Buckle up, crypto enthusiasts! The Bitcoin rollercoaster just took another dramatic dip. After a thrilling climb fueled by spot Bitcoin ETF anticipation, the market experienced a sharp downturn. What triggered this sudden shift? A new report from crypto financial services firm Matrixport suggests the U.S. Securities and Exchange Commission (SEC) is likely to reject all spot Bitcoin ETF proposals this January. Let’s dive into what happened, why it matters, and what could be next for Bitcoin.

Why Did Bitcoin’s Price Crash? The Matrixport Effect

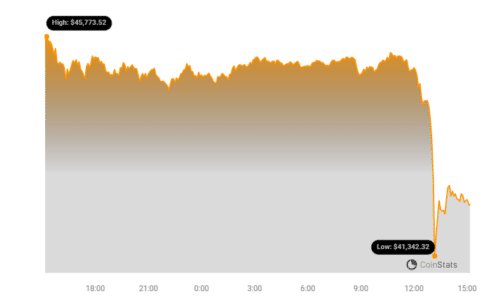

On Wednesday, Bitcoin experienced a significant drop, plunging over 5.5%. This wasn’t just another day in the volatile crypto market; it was a direct reaction to Matrixport’s research report. The report cast doubt on the widely anticipated approval of spot Bitcoin ETFs, sending shockwaves through the crypto sphere.

- Matrixport’s report suggested the SEC is poised to reject all spot Bitcoin ETF proposals in January, contrary to previous widespread optimism.

- This news triggered a rapid Bitcoin price crash, with a 6.5% drop in just 20 minutes, plummeting from $44,400 to $41,500.

As you can see in the chart below, the impact was immediate and significant:

The report further indicated that ETF approval might be delayed until Q2 2024 at the earliest, pushing Bitcoin down to around $42,500 in the following 24 hours. This highlights the immense influence of ETF expectations on Bitcoin’s price trajectory.

See Also: Fidelity and Galaxy Charge 0.39% Fees To Shareholders Of Its Spot BTC ETFs

Matrixport’s Bearish Stance: Why Rejection is Predicted?

Matrixport’s report, which triggered the market downturn, outlined specific reasons for their pessimistic outlook on January ETF approvals. Despite recent updates to spot BTC ETF applications from several firms, Matrixport believes these applications still “fall short of a critical requirement that must be met before the SEC approves.”

While the exact nature of these unmet requirements remains unspecified in the public report, Matrixport suggests they might be addressed by Q2 2024. However, their core message is clear: don’t expect a spot Bitcoin ETF to get the green light this month.

What Happens if the SEC Says ‘No’ to Spot ETFs?

Matrixport paints a potentially bleak picture for Bitcoin’s price if the SEC rejects the spot ETF applications. They foresee a scenario of “cascading liquidations.” Here’s the breakdown:

- Unwinding Long Positions: A significant $5.1 billion in additional perpetual long Bitcoin futures is expected to be unwound if rejection occurs.

- Price Plunge: This unwinding could trigger a sharp 20% downturn in Bitcoin’s price.

- Target Price Range: Bitcoin could potentially retreat to the $36,000 – $38,000 range.

However, it’s not all doom and gloom according to Matrixport. Even with a potential ETF rejection, they anticipate Bitcoin ending 2024 at a higher value than it started. Why? Because history suggests US election years and Bitcoin halving events tend to be bullish catalysts for the cryptocurrency.

See Also: Bitcoin Rallies Past $45,000 Level As Spot BTC ETF Deadline Nears

Bitcoin: A Narrative-Driven Asset

This recent price dip serves as a stark reminder of just how much narratives drive the Bitcoin market. Consider the preceding months: Bitcoin enjoyed a nearly 70% surge. While broader economic factors and hopes for a less hawkish Federal Reserve contributed, the dominant force was the growing belief in imminent spot ETF approval.

Now, Matrixport’s report has flipped the script, demonstrating the immediate and powerful negative impact a narrative shift can have. Will Clemente, founder of Reflexivity Research, highlighted the report’s dramatic effect, noting a wipeout of over $1 billion in open interest (OI) for Bitcoin futures contracts in a single candlestick. Crypto investor Scott Melker further pointed out approximately $500 million in liquidations in under an hour, with 95% being long positions.

This isn’t the first time we’ve seen narrative-driven volatility. Remember last year’s brief surge to $30,000 on a false spot ETF approval rumor on X (formerly Twitter)? It underscores a crucial point: Bitcoin’s price is heavily influenced by market sentiment and expectations, especially surrounding major regulatory events like spot ETF decisions.

Key Takeaways and What to Watch For

- Spot ETF Hopes are Fragile: The anticipation of a spot Bitcoin ETF has been a major price driver, but its approval is far from guaranteed and subject to significant speculation and potential delays.

- Market Sentiment is Powerful: Bitcoin’s price reacts sharply to shifts in market narrative, as evidenced by both the recent crash and past events.

- Volatility is Inherent: Expect continued price swings as the market grapples with ETF uncertainty and regulatory developments.

- Monitor SEC Announcements: Keep a close eye on official statements and deadlines from the SEC regarding spot Bitcoin ETF applications.

- Stay Informed: Follow reputable crypto news sources and analysts to stay ahead of market-moving narratives.

In conclusion, the Matrixport report has injected a dose of reality into the Bitcoin market, reminding us that spot ETF approval is not a done deal. While short-term price volatility may persist, the long-term trajectory of Bitcoin will likely depend on a multitude of factors, including regulatory clarity, macroeconomic conditions, and continued adoption. Stay tuned, and prepare for more twists and turns on the Bitcoin journey!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.