The FTX saga continues to unfold, with the latest chapter revealing a significant shift in strategy. Forget the relaunch! FTX has officially dropped its plans to revive the exchange, setting its sights on a new, arguably more crucial, goal: fully repaying its customers. This news sent ripples through the crypto market, impacting the FTT token and raising questions about the future of the platform’s creditors. Let’s dive into the details.

FTX Ditches Relaunch: Why?

Initially, there was hope for a phoenix-like rebirth of FTX as FTX.com, catering to international users. A draft creditor-repayment plan was even proposed, aiming for cash settlements. However, the complexities of rebuilding trust and securing sufficient capital proved too challenging. According to court filings, despite negotiations with potential investors, the financial commitment required to resurrect the exchange was simply too high. As FTX attorney Andy Dietderich put it, the exchange was an “irresponsible sham” and the risks of rebuilding from the ground up were insurmountable.

Repaying Customer Funds: The New Priority

With the relaunch off the table, FTX is now laser-focused on liquidating assets to reimburse its customers. The company has reportedly recovered over $7 billion in assets and aims for full repayment. This is welcome news for those who had funds locked on the platform when it collapsed in 2022. Even government regulators with substantial claims ($9 billion) are willing to wait to ensure customers are prioritized.

See Also: Annoyed FTX Customers Ask Judge To Block The Exchange’s Valuation Plan

FTT Token Takes a Hit

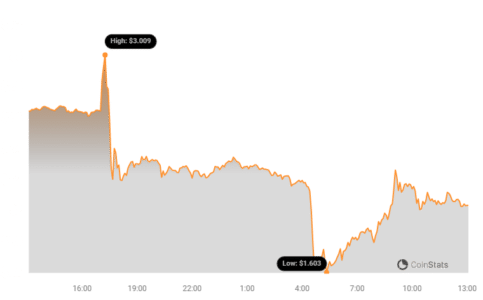

The news of the abandoned relaunch sent the FTT token into a tailspin. The price plummeted by roughly 35%, from $2.04 to $1.6, before recovering slightly.

Analytics platform Coinstats highlighted unusual activity, noting that “whales are playing the game here, based on the news that ‘the defunct crypto exchange won’t be restarted.’” This suggests that large holders of FTT tokens reacted swiftly to the announcement, contributing to the price drop.

https://twitter.com/spotonchain/status/1752915263887147472

What Does This Mean for FTX Customers?

The focus on repayment is undoubtedly a positive development for FTX customers. While the complete reimbursement remains the goal, several factors could influence the final outcome:

- Asset Recovery: The success of the repayment plan hinges on FTX’s ability to recover and liquidate assets effectively.

- Legal Challenges: Ongoing legal battles and claims could potentially impact the distribution of funds.

- Market Volatility: Fluctuations in the crypto market could affect the value of FTX’s holdings and, consequently, the amount available for repayment.

Key Takeaways

- FTX has abandoned plans to relaunch its exchange.

- The company is now prioritizing the full repayment of customer funds.

- Over $7 billion in assets have been recovered so far.

- The FTT token experienced a significant price drop following the announcement.

In Conclusion

The FTX saga is far from over, but the shift in focus towards customer repayment is a significant step. While challenges remain, the commitment to reimburse those affected by the exchange’s collapse offers a glimmer of hope in a complex and often disheartening situation. The future of FTT token remains uncertain, heavily influenced by market sentiment and the actions of large holders. For now, all eyes are on FTX as it navigates the liquidation process and strives to fulfill its promise to its customers.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.