Cardano ($ADA) is turning heads in the crypto sphere, and it’s not just retail investors taking notice. Recent data from crypto analytics firm IntoTheBlock (ITB) reveals a significant uptick in institutional interest in the Cardano network. Are whales accumulating ADA? Is on-chain activity surging? Let’s dive into the key insights ITB uncovered and what it could mean for Cardano’s future.

IntoTheBlock: Your Crypto Intelligence Partner

First off, who is IntoTheBlock? Think of them as your data-driven detectives in the crypto world. ITB describes itself as an “intelligence company that delivers actionable intelligence for crypto assets using machine learning and statistical modeling.” In simpler terms, they crunch the numbers and analyze blockchain data to give you a clearer picture of what’s happening under the hood of cryptocurrencies like Cardano. And recently, their spotlight has been shining brightly on $ADA.

Key Cardano Insights from IntoTheBlock: What’s the Buzz?

On Tuesday, March 29th, ITB dropped some intriguing data points about Cardano. Let’s break down these insights to understand what’s fueling the growing institutional interest:

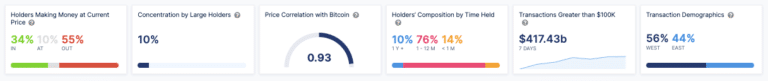

- Profitability Snapshot: Currently, 34% of ADA holders are “in the money,” meaning the current price is higher than their average purchase price. Conversely, 55% are “out of the money.” This suggests a mixed bag of holder sentiment, but the significant portion in profit could indicate strong conviction among a segment of investors.

- Whale Watch: Concentration by Large Holders: Here’s where it gets interesting for institutional interest. According to ITB, “whales” (addresses owning over 1% of circulating supply) and “investors” (0.1% to 1%) hold a substantial 10% of the total ADA supply. This concentration in the hands of large players often signals institutional accumulation.

- Bitcoin’s Shadow? Price Correlation: Cardano’s 30-day price correlation with Bitcoin is a high 0.93. This means ADA’s price movements are still strongly tied to Bitcoin’s overall market direction. While Cardano is forging its own path, it’s still influenced by the broader crypto market leader.

- Holder Time Horizon: Long-Term Vision? ITB’s data reveals the composition of ADA holders by holding time:

- Long-Term Holders (Hodlers): 10% have held ADA for over a year, showcasing a core group of long-term believers.

- Mid-Term Holders: A significant 76% have held for one to twelve months, indicating a growing base of investors who entered within the past year.

- Short-Term Speculators: 14% have held for less than a month, representing the more speculative traders reacting to short-term market fluctuations.

Cardano Holder Composition by Holding Time Holding Time Percentage Over 1 Year 10% 1 to 12 Months 76% Less than 1 Month 14% - Global Trading Activity: East Meets West: Analyzing transaction timings, ITB found that 56% of transactions in the last 14 days occurred during Western trading hours, while 44% took place during Eastern trading times. This nearly even split indicates a truly global and active trading market for ADA, spanning different time zones.

On-Chain Transaction Volume: A 50x Explosion in 2022!

Now, for the real eye-opener. ITB highlighted a staggering surge in large on-chain transactions on the Cardano network. In a tweet on March 29th, they announced: “The volume of on-chain transactions >$100k has surged by 50x only in 2022!” That’s not a typo – 50 times growth in just the first few months of the year! And on March 28th alone, a massive 69.09 billion $ADA was moved in these large transactions, accounting for a whopping 99% of the total on-chain volume. This explosive growth in high-value transactions strongly suggests increased institutional participation and capital flowing into the Cardano ecosystem.

Cardano DeFi: TVL Holding Steady

Beyond on-chain transactions, let’s look at Cardano’s Decentralized Finance (DeFi) ecosystem. According to DeFi Llama, the Total Value Locked (TVL) in Cardano’s DeFi protocols currently sits at $302.37 million (as of 5:50 a.m. UTC on March 30th). While slightly below its all-time high of $326 million reached on March 24th, the TVL remains robust, indicating continued growth and user engagement within Cardano’s DeFi space. This steady TVL, coupled with surging on-chain volume, paints a picture of a healthy and expanding Cardano network.

Source: DeFi Llama

What Does This Mean for Cardano and ADA?

The data from IntoTheBlock paints a bullish picture for Cardano. The 50x surge in large on-chain transactions, coupled with the concentration of holdings among whales and investors, strongly suggests growing institutional interest. While Cardano’s price is still correlated with Bitcoin, the increasing on-chain activity and developing DeFi ecosystem indicate a strengthening foundation for independent growth. For Cardano investors and crypto traders, these metrics are crucial to watch. They signal a potential shift towards greater institutional adoption, which could be a significant catalyst for ADA’s price and the overall Cardano network in the long run.

Related Posts – XRP Price Goes Up After Unexpected Reappearance On Coinbase

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.