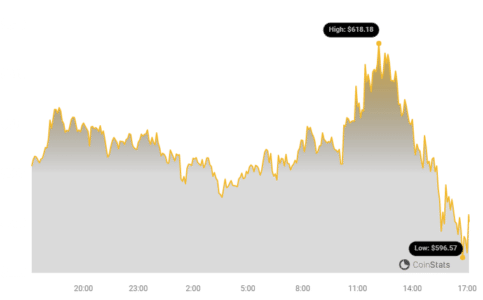

Cryptocurrency enthusiasts, buckle up! BNB, the token powering the Binance ecosystem, is showing serious signs of strength. After hovering around the $550 mark, BNB has decisively broken through the crucial $600 resistance. Could this be the start of a significant bull run, pushing BNB to new heights in 2024? Let’s dive into the charts and analyze what’s fueling this upward momentum and what we can expect next.

BNB Bulls in Charge: Reclaiming $600 and Beyond

After establishing a solid foundation above the $520 level, BNB initiated a fresh surge, mirroring the positive movements seen in market leaders like Bitcoin and Ethereum. This wasn’t just a minor blip; BNB decisively overcame the $550 and $565 resistance barriers, signaling strong bullish intent.

- Fresh Momentum: BNB’s price action indicates a strong upward trend, breaking free from the $550 zone.

- $600 Resistance Shattered: The bulls successfully pushed BNB past the significant $600 resistance level, opening the door for further gains.

- Trading Above Key Averages: Currently, BNB is comfortably trading above $580 and the 100 simple moving average on the 4-hour chart, reinforcing the bullish outlook.

- Bullish Trendline in Play: A key bullish trend line is forming on the 4-hour chart, providing support around $592, suggesting buying interest on dips.

- Eyes on $608-$610: A decisive break above the $608-$610 resistance zone could ignite further bullish momentum, potentially propelling BNB even higher.

The bulls demonstrated their strength by driving the price above the $580 pivot level, conquering the 61.8% Fib retracement level from the recent downward wave (from $630 high to $512 low). This move signifies a strong recovery and potential for continued upward trajectory.

Adding to the bullish narrative, BNB is maintaining its position above the 76.4% Fib retracement level of the same downward wave, consolidating its gains. The formation of a key bullish trend line with support at $592 on the 4-hour chart further solidifies this positive outlook.

See Also: Cardano (ADA) Price Analysis: Bulls Aim Steady Increase

Looking ahead, the immediate hurdle lies near the $608 resistance. Beyond that, the $630 level looms as the next significant resistance. Should BNB decisively overcome the $630 zone, we could witness an accelerated climb, potentially testing $650 and even $680 in the near term. Ambitious targets of $720 could be on the horizon if the bullish momentum persists.

What Happens if the Bulls Lose Steam? Key Support Levels to Watch

While the current outlook is optimistic, it’s crucial to consider potential pullbacks. If BNB struggles to breach the $608 resistance, a downside correction could be in the cards. So, where are the critical support levels to watch if the tide turns?

- Initial Support: The $592 level and the bullish trend line provide the first layer of support. A bounce here would reaffirm bullish control.

- Major Support Zone: The $585 level represents the next significant support zone, followed by the crucial $570 mark.

- Critical Breakdown Level: A break below $570 could trigger a deeper correction towards the $550 support, and potentially even $532 in a more bearish scenario.

Technical Indicators Paint a Bullish Picture

Let’s peek at the technical indicators to gauge the underlying strength of this BNB rally:

- 4-Hour MACD: The Moving Average Convergence Divergence (MACD) is gaining momentum in the bullish territory, suggesting increasing buying pressure.

- 4-Hour RSI: The Relative Strength Index (RSI) is currently above 50, indicating that BNB is experiencing positive momentum without being overbought.

|

Major Support Levels |

$592, $585, and $570 |

|

Major Resistance Levels |

$608, $630, and $650 |

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.