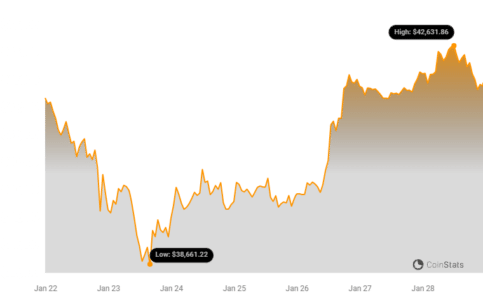

Hold onto your hats, crypto enthusiasts! Bitcoin is showing its resilience once again, bouncing back above the $42,000 mark after a dip below $39,000 earlier this week. Just when some were predicting further drops, BTC is proving its volatility can work both ways. But that’s not all that’s catching the eye of market observers. A fascinating trend is unfolding beneath the surface – Bitcoin accumulation wallets are surging to levels not seen in five years!

Bitcoin’s Price Rebound: A Sign of Strength?

After experiencing some downward pressure, Bitcoin’s recent price recovery is definitely welcome news for bulls. Climbing back above $42,000 suggests a level of underlying support and renewed buying interest. But what’s truly intriguing is happening in the background.

The Rise of the Bitcoin Accumulation Wallets: What Does It Mean?

Despite the price fluctuations, something significant is happening: Bitcoin accumulation wallets are on the rise. These wallets, typically associated with long-term investors who are ‘HODLing’ (holding on for dear life) rather than actively trading, are now collectively holding a staggering amount of Bitcoin.

According to Ki Young Ju, CEO of CryptoQuant, these accumulation wallets now hold a massive 1.7 million BTC. At current prices, this hoard is worth approximately $68 billion! This surge in accumulation is happening even amidst price dips, indicating a strong belief in Bitcoin’s long-term potential.

Bitcoin accumulation wallets hit a 5-year high, holding 1.7M $BTC ($68B).

Despite negative price momentum, investors continue to accumulate $BTC, signaling strong conviction.

Link -> https://t.co/5fWKGqdGZ9 pic.twitter.com/a60T5VOSms

— Ki Young Ju (@ki_young_ju) January 25, 2024

Why is Bitcoin Accumulation on the Rise?

Several factors could be contributing to this accumulation trend:

- Long-Term Investment Thesis: Many investors view Bitcoin as a long-term store of value, a hedge against inflation, and a crucial part of a diversified portfolio. Price dips are seen as buying opportunities to increase their holdings at a discount.

- Confidence in Future Growth: Despite short-term volatility, the fundamental belief in Bitcoin’s potential for future growth remains strong. Events like the upcoming Bitcoin halving in April often fuel bullish sentiment.

- Institutional Adoption: While not explicitly stated in the provided content, growing institutional interest and adoption of Bitcoin could be playing a role in larger accumulation trends.

Bitcoin Accumulation Wallets: Key Takeaways

Let’s break down the significance of this trend:

- Strong Investor Confidence: The accumulation trend, even during price dips, clearly signals strong investor confidence in Bitcoin’s future.

- Potential Supply Squeeze: As more Bitcoin moves into accumulation wallets and is taken out of active circulation, it could lead to a supply squeeze. Reduced supply with sustained or increased demand can potentially drive prices higher.

- Long-Term Holding Mentality: The rise of accumulation wallets reinforces the narrative of Bitcoin as a long-term investment rather than just a speculative trading asset.

- 5-Year Peak: Reaching a 5-year peak in accumulation wallets highlights the strength and longevity of this trend, suggesting it’s not just a short-term phenomenon.

Bitcoin inflows to accumulation addresses just reached a 5-year high.

This includes Coinbase Custody. https://t.co/5fWKGqdGZ9 pic.twitter.com/pLw8pQtc69

— Ki Young Ju (@ki_young_ju) January 25, 2024

Whales and Sharks Selling, But Accumulation Persists

The article mentions that recent downward pressure on Bitcoin was partly due to selling activity from large holders, often referred to as ‘sharks’ and ‘whales’. These entities sometimes take profits, contributing to market volatility. However, the continued and even increased accumulation by other investors suggests that this selling pressure might be temporary and is being offset by strong buying interest from those with a longer-term perspective.

Active Bitcoin Addresses on the Rise

Adding to the positive signals, the number of active Bitcoin addresses has also surpassed 1 million. This indicates growing user engagement and adoption of Bitcoin for transactions and other purposes. Increased network activity is generally a healthy sign for any cryptocurrency.

See Also: Bitcoin (BTC) Will Continue To Drop In Price: Arthur Hayes

Looking Ahead: Is This a Bullish Sign?

The combination of Bitcoin’s price recovery, the surge in accumulation wallets to a 5-year high, and the increasing number of active addresses paints an interesting picture. While market volatility is inherent in crypto, these factors suggest a potentially bullish underlying sentiment. The anticipation of the Bitcoin halving in April could further fuel positive price action.

In Conclusion: Bitcoin’s journey is never a straight line. While price dips and corrections are part of the game, the increasing accumulation of Bitcoin in long-term holding wallets suggests a strong and growing conviction in its future. As we move closer to the halving and witness continued network growth, it will be fascinating to see if this accumulation trend translates into sustained upward price momentum.

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.