The cryptocurrency market is buzzing, and Cardano (ADA) is definitely catching the wave! Following the much-anticipated approval of Bitcoin’s spot ETF, ADA has experienced a significant upswing, painting crypto charts green. Let’s dive into what’s fueling this surge, the exciting developments within the Cardano ecosystem, and some potential bumps in the road ahead.

Cardano’s Price Soars: Riding the Bitcoin ETF Wave

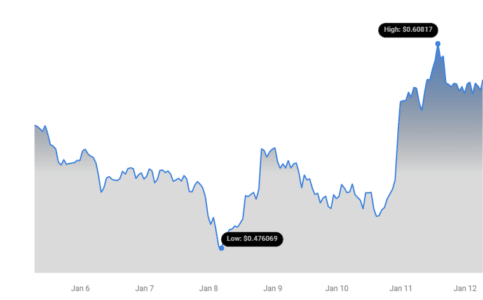

In the past 24 hours, Cardano (ADA) has emerged as a star performer, mirroring the positive sentiment sweeping through the crypto market after the Bitcoin ETF approval. The numbers speak for themselves:

- Impressive Price Jump: ADA witnessed a remarkable 13.31% surge in price.

- New Trading Value: This surge propelled ADA to a trading value of $0.585207.

This upward trajectory clearly indicates a growing positive sentiment around ADA and its potential in the evolving crypto landscape. The approval of the Bitcoin ETF seems to have acted as a catalyst, injecting fresh energy into the broader altcoin market, and Cardano is reaping the benefits.

More Addresses Holding ADA: Is Adoption on the Rise?

The price surge isn’t the only positive indicator for Cardano. Interestingly, there’s a noticeable increase in the number of addresses holding ADA. What does this tell us?

- Growing Investor Interest: The uptick in addresses suggests a growing interest and participation from both new and existing investors.

- Expanding User Base: It could also indicate a widening user base, with more people adopting ADA for various purposes within the Cardano ecosystem.

This expansion of the Cardano community is a healthy sign, potentially laying a stronger foundation for future growth and network effects.

However, before we get carried away with the green signals, let’s consider a nuanced perspective.

A Word of Caution: Trading Velocity Slowing Down

While the price is up and addresses are increasing, there’s another metric that investors should keep an eye on: trading velocity. Interestingly, despite the positive price action, ADA’s trading velocity has actually experienced a decline.

What does this mean?

- Reduced Trading Activity: Lower velocity suggests that ADA tokens are being traded less frequently.

- Potential Sustainability Concerns: A sustained decline in velocity, alongside a price surge driven by external factors like the Bitcoin ETF, could raise questions about the long-term sustainability of the current momentum. Is the price increase solely based on speculation, or is there genuine organic growth?

See Also: CLINKSINK Drainer Campaigns Stole About $1M Worth Of SOL

Investors should carefully analyze this aspect and consider it alongside other indicators to get a holistic view of ADA’s market position.

Mithril Upgrade: A Strong Foundation for Cardano’s Future

Beyond the immediate price movements, it’s crucial to acknowledge the significant developments happening within the Cardano ecosystem itself. The Mithril upgrade is a prime example of this positive progress.

Since its mainnet launch in June, Mithril has been consistently contributing to network stability and efficiency, thanks to the dedicated Stake Pool Operators. How does Mithril benefit Cardano?

- Enhanced Network Functionality: Mithril aims to improve the speed and efficiency of verifying blockchain data.

- Increased Appeal: These improvements can make the Cardano network more attractive to developers and users alike, potentially driving further adoption and growth.

This kind of fundamental development within the ecosystem is a strong indicator of Cardano’s long-term potential. You can learn more about Mithril’s impact directly from Input Output HK’s tweet: https://twitter.com/InputOutputHK/status/1745052229910827275

Clouds on the Horizon? Developer and NFT Ecosystem Trends

While the recent price surge and Mithril upgrade are encouraging, it’s important to maintain a balanced perspective and consider potential challenges. Let’s examine some indicators that might warrant attention.

Developer Decline: A Cause for Concern?

Cardano has witnessed impressive revenue growth, jumping by a significant 92.7% in the last month. However, a concerning trend has emerged: a steady decline in core developers working on the network.

Why is this important?

- Innovation and Growth Engine: Developers are the backbone of any blockchain ecosystem. They drive innovation, build new applications, and contribute to the network’s evolution.

- Potential Long-Term Impact: A continued decline in developers could hinder Cardano’s ability to innovate and compete effectively in the long run.

NFT Interest Waning?

Another area to watch is the Cardano NFT ecosystem. NFTs have been a vibrant part of the crypto space, and a decline in interest could have broader implications. Recent weeks have shown a decrease in volume within the Cardano NFT market.

What could this signify?

- Reduced Community Engagement: NFTs often play a role in community building and engagement within blockchain ecosystems. Lower NFT activity might indicate a dip in overall community vibrancy.

- Impact on Network Activity: NFT marketplaces and activities contribute to network transaction volume. A decline could potentially affect overall network activity metrics.

Final Thoughts: Navigating Cardano’s Path Forward

Cardano’s recent price surge, fueled by the Bitcoin ETF excitement, is undoubtedly a positive development. The increasing number of ADA holders and the ongoing progress with upgrades like Mithril paint a promising picture. However, it’s crucial to acknowledge the mixed signals. The decline in trading velocity, core developers, and NFT market activity suggests that there are challenges to address.

For investors and enthusiasts, the key takeaway is to maintain a balanced perspective. While the short-term price action is encouraging, a deeper dive into the underlying ecosystem health and long-term trends is essential for making informed decisions about Cardano’s future.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.