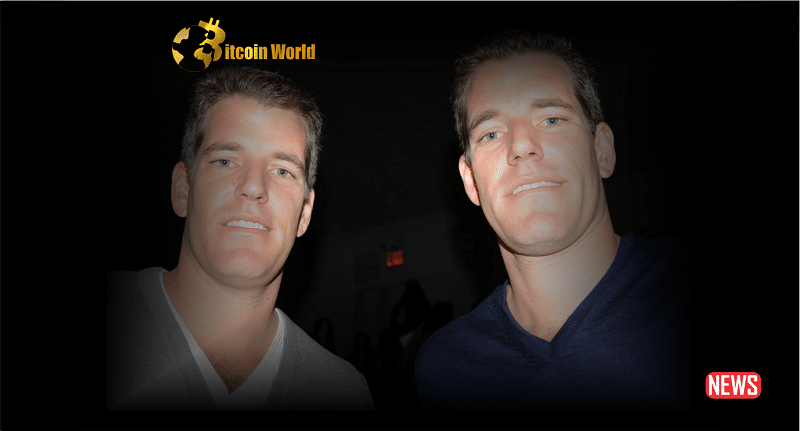

The recent turmoil in the banking sector has sparked heated debates, and cryptocurrency exchange Gemini’s co-founder, Cameron Winklevoss, is adding fuel to the fire. He’s accusing US regulators of playing favorites, suggesting that First Republic Bank is being treated with kid gloves compared to how a hypothetical ‘crypto bank’ in the same situation would have been handled. Is he right? Let’s dive into the details and explore the unfolding situation.

A Tale of Two Banking Worlds: Crypto vs. Traditional?

Winklevoss didn’t mince words, stating that if First Republic Bank operated within the cryptocurrency space, it would have faced swift and decisive action from regulators. This accusation comes amidst the backdrop of the recent collapses of Silvergate Bank and Silicon Valley Bank, events that sent shockwaves through the financial world. Interestingly, First Republic Bank began experiencing its own financial pressures around the same time. This raises a crucial question: are regulators applying different rules to different players?

What Sparked Winklevoss’ Outburst?

Several factors seem to have contributed to Winklevoss’ strong stance:

- The Closure of Crypto-Friendly Banks: The swift actions taken against Silvergate and Silicon Valley Bank, both known for their involvement with cryptocurrency companies, left many in the crypto industry feeling targeted.

- First Republic’s Struggles: First Republic Bank has been facing significant challenges, including a massive drop in deposits. Yet, instead of immediate receivership, efforts are being made to find a private sector solution.

- Allegations of Concerted Action: Adding to the tension, Republican members of the House Financial Services Committee have raised concerns about potential coordinated efforts against crypto businesses in the US.

First Republic’s Predicament: A Timeline of Trouble

To understand the situation better, let’s look at the timeline of events surrounding First Republic Bank:

- Early Signs of Trouble: Around the time Silvergate and Silicon Valley Bank faced regulatory action, First Republic started experiencing balance sheet issues.

- Seeking Solutions: Unlike the immediate government intervention in the cases of Silvergate and Silicon Valley Bank, advisors for First Republic are reportedly seeking additional financial aid from major US banks. These banks had already provided over $30 billion in support.

- Avoiding Receivership: The goal is to keep the bank operational through a private market solution, avoiding government receivership – the fate of Silvergate and Silicon Valley Bank.

- Deposit Drain: On April 23rd, First Republic revealed a staggering $100 billion+ decrease in deposits during its first-quarter earnings call, signaling deepening financial woes.

- Strategic Options: The bank announced it was exploring strategic options to improve its financial standing.

- Stock Plunge: Reflecting investor anxiety, First Republic Bank shares plummeted over 64% since the deposit disclosure.

The Role of Regulators: Fair Play or Double Standards?

The core of Winklevoss’ argument lies in the perception of unfair treatment. Why the different approaches? Here are some potential perspectives:

| Perspective | Explanation |

|---|---|

| Double Standard (Winklevoss’ View) | Regulators are unfairly targeting the cryptocurrency industry, applying stricter rules and quicker action compared to traditional banks. |

| Systemic Risk | Traditional banks like First Republic may be deemed systemically important, meaning their failure could have wider repercussions for the entire financial system, necessitating different intervention strategies. |

| Regulatory Differences | The regulatory frameworks governing traditional banks and cryptocurrency businesses differ significantly, leading to varied responses from authorities. |

| Political Influence | As suggested by the letters from Republican committee members, there might be political considerations influencing regulatory actions. |

The Crypto Angle: A Silver Lining?

Interestingly, the struggles of traditional financial institutions like First Republic are being seen by some as a positive sign for the cryptocurrency market. As confidence in centralized finance wavers, investors may be looking for alternative assets like Bitcoin. Indeed, Bitcoin saw a price increase around the time First Republic’s troubles intensified.

Bitcoin’s Recent Performance:

- At the time of writing, Bitcoin was trading around $29,279.

- This represents a 7% increase over the previous seven days.

- This uptick could be partially attributed to investors seeking refuge from traditional banking instability.

Looking Ahead: What Does This Mean for the Future?

The situation with First Republic Bank and the reactions from figures like Cameron Winklevoss highlight the ongoing tension between the traditional financial world and the burgeoning cryptocurrency industry. Several key questions remain:

- Will First Republic survive? The success of the private bailout efforts remains to be seen.

- Will regulatory scrutiny on crypto ease? The debate about fair regulation is likely to continue.

- Will the banking crisis further fuel crypto adoption? Investor sentiment and market dynamics will play a crucial role.

Conclusion: A Crisis of Confidence and a Call for Clarity

The accusations leveled by Cameron Winklevoss resonate with many in the cryptocurrency space who feel unfairly targeted by regulators. Whether it’s a genuine double standard or a reflection of differing systemic risks and regulatory frameworks, the perception of inequitable treatment persists. The unfolding situation with First Republic Bank serves as a stark reminder of the vulnerabilities within the traditional financial system and may indeed accelerate the shift towards decentralized alternatives. Ultimately, this episode underscores the need for clearer and more consistent regulatory guidelines that foster innovation while ensuring consumer protection across all sectors of the financial landscape.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.