Just when everyone thought Bitcoin was headed to the moon with the shiny new Bitcoin ETFs, the market took an unexpected turn. Instead of soaring, Bitcoin’s price took a nosedive shortly after the much-anticipated ETF approval. Confused? You’re not alone. Let’s dive into why this happened and what it means for the crypto king.

The ETF Effect: Buy the Rumor, Sell the News?

For months, the crypto community buzzed with anticipation for a spot Bitcoin ETF in the US. The expectation was that these ETFs would open the floodgates for institutional money, driving Bitcoin’s price to new heights. And guess what? The SEC finally gave the green light, approving the first US spot Bitcoin ETFs. Cue the celebrations… or so we thought.

Instead of a sustained rally, Bitcoin experienced a significant price correction. Let’s break down the timeline:

- ETF Approval (Wednesday): The SEC approves spot Bitcoin ETFs, a landmark moment for crypto.

- Initial Price Surge: Bitcoin price briefly hits a 21-month high, nearing $49,000 as ETFs start trading on Thursday.

- Sharp Reversal: Almost immediately after the peak, Bitcoin’s price begins to tumble.

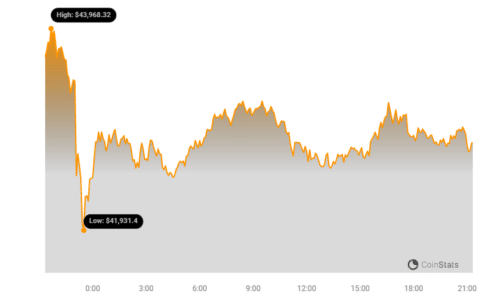

- Massive Dump (Past 24 Hours): The sell-off intensifies, with Bitcoin plummeting to under $41,600 – a stark contrast to the pre-ETF hype.

- 7% Drop: In the last 24 hours alone, Bitcoin has shed 7% of its value.

This price action strongly suggests a classic “sell the news” event. Think of it like this: Investors bought Bitcoin leading up to the ETF approval, betting on a price surge. Once the news became official and ETFs started trading, many of these investors took profits, triggering a significant sell-off.

See Also: Vanguard Have No Plans To Allow Spot Bitcoin ETF Trading On Its Platform

BTC’s Wild Ride: Volatility is Back in Town

If you thought crypto volatility was a thing of the past, think again! The past week has been a rollercoaster for Bitcoin, even before the ETF launch. Let’s recap the drama:

- SEC Hiccups: Before the official approval, the SEC’s journey was bumpy, to say the least. Fake news about approval, deleted and reposted announcements, and even Chairman Gary Gensler’s cautious statements added to the uncertainty.

- Price Swings: All this drama fueled intense volatility. Bitcoin experienced rapid and significant price swings.

- ETF Launch Volatility: As ETFs launched, Bitcoin initially spiked to over $49,000, only to crash by $3,000 within minutes. Talk about whiplash!

- Further Decline: After a brief period of calm during Asian and European trading hours on Friday, the US trading session brought another wave of selling, pushing Bitcoin below $41,600.

Currently, Bitcoin is trying to regain its footing, hovering around $43,000. Its market capitalization has decreased to $843 billion, and its dominance in the crypto market has also slightly dropped to 50% from over 53% earlier in the week.

See Also: Robinhood Lists All 11 Spot Bitcoin ETFs On Trading App

Altcoins Feeling the Heat

Bitcoin’s price drop has dragged down the broader crypto market. While not all altcoins have suffered equally, most are currently in the red. Ethereum (ETH), for instance, has seen a more moderate decline of around 2.6%, trading at $2,550.

Other major altcoins like Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), and Toncoin (TON) have also experienced declines, but less than 5%.

However, some altcoins have been hit harder, including Solana (SOL), Cardano (ADA), Avalanche (AVAX), Polygon (MATIC), Bitcoin Cash (BCH), Polkadot (DOT), and Cosmos (ATOM). These have slumped by more than 5%, with Bitcoin Cash taking the biggest hit, dropping by as much as 11%.

Overall, the crypto market capitalization has shrunk by a significant $80 billion in a single day, falling below $1.7 trillion, according to CoinMarketCap.

What’s Next? Is This Just a Dip, or Something More?

The Bitcoin ETF launch was a major milestone, but it’s clear that it’s not a magic bullet for instant price gains. The “sell the news” phenomenon is a well-known market dynamic, and it seems to be playing out in the crypto space now.

Key Takeaways:

- Market Correction: The price drop can be seen as a healthy market correction after a period of significant hype and anticipation.

- Volatility Remains: Crypto markets are still volatile. Expect more price swings, even with institutional adoption increasing.

- Long-Term Outlook: The long-term impact of Bitcoin ETFs is still unfolding. Increased accessibility for institutional investors could still be a positive factor in the long run.

- Altcoin Impact: Bitcoin’s price action heavily influences the altcoin market. Keep an eye on BTC’s recovery for clues about the broader market.

For now, the dust is still settling. Whether this is just a temporary dip or the start of a larger correction remains to be seen. One thing is certain: the crypto market continues to keep us on our toes!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.