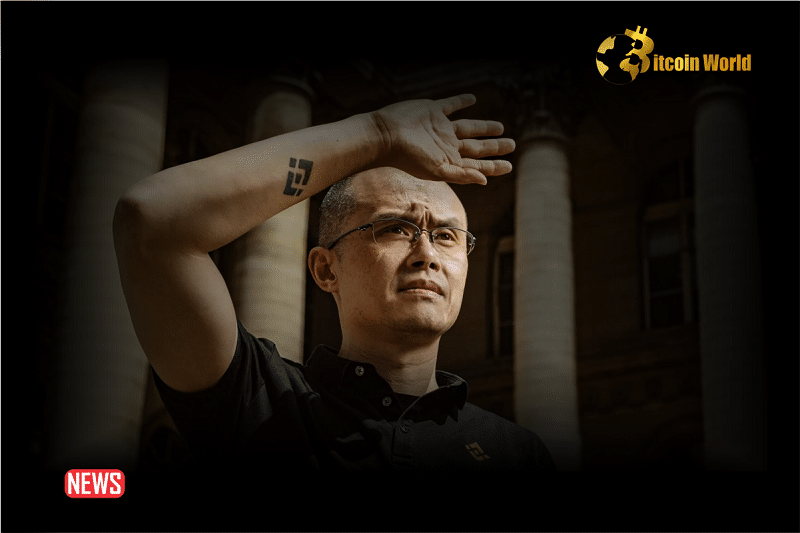

Hold onto your hats, crypto enthusiasts! The digital asset world is buzzing with some seismic news. According to a bombshell report from Forbes, Changpeng Zhao, the iconic CEO and founder of Binance, the world’s largest cryptocurrency exchange, is reportedly preparing to step down from his leadership role. Yes, you read that right – CZ, the face of Binance, might be making an exit.

Is CZ Really Leaving Binance? The Million-Dollar Question

This isn’t just another rumor swirling around the crypto sphere. Reputable sources, including Forbes, are indicating that CZ’s potential resignation is linked to a massive $4 billion settlement being negotiated between Binance and the U.S. Department of Justice (DOJ). Let’s unpack what we know so far:

- The Source: The initial report comes from Forbes, citing a source ‘familiar with the matter.’ This suggests the information is coming from someone with inside knowledge of the ongoing discussions.

- The Reason: CZ’s potential departure is directly tied to investigations in the United States. It seems the regulatory spotlight on Binance is intensifying.

- The Settlement: A staggering $4 billion settlement is reportedly on the table between Binance and the DOJ. This is a monumental figure, highlighting the seriousness of the issues at hand.

- Agencies Involved: The Department of Justice and the Commodity Futures Trading Commission (CFTC) are reportedly party to this agreement. However, the Securities and Exchange Commission (SEC) apparently disagrees with the proposed deal, adding another layer of complexity.

This is developing news, and details are still emerging. But one thing is clear: this is a pivotal moment for Binance and the entire cryptocurrency industry.

Why Now? Diving Deeper into the US Investigations

While the specifics of the US investigations haven’t been fully disclosed, it’s no secret that Binance has been under increased regulatory scrutiny in various jurisdictions globally, including the United States. Here’s what might be fueling these investigations:

- Compliance Concerns: Regulatory bodies worldwide are tightening the screws on crypto exchanges to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. Binance, due to its global scale and rapid growth, has likely faced challenges in meeting these evolving standards across different regions.

- Operational Transparency: Regulators are pushing for greater transparency in the operations of crypto exchanges. This includes aspects like trading practices, fund security, and market surveillance. Binance, being a decentralized and globally distributed exchange, might face hurdles in demonstrating complete transparency to the satisfaction of all regulators.

- Market Manipulation Allegations: Like many crypto exchanges, Binance has faced (and denied) allegations of market manipulation on its platform. Investigations could be looking into whether Binance has adequate measures in place to prevent and detect such activities.

- Securities Law Scrutiny: A key point of contention in crypto regulation is whether certain digital assets should be classified as securities. The SEC’s disagreement with the reported settlement suggests that securities law violations might be a significant aspect of the investigations.

It’s important to remember that these are potential reasons based on the general regulatory landscape. The exact nature of the US investigations and the settlement terms will likely become clearer as more information surfaces.

CZ’s Legacy: From Code to Crypto Empire

Changpeng Zhao, or CZ as he’s widely known, is undoubtedly one of the most influential figures in the cryptocurrency world. His journey from a coder to the CEO of the world’s largest crypto exchange is nothing short of remarkable. Let’s take a moment to appreciate his impact:

| Aspect | CZ’s Impact |

| Binance’s Creation & Growth | CZ founded Binance in 2017, and within months, it skyrocketed to become the world’s leading crypto exchange by trading volume. His vision and leadership were instrumental in this explosive growth. |

| Innovation in Crypto Services | Binance, under CZ’s guidance, has been at the forefront of innovation, introducing a wide range of crypto products and services, including spot trading, futures, staking, NFTs, and more. |

| Global Crypto Adoption | Binance’s global reach has significantly contributed to the broader adoption of cryptocurrencies worldwide. It has provided millions of users with access to the digital asset market. |

| Industry Influence | CZ’s opinions and actions carry significant weight in the crypto industry. He’s been a vocal advocate for crypto and blockchain technology, shaping industry narratives and discussions. |

Even if CZ steps down, his contribution to the crypto world is undeniable. He has built a crypto empire that has transformed the landscape of digital finance.

What Does This Mean for Binance and the Crypto Market?

The potential resignation of CZ and a $4 billion settlement are undoubtedly major events that could have ripple effects across Binance and the broader crypto market. Let’s consider some potential implications:

- Binance’s Future Leadership: Who will take the helm at Binance if CZ steps down? The choice of successor will be crucial. The market will be watching closely to see if Binance appoints another visionary leader who can maintain its growth trajectory and navigate the evolving regulatory environment.

- Regulatory Compliance Overhaul: The settlement will likely necessitate significant changes in Binance’s compliance framework. We can expect Binance to invest heavily in strengthening its AML, KYC, and regulatory compliance measures to appease authorities and ensure future operational stability.

- Market Confidence: News of CZ’s potential resignation and a large settlement could initially shake market confidence in Binance. However, how Binance handles this transition and demonstrates its commitment to regulatory compliance will be key to regaining and maintaining user trust.

- Broader Regulatory Impact: This event could serve as a significant precedent for crypto regulation globally. It might signal a more aggressive stance from regulators towards crypto exchanges and push for stricter compliance standards across the industry.

- Potential Price Volatility: In the short term, we might see some volatility in the prices of cryptocurrencies, particularly BNB, Binance’s native token. Market reactions will depend on the further details of the settlement and Binance’s communication strategy.

What’s Next? Keeping a Close Watch

This is a developing story, and the crypto world is waiting with bated breath for more information. Here’s what we should be looking out for:

- Official Confirmation: We need official confirmation from Binance and CZ regarding the resignation and settlement. So far, the news is based on reports.

- Settlement Details: The specifics of the $4 billion settlement agreement will be crucial. What are the exact terms? What concessions has Binance made?

- Successor Announcement: If CZ steps down, the announcement of his successor will be a major event. Who will Binance choose to lead the exchange into the future?

- Regulatory Response: How will regulators worldwide react to this development? Will it trigger further investigations or stricter regulations for other crypto exchanges?

- Market Reaction: Monitor the price movements of BNB and other cryptocurrencies in the coming days and weeks to gauge the market’s response to this news.

The coming days will be critical for Binance and the crypto industry as a whole. This situation underscores the increasing importance of regulatory compliance in the rapidly evolving world of digital assets.

In Conclusion: A Turning Point for Binance and Crypto?

The potential departure of Changpeng Zhao as CEO of Binance and the looming $4 billion settlement mark a potentially transformative moment for both Binance and the broader cryptocurrency landscape. While CZ’s leadership has been instrumental in Binance’s meteoric rise, the exchange now faces significant regulatory headwinds. How Binance navigates this transition will not only determine its own future but also set precedents for the relationship between crypto exchanges and global regulators.

Stay tuned as we continue to follow this developing story and bring you the latest updates. The crypto world never stands still, and this latest development is a stark reminder of the dynamic and often unpredictable nature of this exciting industry.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Read Also: Kyle Vogt Resigns As CEO Of Cruise Amidst Regulatory Troubles

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.