The cryptocurrency market is a rollercoaster, and ApeCoin (APE) is no exception! While many altcoins are seeing green, APE is experiencing both gains and corrections. Let’s dive into the latest ApeCoin developments and see what’s driving its price action.

ApeCoin: A Story of Growth and Correction

ApeCoin experienced a fascinating 24 hours. After an initial dip of 4.64%, it surged, rallying to a 15.13% gain. However, this was followed by an 8.61% drop, settling the overall increase to around 7%. So, what’s going on?

Despite this volatility, APE has been a strong performer this month, increasing by 82.32% in just 20 days, jumping from $10.65 to $19.3. At the time of writing, it’s trading around $17.65.

This recent correction is likely a healthy one. The market was becoming overheated due to APE’s rapid growth. This pullback allows the market to cool down and consolidate before potentially pushing higher.

What’s fueling this bullish trend? Increasing adoption! ApeCoin’s adoption has risen by 44% in just one month.

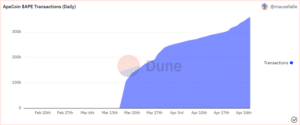

ApeCoin Transactions on the Blockchain are Rising

The number of ApeCoin transactions has jumped from 298,000 to 360,000, and it’s expected to keep climbing. The network is adding approximately 1102 new investors daily, a significant number for a cryptocurrency launched just a month ago.

Image : ApeCoin daily transactions | Source: Dune

It’s also important to consider the Bored Ape Yacht Club (BAYC). With over $1.53 billion in trades and a floor price of 138 ETH ($414.3k), even a small increase in APE is impactful for this ecosystem. A steady, sustainable gain is attracting more investors.

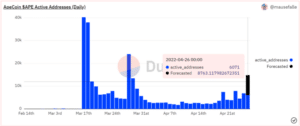

APE holders are becoming more active. Recent data shows around 14,000 active addresses on the network.

Image : ApeCoin active addresses | Source: Dune

Out of APE’s 52,000 total holders, 14,000 represent over 27% of active investors. This engagement rate is significantly higher than Bitcoin (2.4%), Ethereum (0.6%), and Cardano (0.37%), showing strong community support for APE.

This high level of investor engagement is crucial for APE’s future growth, especially if it aims to surpass the $20 mark.

Related Posts – Elon Musk, a Dogecoin supporter, has decided not to join the Twitter board of directors

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.