundation’s announcement gained significant attention, accumulating over 2.9 million views and 3,200 reposts within a little over 36 hours.

Archax CEO Graham Rodford explained that Archax had clients interested in investing in the BlackRock fund, and they established an account at BlackRock to facilitate the process and tokenize shares of BlackRock’s money market fund on Hedera.

Following the news, the HBAR token declined by over 35% from $0.1746 to $0.1143. This came after HBAR gained 103% following the HBAR Foundation announcement, rising from $0.0880 to $0.1759.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN