Buckle up, crypto enthusiasts! BNB, the token powering the Binance ecosystem, has been on an absolute tear recently. We’re talking a whopping 62% price surge in just 30 days! Hitting highs of $485, BNB has cemented its place as the third-largest cryptocurrency, excluding stablecoins. But what’s fueling this impressive rally, and more importantly, can it last? Let’s dive into the factors driving BNB’s bullish run and explore what the future might hold.

BNB’s Rocketing Price: Key Highlights

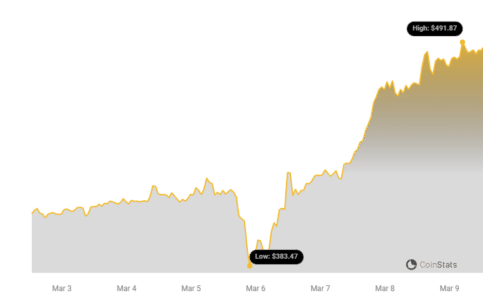

- Massive Price Jump: BNB’s price exploded by 62% in just one month.

- Hitting New Peaks: It reached a two-year high of $489.50 on March 8th, currently hovering around $485.

- Top 3 Crypto: This surge propelled BNB to become the third-largest cryptocurrency by market cap (excluding stablecoins).

- Market Momentum: The broader crypto market gains are definitely playing a role in BNB’s ascent.

- Resilience Amidst Challenges: BNB’s rally is particularly noteworthy considering the regulatory storms Binance has weathered.

This impressive climb begs the question: Is this just another flash in the pan, or is there real substance behind BNB’s surge?

Binance Coin (BNB) has indeed experienced a significant surge in price, climbing by 62% over the past 30 days.

After reaching its highest level in two years on March 8, hitting $489.50, BNB’s price now stands at $485. This surge solidifies BNB’s position as the third-largest cryptocurrency by market capitalization, excluding stablecoins.

Market Dynamics Fueling BNB’s Position

The recent surge in BNB’s price is undeniably linked to the overall positive momentum in the cryptocurrency market. As Bitcoin and other major cryptos have rallied, so has BNB, riding the wave of renewed investor enthusiasm.

Despite lingering doubts some investors might have had about BNB’s capacity to reach these levels again, its market position has undeniably become stronger. This price action signals growing market confidence in BNB’s underlying potential, even with the backdrop of ongoing uncertainties surrounding the Binance ecosystem.

See Also: Bitcoin Price Hits $70K And Retreat, FLOKI Skyrockets 111% Weekly

Navigating Regulatory Waters: Binance’s Challenges and Resilience

Let’s address the elephant in the room: the regulatory challenges. Binance, and by extension BNB, haven’t had a smooth ride. Remember Changpeng “CZ” Zhao, Binance’s founder and former CEO? He entered a plea deal with the U.S. federal court in November 2023, stemming from allegations related to illicit activities on the exchange. CZ stepped down as CEO, understandably raising eyebrows and casting shadows over BNB’s future.

Adding to the complexity, Binance also reached a settlement with the U.S. Commodity Futures Trading Commission (CFTC) in December 2023. This settlement wasn’t just a slap on the wrist; it mandated significant changes, including the implementation of a formal corporate governance structure with compliance and audit committees. CZ himself is awaiting sentencing and is currently in the U.S.

However, these settlements, while significant, might have inadvertently cleared some of the regulatory fog surrounding Binance and BNB. By addressing these issues head-on, Binance may be paving a path towards greater regulatory clarity, which could be interpreted positively by the market.

Exchange Performance in the Spotlight: Binance vs. Competitors

The recent crypto market surge has been a stress test for exchanges. While trading volumes exploded, some platforms struggled to keep up. Coinbase, for example, faced criticism for outages, impacting its ability to provide smooth trading during peak activity. This is a critical point – liquidity and reliability are paramount during market rallies.

Interestingly, Binance reportedly sailed through the surge without major disruptions. This robust performance is a significant advantage. BNB’s success is partly rooted in Binance’s powerful trading engine and server infrastructure, which appears to outperform some competitors like Coinbase. This reliability incentivizes users to stick with Binance, directly benefiting BNB’s value and market performance. Think about it: if you’re actively trading, you’ll naturally gravitate towards the platform that’s consistently online and functioning smoothly, especially during periods of high volatility.

BNB Chain Activity: Is the Network Thriving?

Beyond exchange performance, BNB’s utility is deeply connected to the BNB Chain. So, how is the network doing? Let’s take a look at the data.

While smart contract deposits on the BNB Chain have seen a slight decrease in the past month, DApp (Decentralized Application) volume has impressively surged by 41%! This surge propels BNB Chain to the third-place ranking in overall DApp volume. Furthermore, the number of active addresses interacting with BNB Chain’s DApps has reached a remarkable 5.6 million. These are strong indicators of a healthy and active network.

See Also: The Price Of Kadena (KDA) Increased As Binance Showed Support

The robust DApp activity on BNB Chain suggests that the recent BNB price rally isn’t just hype; it’s grounded in real network usage and demand. However, a deeper dive into the quality and sustainability of this network activity, especially in the post-CZ era, is warranted for a comprehensive assessment.

Looking Ahead: Can BNB Sustain the Momentum?

Initial data paints a bullish picture for BNB. The combination of broader market recovery, Binance’s resilient exchange performance, and thriving BNB Chain activity provides a solid foundation for continued growth. While CZ’s trial and sentencing remain a factor to watch, the market seems to be focusing on the positive aspects: Binance’s operational strength and the expanding BNB Chain ecosystem. Could BNB reclaim the $500 level and potentially push even higher? It’s certainly looking like a strong possibility.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.