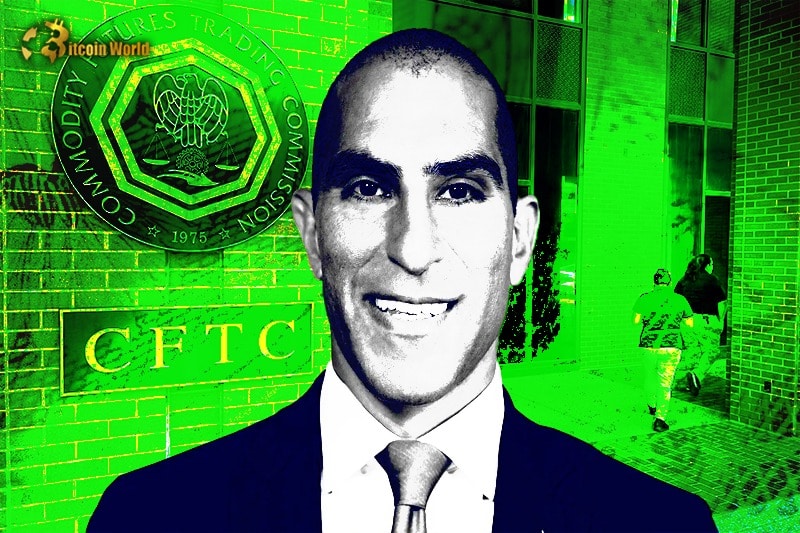

The cryptocurrency world is no stranger to regulatory discussions, and recently, Rostin Behnam, Chairman of the Commodity Futures Trading Commission (CFTC), has stepped into the spotlight with some compelling insights. Speaking at the Financial Industry Association Expo in Chicago, Chairman Behnam didn’t mince words about the CFTC’s active involvement in the crypto space and the critical need to bring crypto legislation into the modern age. Are current regulations keeping pace with the rapidly evolving world of digital assets? Let’s dive into what Chairman Behnam had to say and what it means for the future of crypto.

CFTC: The Crypto Watchdog in Action

Chairman Behnam painted a picture of an agency deeply engaged in policing the cryptocurrency landscape. He lauded the CFTC Enforcement Division as a force to be reckoned with, highlighting their relentless efforts. The numbers speak for themselves – in fiscal year 2023, the CFTC raked in a staggering $6 billion in penalties. But here’s the kicker:

- Digital Asset Focus: Out of all enforcement actions, 45 were specifically related to digital assets.

- Significant Portion: These crypto-related actions constitute over 34% of the 131 total actions initiated by the CFTC since 2015.

This clearly indicates a significant and growing focus on the digital asset market by the CFTC. It’s not just about dipping a toe in; they’re diving headfirst into the crypto regulatory pool.

Landmark Victory: Shutting Down Ooki DAO

One case stood out in Chairman Behnam’s address – the groundbreaking legal victory against Ooki DAO, a decentralized autonomous organization. This wasn’t just another enforcement action; it set a precedent. Here’s why it’s important:

- DAO Shutdown: The CFTC’s legal action resulted in the shutdown of Ooki DAO.

- Hefty Penalty: A substantial penalty of $643,542 was imposed.

- DAO as a “Person”: The U.S. District Court for the Northern District of California ruled that Ooki DAO qualifies as a “person” under the Commodity Exchange Act (CEA) of 1936.

This ruling is a game-changer. It signifies that DAOs, despite their decentralized nature, are not beyond the reach of existing regulations. The CFTC is signaling that decentralization doesn’t equal deregulation.

CEA: A Relic of the Past in a DeFi World?

Chairman Behnam then shifted gears to discuss the Commodity Exchange Act (CEA) and its relevance in today’s tech-driven financial world. He pointed out the obvious:

“Our current era is defined by disintermediation, driven by revolutionary technologies such as DeFi, AI, and ubiquitous WiFi.”

In essence, we’re in a new era of finance, light years away from 1936 when the CEA was enacted. This brings us to the core challenge:

“The constraints within the CEA, originally established in a vastly different era, present formidable obstacles to our ability to enact regulations and policies essential to our mission but currently beyond our jurisdiction.”

The CEA, designed for a traditional financial system, might be struggling to keep up with the decentralized, digital, and rapidly evolving crypto space. It’s like trying to navigate a Formula 1 race with a horse-drawn carriage.

Challenges Posed by the Current Regulatory Framework

Let’s break down the specific challenges Chairman Behnam highlighted:

| Challenge | Description |

|---|---|

| Resource-Intensive Enforcement | The CEA’s limitations force the CFTC to expend more resources to ensure their actions remain within the intended scope of the law. This means more time, money, and effort for each enforcement case. |

| Vertical Integration Concerns | Electronification and DeFi have led to vertical integration, raising regulatory concerns. This complexity makes it harder to oversee and protect customers. |

| Evolving Customer Protections | The concept of customer protection needs a revamp in the context of DeFi. Traditional protections may not be adequate or applicable in this new landscape. |

These challenges underscore a critical point: the existing regulatory framework, primarily the CEA, may not be adequately equipped to handle the nuances and complexities of the modern crypto market.

Clash of Perspectives: CFTC vs. SEC

Chairman Behnam’s perspective stands in stark contrast to that of Securities and Exchange Commission (SEC) Chair Gary Gensler. Gensler maintains that current financial legislation has served investors and economic growth well for decades and should remain largely unchanged. It’s a classic case of differing viewpoints:

- Behnam (CFTC): Advocates for modernizing legislation to address the challenges posed by DeFi and crypto.

- Gensler (SEC): Believes existing legislation is sufficient and effective.

This divergence highlights the ongoing debate within regulatory bodies about how to best approach cryptocurrency regulation. Are we in need of new rules, or can the old ones be adapted?

A Call for Expanded Authority

Chairman Behnam didn’t shy away from directly addressing the limitations on the CFTC’s enforcement authority. He made a powerful statement:

“To suggest that we must wait for victims to suffer and plead for assistance before taking proactive measures undermines our mission and purpose.”

This is a clear call for the CFTC to have more proactive power in the crypto space. He concluded his address with a resolute demand:

Expanded authority in the realm of cryptocurrencies.

In essence, Behnam is arguing that waiting for harm to occur before acting is a reactive and insufficient approach. He wants the CFTC to be able to step in earlier, to prevent issues before they escalate and cause harm to investors and the market.

Key Takeaways and the Road Ahead

Chairman Behnam’s address delivers a clear message: the CFTC is serious about crypto regulation, and they believe current laws need updating to effectively oversee this evolving market. Here’s what we can glean from his statements:

- CFTC is Active: The CFTC is actively enforcing regulations in the crypto space and achieving significant penalties.

- CEA Limitations: The Commodity Exchange Act, while foundational, may not be sufficient for regulating DeFi and modern crypto markets.

- Need for Modernization: There’s a pressing need to modernize crypto legislation to address the unique challenges of DeFi and digital assets.

- Proactive Regulation: The CFTC is advocating for expanded authority to take proactive regulatory measures, rather than just reactive enforcement.

- Regulatory Divergence: There are differing views among regulators (like CFTC and SEC) on the best approach to crypto regulation.

The future of crypto regulation remains a hot topic. Chairman Behnam’s remarks underscore the urgency and complexity of the situation. As the crypto landscape continues to evolve at breakneck speed, the call for updated and more effective regulations is only going to grow louder. Will lawmakers heed the call and modernize the rules of the game? The crypto world is watching closely.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.